NSW Inc.'s (TSE:9739) investors are due to receive a payment of ¥30.00 per share on 24th of June. This means the annual payment is 1.8% of the current stock price, which is above the average for the industry.

See our latest analysis for NSW

NSW's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. However, NSW's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

If the trend of the last few years continues, EPS will grow by 15.6% over the next 12 months. If the dividend continues on this path, the payout ratio could be 19% by next year, which we think can be pretty sustainable going forward.

NSW Has A Solid Track Record

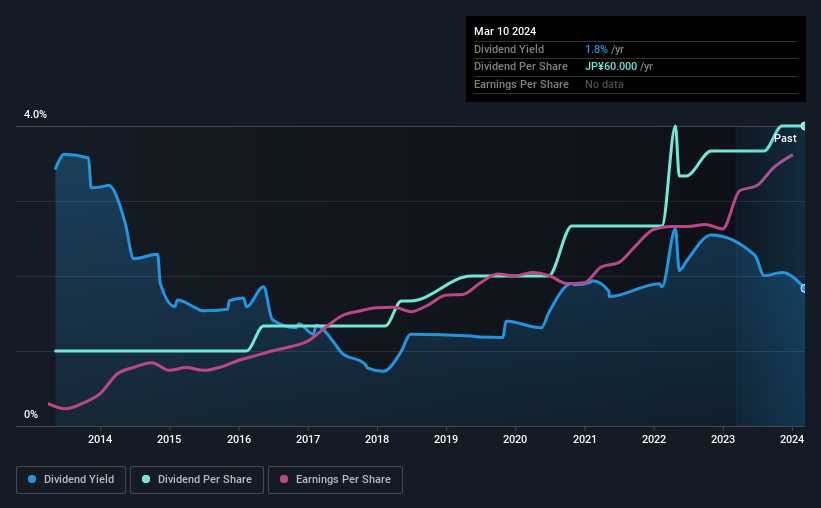

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of ¥15.00 in 2014 to the most recent total annual payment of ¥60.00. This means that it has been growing its distributions at 15% per annum over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see that NSW has been growing its earnings per share at 16% a year over the past five years. NSW definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

NSW Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Are management backing themselves to deliver performance? Check their shareholdings in NSW in our latest insider ownership analysis. Is NSW not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if NSW might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9739

NSW

Operates as an enterprise, services, embedded, and device solutions provider in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026