Genetec Corporation (TSE:4492) Stock Rockets 38% As Investors Are Less Pessimistic Than Expected

Genetec Corporation (TSE:4492) shares have continued their recent momentum with a 38% gain in the last month alone. The last 30 days were the cherry on top of the stock's 434% gain in the last year, which is nothing short of spectacular.

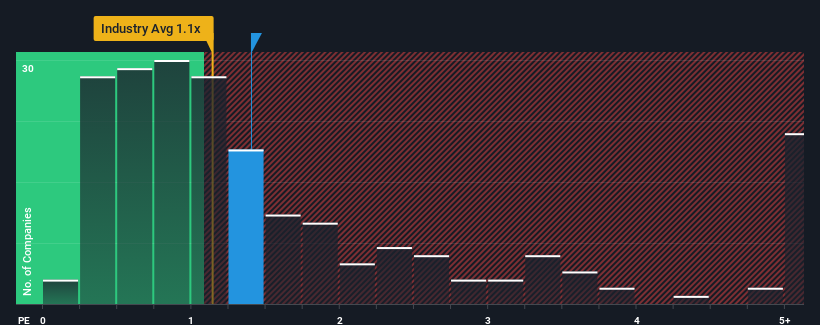

Even after such a large jump in price, it's still not a stretch to say that Genetec's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the IT industry in Japan, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Genetec

How Genetec Has Been Performing

With revenue growth that's superior to most other companies of late, Genetec has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Genetec will help you uncover what's on the horizon.How Is Genetec's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Genetec's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. Pleasingly, revenue has also lifted 62% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 2.3% as estimated by the sole analyst watching the company. With the industry predicted to deliver 6.4% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Genetec's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Genetec appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Genetec currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you settle on your opinion, we've discovered 3 warning signs for Genetec (2 are concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Genetec, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4492

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026