- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A215200

MegaStudyEdu And 2 Other Leading Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments from major central banks and mixed performances across key indices, investors are closely monitoring economic indicators such as inflation and labor market trends. In this environment, dividend stocks offer a compelling option for those seeking income stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

Click here to see the full list of 1847 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

MegaStudyEdu (KOSDAQ:A215200)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MegaStudyEdu Co. Ltd. offers online and offline educational services mainly in South Korea, with a market cap of ₩465.32 billion.

Operations: MegaStudyEdu Co. Ltd.'s revenue segments include High School at ₩584.07 billion, Elementary and Middle School at ₩214.70 billion, University at ₩81.15 billion, and Employment services at ₩56.81 billion.

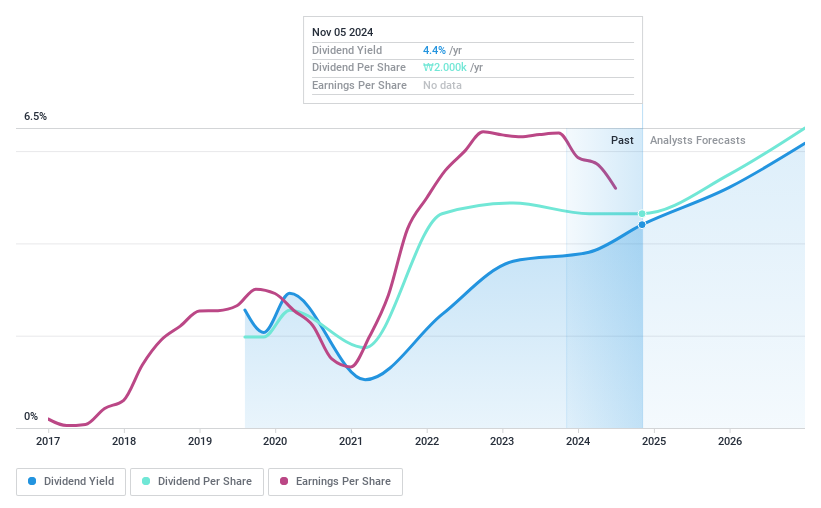

Dividend Yield: 4.6%

MegaStudyEdu's dividend payments are well covered by both earnings and cash flows, with payout ratios of 28% and 17.8%, respectively. Despite being in the top 25% for dividend yield in South Korea, its dividends have been volatile over the past five years. The company has completed a share buyback program worth KRW 9.99 billion, repurchasing approximately 1.8% of shares, which may impact future dividend sustainability positively or negatively depending on financial strategies moving forward.

- Get an in-depth perspective on MegaStudyEdu's performance by reading our dividend report here.

- The analysis detailed in our MegaStudyEdu valuation report hints at an deflated share price compared to its estimated value.

Hanatour Service (KOSE:A039130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. is a company that offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe, with a market cap of ₩886.02 billion.

Operations: Hanatour Service Inc.'s revenue segments include Trip services generating ₩582.45 billion and Hotel services contributing ₩24.71 billion.

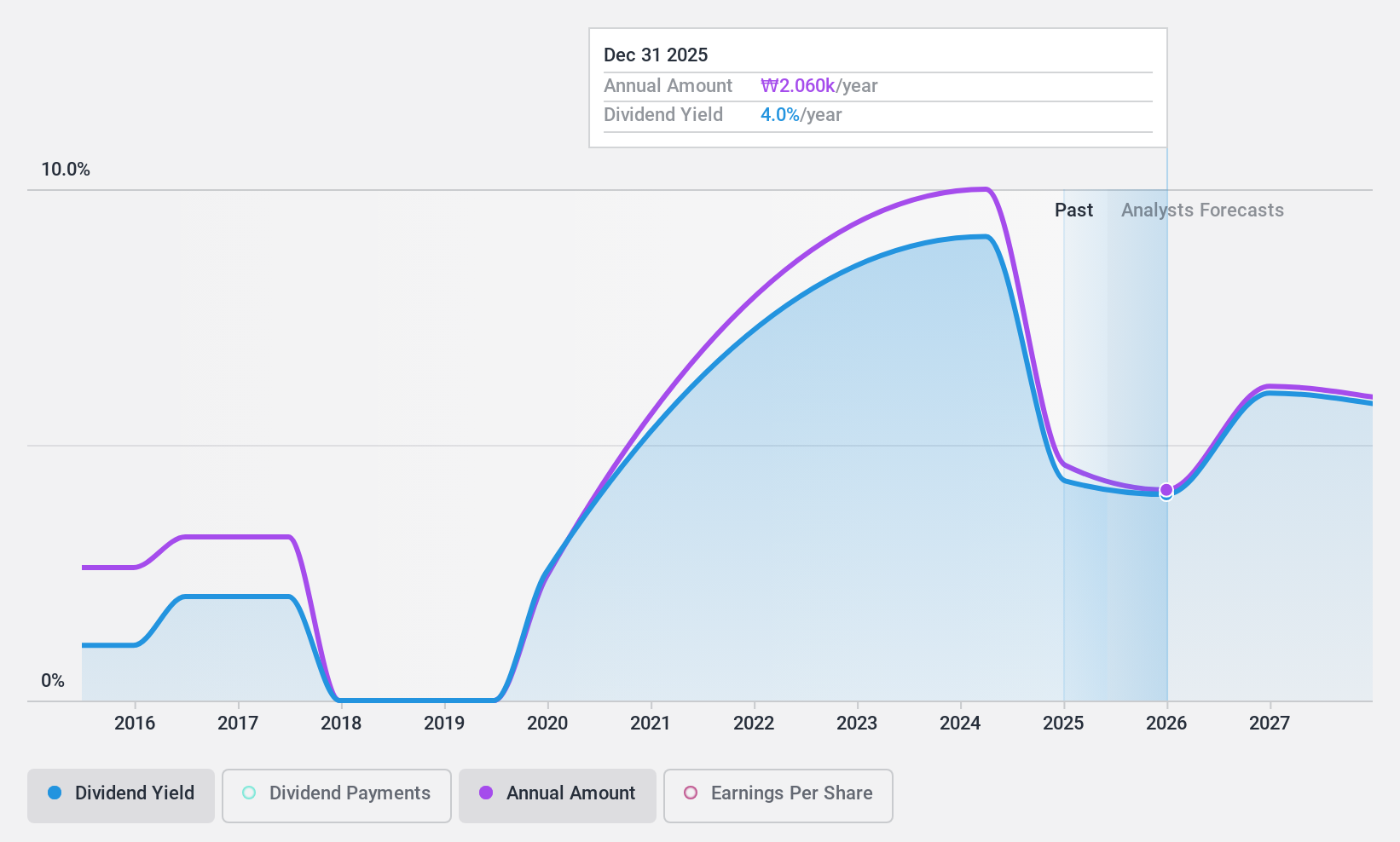

Dividend Yield: 4%

Hanatour Service's dividend yield is in the top 25% of South Korea's market, yet its dividends are not well covered by earnings, indicated by a high payout ratio of 147.8%. Despite growth in earnings and revenue over the past year, profit margins have declined from 13.1% to 8.8%. Although cash flows adequately cover dividends with a low cash payout ratio of 26.8%, dividend payments have been unreliable and volatile over the past decade.

- Take a closer look at Hanatour Service's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hanatour Service shares in the market.

Intelligent Wave (TSE:4847)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intelligent Wave Inc. offers system development services and system products both in Japan and internationally, with a market cap of ¥29.32 billion.

Operations: Intelligent Wave Inc. generates revenue from its Software & Programming segment, amounting to ¥14.90 billion.

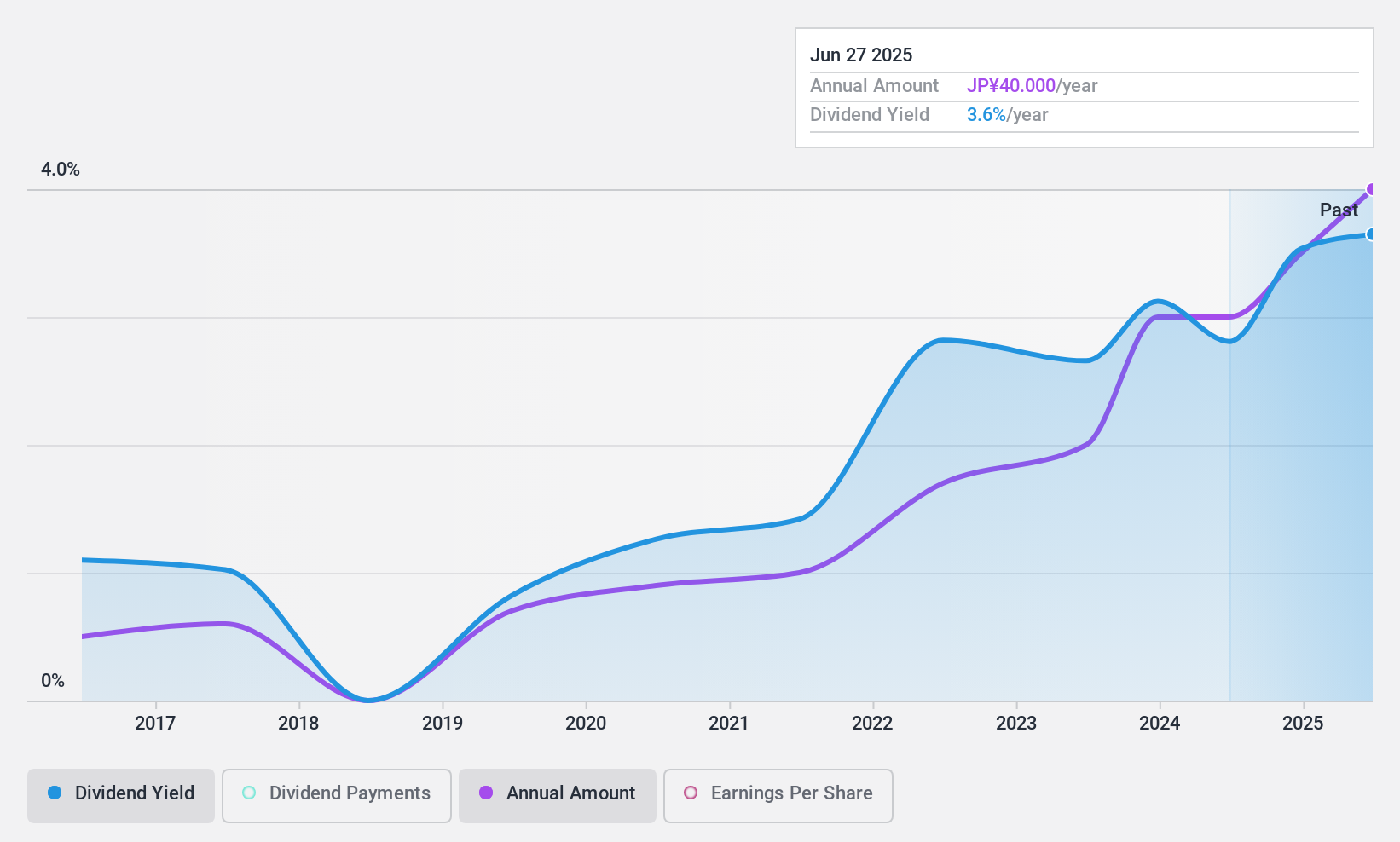

Dividend Yield: 3.1%

Intelligent Wave offers a stable dividend history with payments growing over the past decade. Its current yield of 3.13% is reliable but lower than the top quartile in Japan's market. The company's dividends are well-supported by earnings, with a payout ratio of 54.1%, and adequately covered by cash flows at a 75.9% cash payout ratio, ensuring sustainability despite being undervalued by 24.6% against its estimated fair value.

- Dive into the specifics of Intelligent Wave here with our thorough dividend report.

- According our valuation report, there's an indication that Intelligent Wave's share price might be on the cheaper side.

Key Takeaways

- Dive into all 1847 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A215200

MegaStudyEdu

Provides online and offline educational services primarily in South Korea.

Very undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives