- Japan

- /

- Metals and Mining

- /

- TSE:5857

Undiscovered Gems With Potential To Explore This January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and economic indicators, the S&P 500 has reached new highs, while small-cap stocks have lagged behind their larger counterparts. In this environment of shifting trade policies and AI investment enthusiasm, identifying undiscovered gems in the stock market involves looking for companies with strong fundamentals that can capitalize on emerging trends and navigate potential challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Woori Technology Investment | NA | 25.42% | -1.59% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

ARE Holdings (TSE:5857)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ARE Holdings, Inc. operates in the recycling and sale of precious and rare metals across Japan, the rest of Asia, and North America, with a market capitalization of ¥127.87 billion.

Operations: ARE Holdings generates revenue primarily from the sale of precious metals, amounting to ¥418.61 billion. The company's market capitalization stands at ¥127.87 billion.

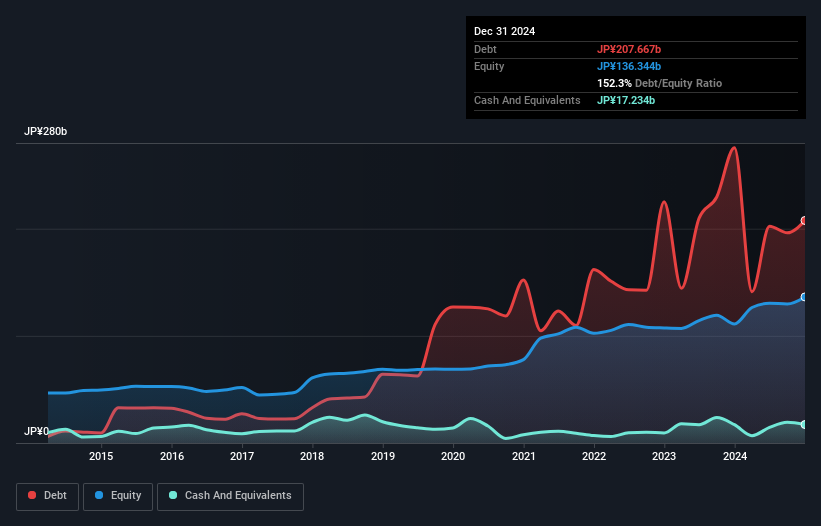

ARE Holdings, a smaller player in its industry, has shown promising growth with earnings increasing by 10.8% over the past year, outpacing the broader Metals and Mining sector's -13.1%. Despite a high net debt to equity ratio of 136.3%, interest payments are comfortably covered by EBIT at an impressive 2711 times. Recent guidance suggests revenue for the year ending March 2025 is expected at ¥480 billion (approx. US$4 billion), with operating profit projected at ¥18 billion (approx. US$150 million). However, dividends were reduced from ¥45 to ¥40 per share, which might signal cautious capital management strategies moving forward.

- Navigate through the intricacies of ARE Holdings with our comprehensive health report here.

Gain insights into ARE Holdings' historical performance by reviewing our past performance report.

OYO (TSE:9755)

Simply Wall St Value Rating: ★★★★★☆

Overview: OYO Corporation offers geological survey services both in Japan and internationally, with a market cap of ¥57.61 billion.

Operations: OYO Corporation's revenue streams are derived from its geological survey services. The company has a market capitalization of ¥57.61 billion.

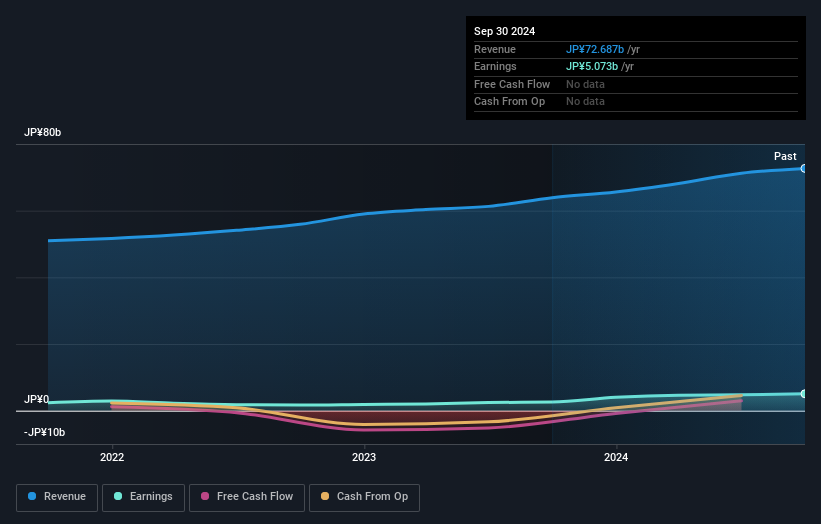

OYO's recent performance paints an intriguing picture, with earnings surging by 96.6% over the past year, outpacing the Commercial Services industry growth of 8.7%. The company seems to manage its finances well, evidenced by a debt-to-equity ratio increase to just 5.5% over five years while maintaining more cash than total debt. Its ability to cover interest payments comfortably adds a layer of financial security. Trading slightly below its estimated fair value suggests potential for appreciation in the market. OYO's high-quality earnings and positive free cash flow position it as a promising player in its sector.

- Delve into the full analysis health report here for a deeper understanding of OYO.

Examine OYO's past performance report to understand how it has performed in the past.

JBCC Holdings (TSE:9889)

Simply Wall St Value Rating: ★★★★★★

Overview: JBCC Holdings Inc. operates in Japan, offering information technology-related services through its subsidiaries, with a market capitalization of approximately ¥66.40 billion.

Operations: JBCC Holdings generates revenue primarily from its Information Solution segment, which accounts for ¥66.24 billion. The company also has a Product Development Manufacturing segment contributing ¥2.57 billion.

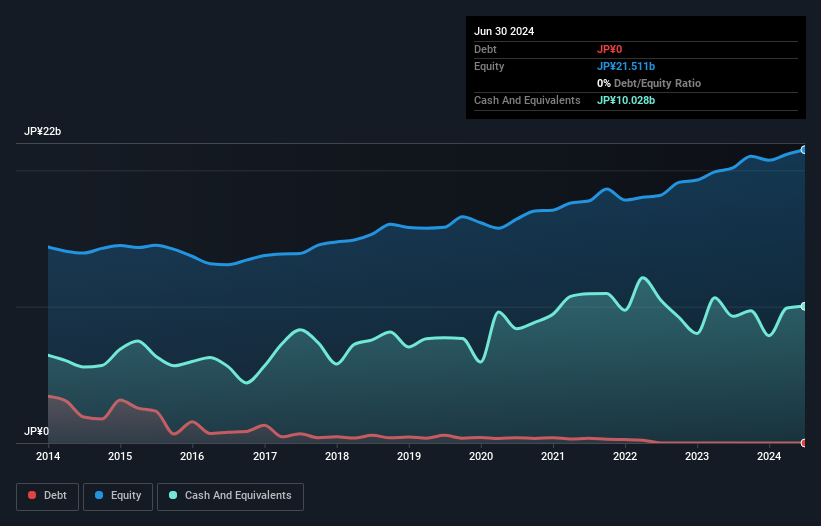

JBCC Holdings, a notable player in the IT sector, has demonstrated impressive financial health with no debt compared to five years ago when its debt-to-equity ratio was 2.1%. The company's earnings growth of 32.6% over the past year outpaced the IT industry average of 11.4%, indicating strong performance relative to peers. Trading at 43.7% below estimated fair value suggests potential undervaluation in the market. Recent corporate guidance projects net sales of JPY 66,500 million and operating profit of JPY 5,800 million for fiscal year ending March 2025, while dividends have been increased to JPY 53 per share from JPY 40 previously paid a year ago.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4674 more companies for you to explore.Click here to unveil our expertly curated list of 4677 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5857

ARE Holdings

Engages in recycling and selling precious and rare metals in Japan, rest of Asia, and North America.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives