Shareholders Would Enjoy A Repeat Of Arent's (TSE:5254) Recent Growth In Returns

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Arent (TSE:5254) looks great, so lets see what the trend can tell us.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Arent is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = JP¥944m ÷ (JP¥4.6b - JP¥745m) (Based on the trailing twelve months to December 2023).

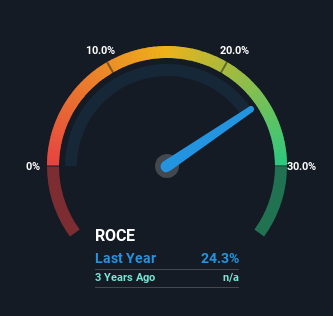

Therefore, Arent has an ROCE of 24%. That's a fantastic return and not only that, it outpaces the average of 16% earned by companies in a similar industry.

View our latest analysis for Arent

Above you can see how the current ROCE for Arent compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Arent for free.

So How Is Arent's ROCE Trending?

The trends we've noticed at Arent are quite reassuring. The numbers show that in the last two years, the returns generated on capital employed have grown considerably to 24%. The amount of capital employed has increased too, by 96%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

What We Can Learn From Arent's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Arent has. Since the stock has returned a solid 75% to shareholders over the last year, it's fair to say investors are beginning to recognize these changes. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

Arent does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those is a bit concerning...

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5254

Arent

Engages in the development of SaaS based solutions for construction industry in Japan.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion