Take Care Before Diving Into The Deep End On Genetec Corporation (TSE:4492)

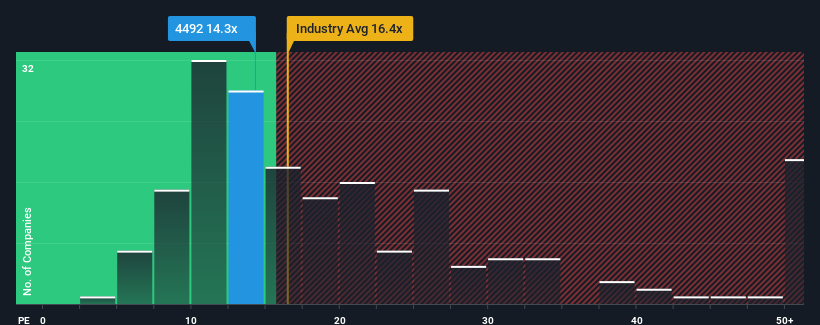

There wouldn't be many who think Genetec Corporation's (TSE:4492) price-to-earnings (or "P/E") ratio of 14.3x is worth a mention when the median P/E in Japan is similar at about 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Genetec has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Genetec

How Is Genetec's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Genetec's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 5.5%. The latest three year period has also seen an excellent 108% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.6% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Genetec is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Genetec's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Genetec currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Genetec that you should be aware of.

If you're unsure about the strength of Genetec's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4492

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026