As global markets react to the recent U.S. election results, with small-cap indices like the Russell 2000 experiencing significant gains, investors are closely examining how policy shifts might impact economic growth and inflation. In this environment of heightened market activity and shifting economic indicators, identifying stocks that possess strong fundamentals and potential for growth can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Argus (Shanghai) Textile ChemicalsLtd (SHSE:603790)

Simply Wall St Value Rating: ★★★★★☆

Overview: Argus (Shanghai) Textile Chemicals Co., Ltd. operates in the textile chemicals industry and has a market capitalization of CN¥2.33 billion.

Operations: The company generates revenue primarily from its textile chemicals segment. It has a market capitalization of CN¥2.33 billion.

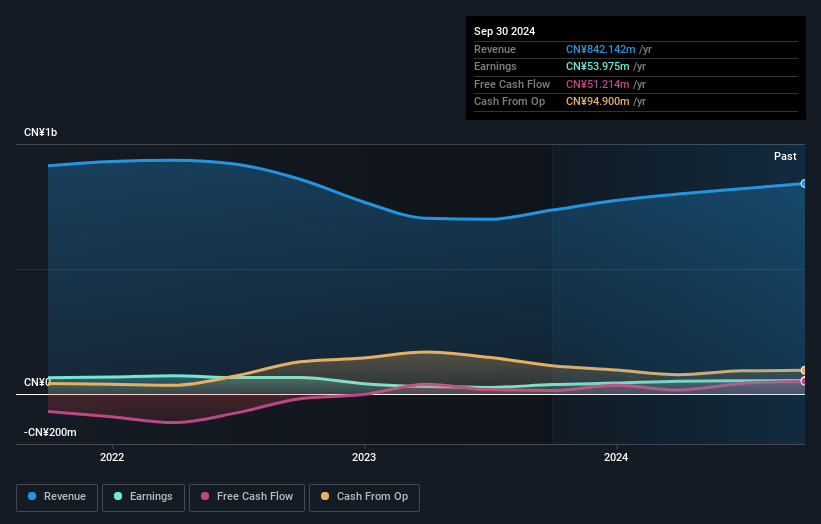

Argus Textile Chemicals, a modestly sized player in its field, showcases robust earnings growth of 43.5% over the past year, significantly outperforming the broader chemicals sector's -5.4%. Despite an increase in its debt-to-equity ratio from 6.8% to 10.3% over five years, Argus maintains a satisfactory net debt to equity ratio of 0.2%, ensuring financial stability with high-quality earnings and well-covered interest payments at 44.6x EBIT coverage. Recent results highlight sales reaching CNY 661 million for nine months ending September 2024, up from CNY 593 million last year, indicating solid operational performance amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Argus (Shanghai) Textile ChemicalsLtd's health report.

Learn about Argus (Shanghai) Textile ChemicalsLtd's historical performance.

KeePer Technical Laboratory (TSE:6036)

Simply Wall St Value Rating: ★★★★★★

Overview: KeePer Technical Laboratory Co., Ltd. is a company that specializes in developing, manufacturing, and selling car coatings, car washing chemicals and equipment, along with other automotive-related products in Japan, with a market cap of ¥107.80 billion.

Operations: The company generates revenue primarily from the sale of car coatings and car washing chemicals, with a market cap of ¥107.80 billion. The cost structure includes manufacturing expenses related to these products. Gross profit margin trends could provide insights into operational efficiency and pricing strategies over time.

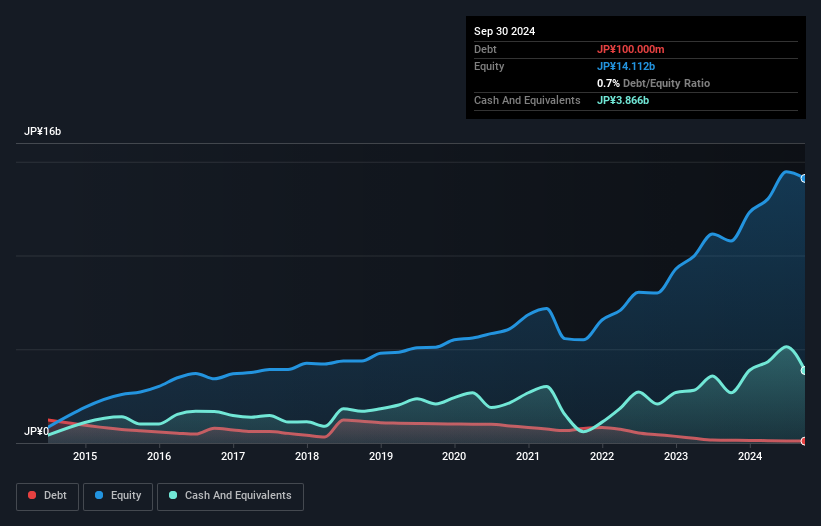

KeePer Technical Laboratory has been making waves with its strategic expansions and solid financials. The company recently opened several new KeePer LABO stores, including the 141st location in Kanazawa City, which features a unique training center. Sales for October 2024 reached ¥1.93 billion, up from ¥1.73 billion the previous year, showcasing robust growth. Over five years, earnings have surged by 32.5% annually, while its debt-to-equity ratio impressively dropped from 20.4% to just 0.8%. Trading at nearly half of its estimated fair value and boasting high-quality earnings, KeePer seems poised for continued success in the market landscape.

ARGO GRAPHICS (TSE:7595)

Simply Wall St Value Rating: ★★★★★★

Overview: ARGO GRAPHICS Inc. offers technical solutions in Japan and has a market cap of ¥105.35 billion.

Operations: ARGO GRAPHICS generates revenue primarily from its PLM Business, contributing ¥43.07 billion, while the EDA Business adds ¥2.13 billion. The company has a segment adjustment of ¥19.56 billion impacting its overall financials.

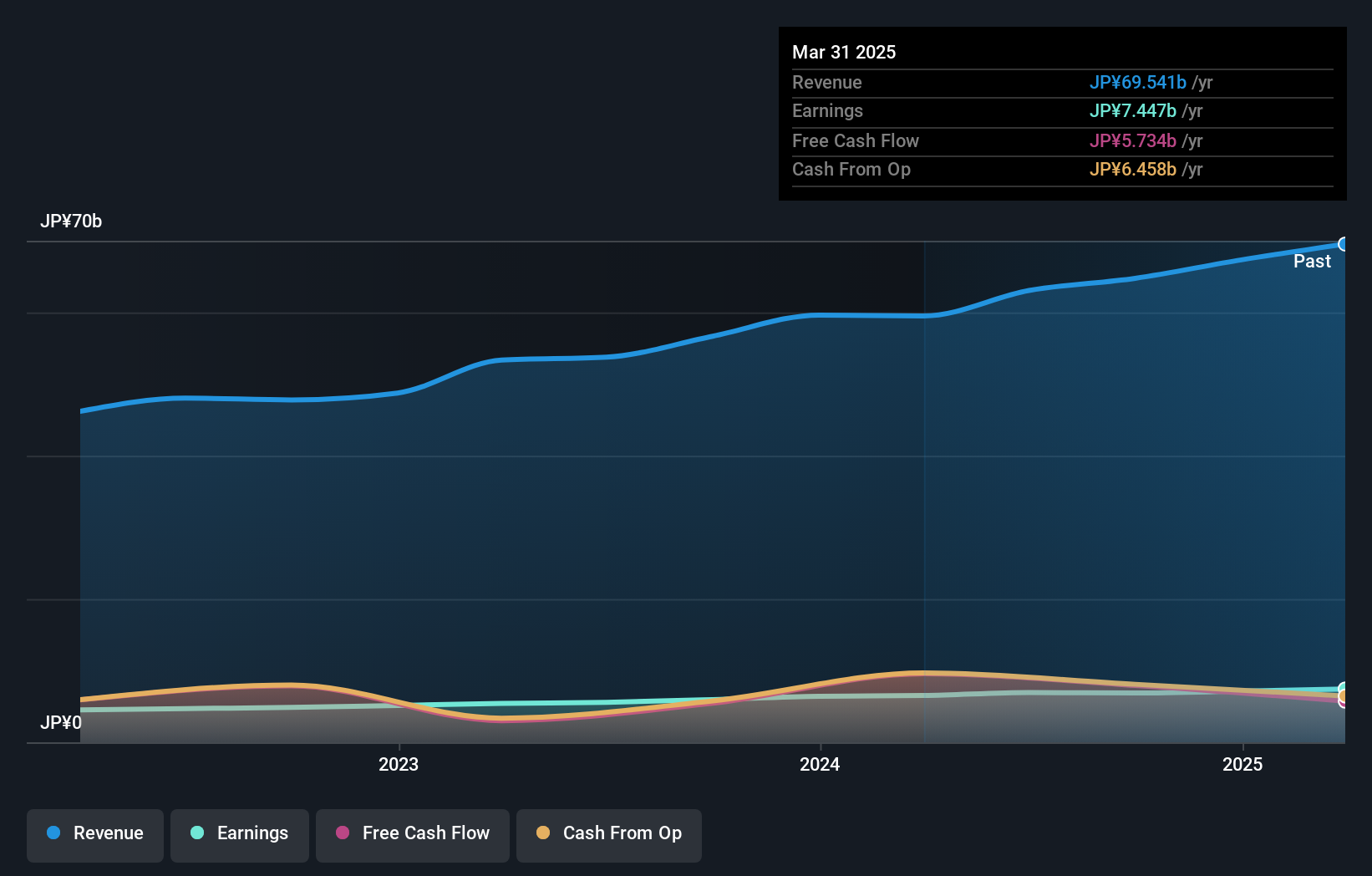

With a robust financial position, ARGO GRAPHICS is debt-free and has seen its earnings grow by 15.4% over the past year, outpacing the IT industry's 10.2% growth rate. The company is trading at a significant discount of 42.8% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in technology sectors. Known for high-quality earnings, ARGO GRAPHICS also benefits from positive free cash flow, reinforcing its stability and operational efficiency. Recent announcements indicate upcoming Q2 results on November 1st, which could provide further insights into their performance trajectory.

- Click here to discover the nuances of ARGO GRAPHICS with our detailed analytical health report.

Review our historical performance report to gain insights into ARGO GRAPHICS''s past performance.

Key Takeaways

- Gain an insight into the universe of 4667 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeePer Technical Laboratory might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6036

KeePer Technical Laboratory

Develops, manufactures, and sells car coatings, car washing chemicals and equipment, and other products in Japan.

Flawless balance sheet with reasonable growth potential.