Why Fujitsu (TSE:6702) Is Up 10.4% After Expanding AI Alliance With NVIDIA for Industry Solutions

Reviewed by Sasha Jovanovic

- Fujitsu announced it has expanded its strategic collaboration with NVIDIA to co-develop a comprehensive AI infrastructure integrating AI agents tailored for sectors such as healthcare, manufacturing, and robotics and combining FUJITSU-MONAKA CPUs with NVIDIA GPUs via NVLink Fusion.

- This partnership aims to accelerate the adoption of industry-specific AI platform solutions in Japan and globally, enabling enterprises to enhance competitiveness and foster continuous system evolution by uniting advanced AI computing with human creativity.

- We'll explore how Fujitsu's focus on building full-stack, cross-industry AI infrastructure with NVIDIA could impact its medium-term growth prospects.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fujitsu Investment Narrative Recap

Shareholders in Fujitsu are typically anchored by the company's ability to scale digital transformation and advanced IT services, particularly through growth segments like AI, cloud, and consulting. The expanded AI collaboration with NVIDIA could support near-term demand for modernization services, yet the primary short-term catalyst remains the execution and monetization of these next-generation offerings, while ongoing dependence on Japan for contract wins remains a key risk. At this stage, the NVIDIA news bolsters the core growth story without materially altering the most critical short-term drivers or underlying risk profile.

Among the recent developments, Fujitsu’s completion of its share buyback in early October stands out. While not directly related to the NVIDIA AI partnership, this move reflects ongoing efforts to manage capital structure and shareholder interests, serving as a reminder that execution on capital allocation remains an active element of the broader business narrative.

By contrast, investors should be aware that heavy reliance on Japan’s domestic modernization market leaves Fujitsu exposed if...

Read the full narrative on Fujitsu (it's free!)

Fujitsu's outlook anticipates ¥3,829.0 billion in revenue and ¥339.8 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 2.6% and a ¥129.4 billion increase in earnings from the current ¥210.4 billion.

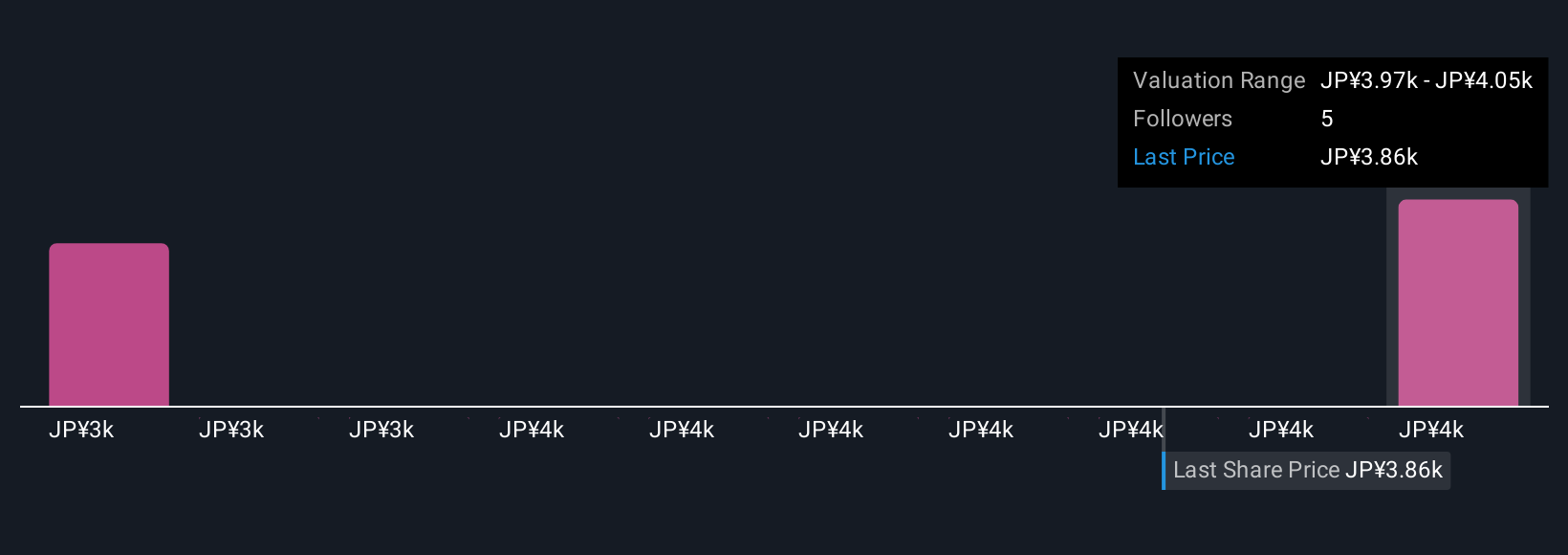

Uncover how Fujitsu's forecasts yield a ¥4047 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users set fair value estimates for Fujitsu between ¥3,233 and ¥4,047, reflecting just two analyses. With modernization and Uvance businesses driving growth, these wide-ranging views show why it pays to explore multiple opinions on future performance.

Explore 2 other fair value estimates on Fujitsu - why the stock might be worth 16% less than the current price!

Build Your Own Fujitsu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fujitsu research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Fujitsu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fujitsu's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6702

Fujitsu

Engages in providing digital services in Japan, Europe, Americas, Asia Pacific, East Asia, and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives