AI inside's (TSE:4488) earnings trajectory could turn positive as the stock hikes 12% this past week

AI inside Inc. (TSE:4488) shareholders should be happy to see the share price up 12% in the last week. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 75% lower after that period. So we don't gain too much confidence from the recent recovery. The fundamental business performance will ultimately determine if the turnaround can be sustained.

On a more encouraging note the company has added JP¥1.4b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for AI inside

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, AI inside moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Revenue is actually up over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

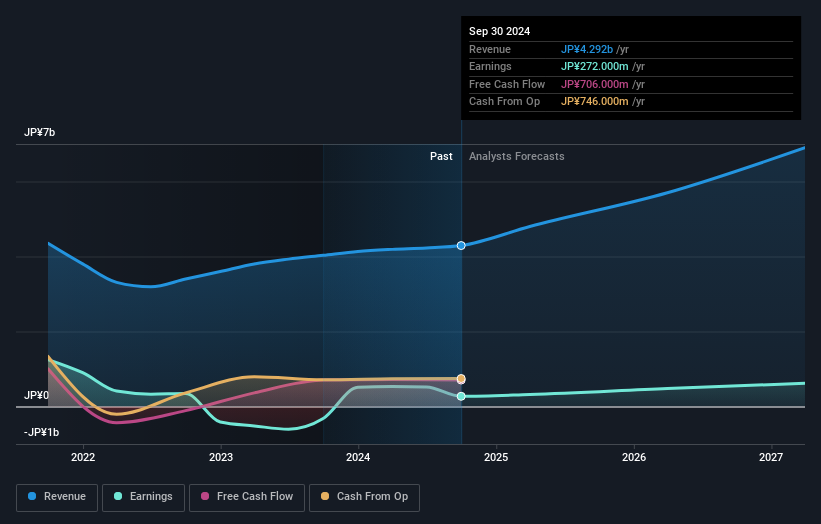

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that AI inside has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for AI inside in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 9.6% in the last year, AI inside shareholders lost 55%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for AI inside you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4488

AI inside

Develops and provides artificial intelligence and related information services in Japan.

Excellent balance sheet with reasonable growth potential.