The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Zuken (TSE:6947), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Zuken's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Zuken managed to grow EPS by 8.7% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

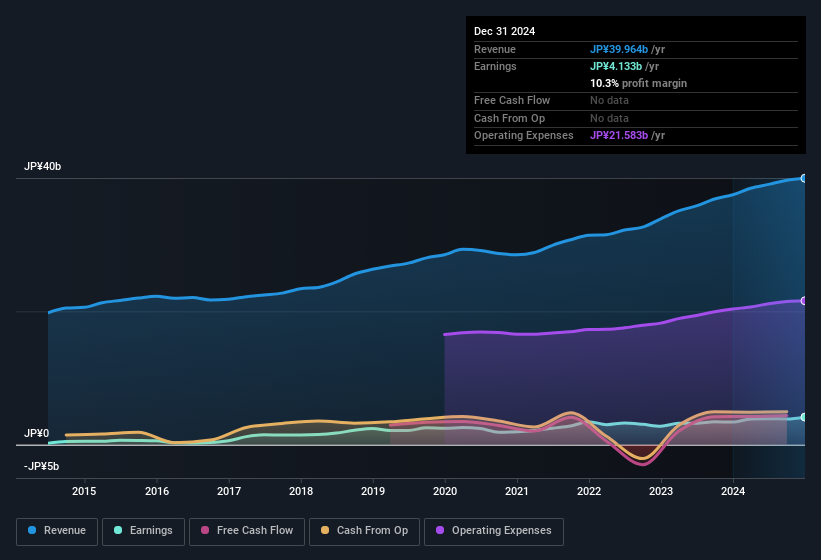

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Zuken remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.6% to JP¥40b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for Zuken

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Zuken's balance sheet strength, before getting too excited.

Are Zuken Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Zuken shares worth a considerable sum. Notably, they have an enviable stake in the company, worth JP¥30b. That equates to 29% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

Does Zuken Deserve A Spot On Your Watchlist?

One important encouraging feature of Zuken is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Now, you could try to make up your mind on Zuken by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although Zuken certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zuken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6947

Zuken

A software company, provides advanced design solutions for the creation and management of printed circuit board (PCB) designs, electrical and fluid systems, and 3D cabinet and wire harness layouts in Japan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives