Cybozu (TSE:4776): Assessing Valuation After a Year of Notable Share Price Gains

Reviewed by Simply Wall St

Price-to-Earnings of 31.8x: Is it justified?

Cybozu currently trades at a price-to-earnings (P/E) ratio of 31.8x, which is considered expensive compared to both the Japanese software industry average and the estimated fair value range for the stock.

The P/E ratio is a widely used metric that reflects how much investors are willing to pay for a company’s earnings. For software companies, a higher P/E can signal strong growth prospects but also raises questions about potential over-optimism.

In this case, Cybozu’s elevated P/E multiple suggests the market is pricing in robust future growth in profit and revenue. However, since the figure is notably above sector norms, investors should consider whether such lofty expectations are justified by the company’s actual performance trends and future forecasts.

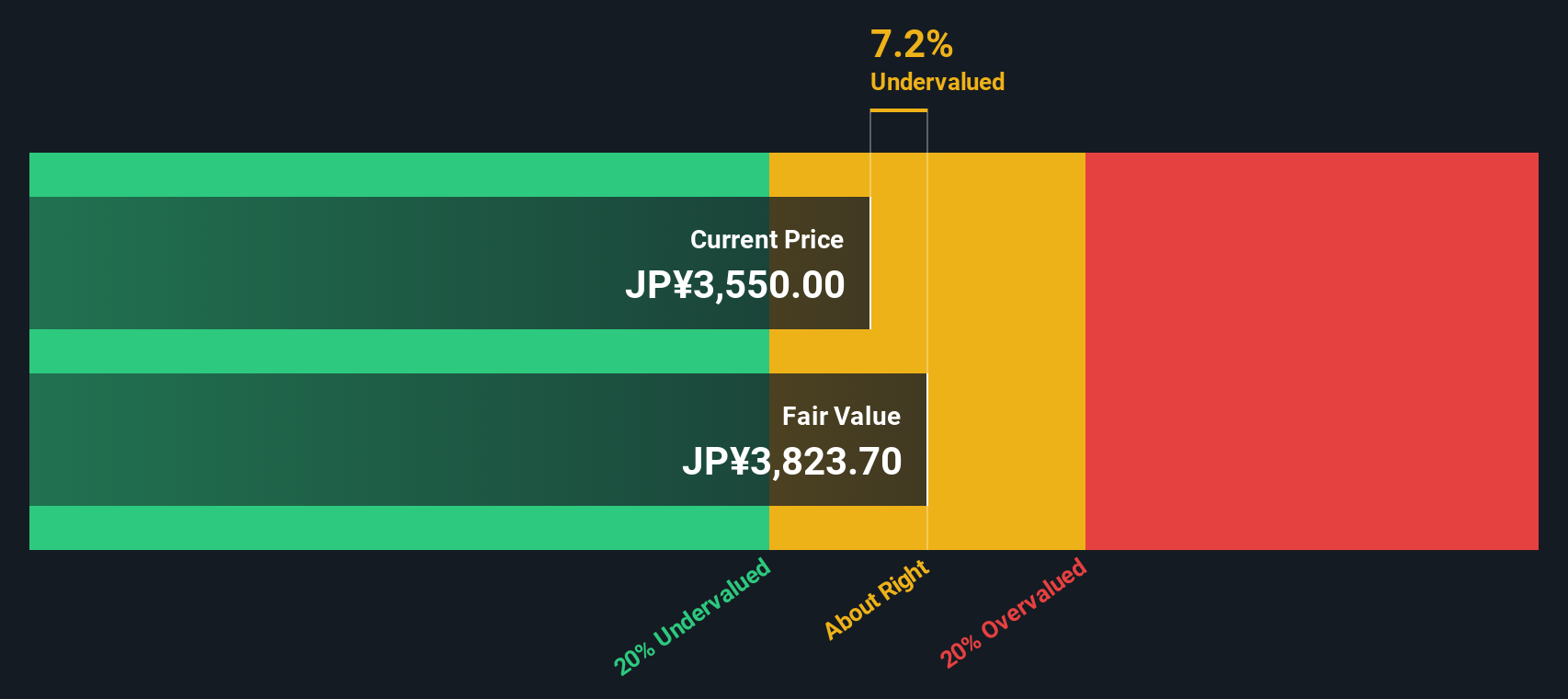

Result: Fair Value of ¥3,624 (OVERVALUED)

See our latest analysis for Cybozu.However, slower revenue growth or a downturn in annual net income could quickly change investor sentiment and put pressure on Cybozu’s premium valuation.

Find out about the key risks to this Cybozu narrative.Another View: What Does the SWS DCF Model Show?

Looking from a different angle, our DCF model also flags Cybozu as trading above its fair value. This supports the earlier conclusion that the current price could be stretched. Does this consensus signal caution, or is the market seeing something others do not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cybozu Narrative

If you want to dig deeper or form your own perspective, you can easily build a personalized view in just a few minutes. Do it your way

A great starting point for your Cybozu research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for even more smart investment ideas?

Don’t wait for opportunities to pass you by. Simply Wall Street’s Screener brings the market’s most exciting themes straight to you, tailored to your strategy.

- Uncover hidden gems among companies shaking up the market, all with robust fundamentals, by using penny stocks with strong financials.

- Catch the wave of high-potential opportunities that look undervalued based on future cash flows when you check out undervalued stocks based on cash flows.

- Get ahead of megatrends and pinpoint promising names at the intersection of science, technology, and finance through quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4776

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives