As global markets navigate a landscape of mixed economic signals and trade negotiations, Asian tech stocks have captured investors' attention with their potential for high growth amid these uncertain times. In this environment, identifying promising tech stocks often involves looking for companies that demonstrate resilience and adaptability to evolving market conditions, such as those benefiting from technological advancements or shifts in consumer demand.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.52% | 29.12% | ★★★★★★ |

| Fositek | 26.80% | 33.99% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.34% | 29.48% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| ALTEOGEN | 54.92% | 71.24% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| HFR | 33.91% | 111.76% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. is a global company specializing in the production and sale of molecular diagnostics products, with a market capitalization of ₩1.36 billion.

Operations: Seegene, Inc. generates revenue primarily from the sale of diagnostic kits and equipment, totaling ₩414.25 billion.

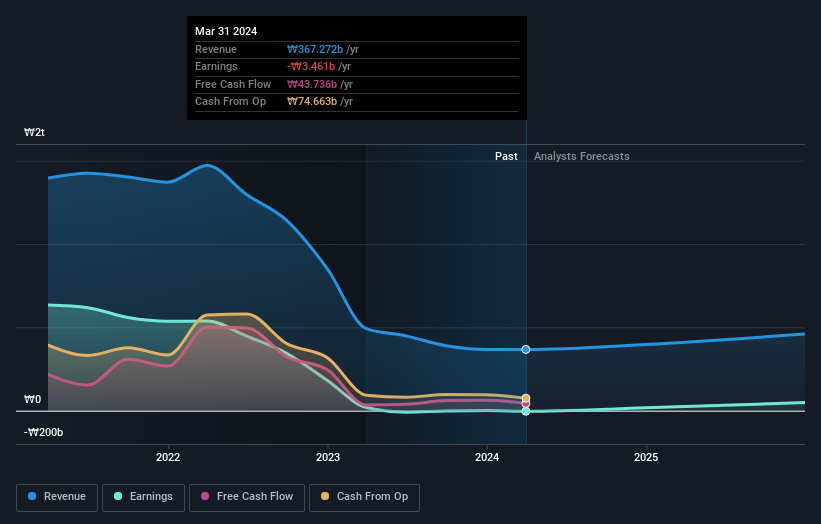

Seegene is steering the future of laboratory automation with its innovative CURECA™ system, designed to enhance efficiency in PCR testing. This system, which integrates technologies for automated sample handling and analysis, could significantly reduce human error and increase throughput in clinical labs. Despite a challenging fiscal year where Seegene reported a net loss of KRW 20.34 billion from sales of KRW 414.25 billion, the company's commitment to R&D and product innovation remains robust. The anticipated profitability over the next three years alongside a revenue growth forecast at 15.3% annually suggests Seegene is positioning itself strongly within the high-tech sector in Asia.

- Click here to discover the nuances of Seegene with our detailed analytical health report.

Gain insights into Seegene's past trends and performance with our Past report.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that specializes in the planning, development, and sale of cloud-based solutions, with a market capitalization of ¥257.57 billion.

Operations: Sansan, Inc. generates revenue primarily from its Sansan/Bill One Business, which accounts for ¥35.69 billion, while the Eight Business contributes ¥4.73 billion. The company's focus on cloud-based solutions positions it within the tech industry in Japan.

Sansan, a trailblazer in digital business card management and contact management solutions, is harnessing robust growth metrics that underscore its strategic positioning in Asia's tech landscape. With an anticipated revenue increase of 17.6% annually, the company outpaces the Japanese market average of 4%. This performance is bolstered by an aggressive R&D commitment, evident from its latest fiscal projections showing planned expenditures to enhance product capabilities and market reach. Notably, Sansan's recent corporate guidance forecasts net sales hitting between JPY 43 billion to JPY 44 billion for FY2025. The firm also shines with a projected annual earnings growth of 38.9%, significantly higher than the broader market's expectation of 7.5%, positioning it as a potent entity in technological innovation within the region.

- Click to explore a detailed breakdown of our findings in Sansan's health report.

Understand Sansan's track record by examining our Past report.

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. offers a diverse range of Internet services globally and has a market capitalization of approximately ¥359.46 billion.

Operations: The company's primary revenue streams include Internet Infrastructure, generating ¥184.91 billion, followed by the Internet Finance Business at ¥43.73 billion, and the Internet Advertising and Media Business contributing ¥34.07 billion. The Crypto Asset Business adds another significant segment with ¥9.13 billion in revenue.

GMO Internet Group is demonstrating a keen ability to navigate the tech sector's demands, evidenced by its robust earnings growth forecast of 16.2% annually, surpassing Japan's market average of 7.5%. This growth trajectory is supported by strategic share repurchases, with the company recently buying back 1.81% of its shares for ¥5.76 billion, underscoring confidence in its financial health and future prospects. Despite a challenging past year with earnings contraction by 5.8%, GMO continues to invest in innovation, as seen in its commitment to R&D which remains integral to overcoming industry hurdles and maintaining competitive advantage in Asia’s dynamic tech landscape.

Summing It All Up

- Investigate our full lineup of 476 Asian High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud- based solutions in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives