As we enter January 2025, global markets are navigating mixed signals, with the S&P 500 marking a strong two-year performance despite recent declines and economic indicators like the Chicago PMI showing contraction. In this environment, identifying high-growth tech stocks involves looking for companies that can thrive amid both positive momentum in major indices and challenges such as fluctuating economic forecasts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| AVITA Medical | 33.38% | 51.81% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.23% | 56.37% | ★★★★★★ |

| TG Therapeutics | 29.99% | 44.07% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1255 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhejiang Wazam New MaterialsLTD (SHSE:603186)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Wazam New Materials Co., LTD. specializes in the design, development, production, and sale of copper clad laminates, adhesive sheets, composite materials, and membrane materials with a market cap of CN¥3.48 billion.

Operations: Zhejiang Wazam New Materials Co., LTD. focuses on producing and selling copper clad laminates, adhesive sheets, composite materials, and membrane materials. The company's market cap stands at CN¥3.48 billion.

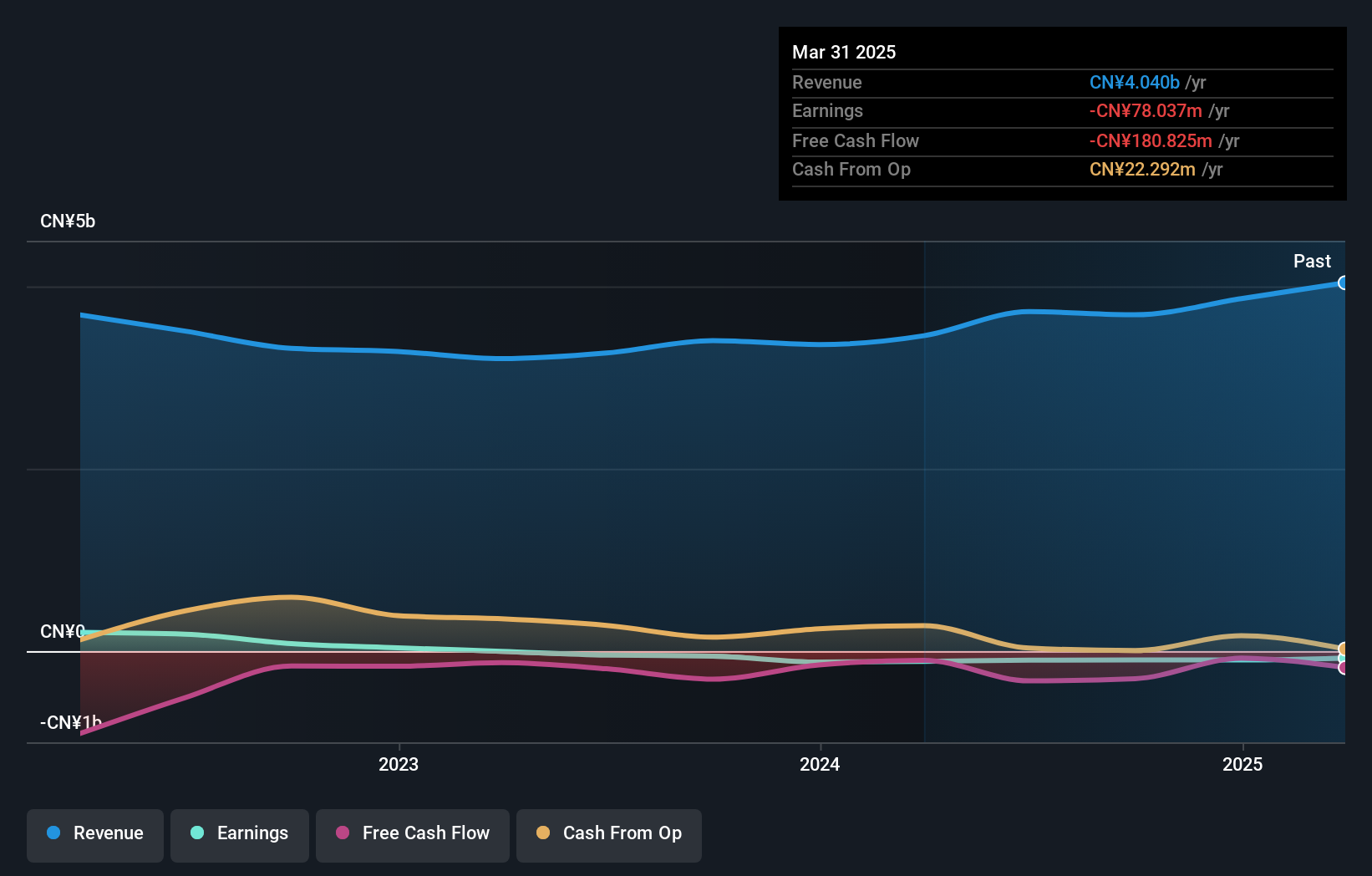

Zhejiang Wazam New Materials Co., LTD., despite its current unprofitable status, is demonstrating robust potential with a forecasted annual revenue growth of 25.9%, significantly outpacing the Chinese market's average of 13.5%. This growth trajectory is complemented by an anticipated earnings increase of 188.15% per year, positioning the company for profitability within three years. Recent financials reveal a narrowing net loss from CNY 30.52 million to CNY 6.65 million year-over-year, reflecting effective cost management and operational improvements. The firm's substantial investment in R&D could be a pivotal factor in sustaining its competitive edge and fostering innovation in new materials technology. In light of these developments, Zhejiang Wazam appears poised for a transformative phase which may redefine its market standing and financial health. While challenges remain, particularly in achieving positive free cash flow and covering debt with operating cash flow, the strategic focus on high-growth sectors like new materials indicates promising prospects for future performance enhancements and industry impact.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Money Forward, Inc. offers financial solutions tailored for individuals, financial institutions, and corporations mainly in Japan with a market capitalization of approximately ¥267.89 billion.

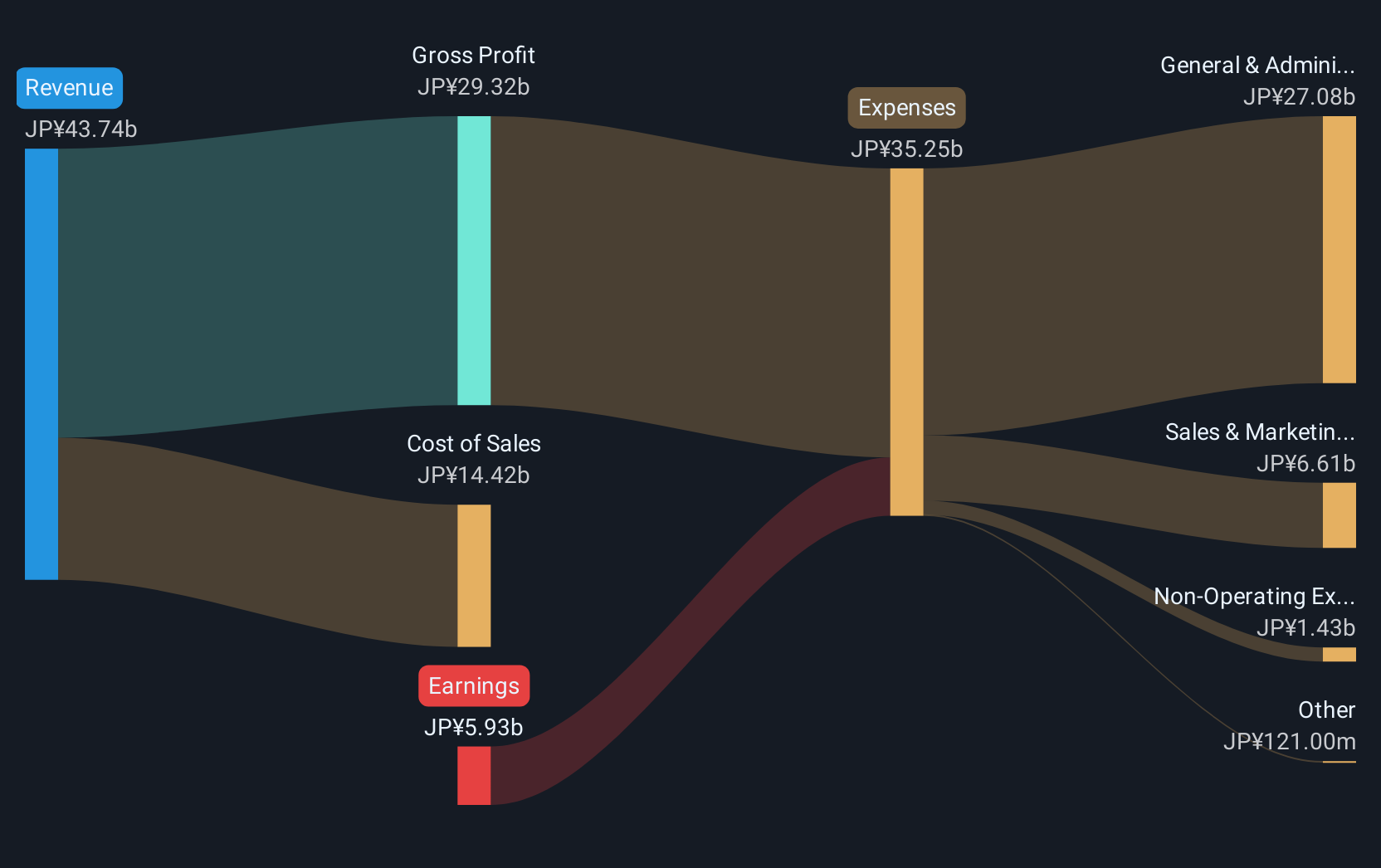

Operations: The company's Platform Services Business generates revenue of ¥38.47 billion, focusing on financial solutions for various sectors in Japan.

Money Forward, Inc., despite its current unprofitable status, is navigating a transformative phase with strategic maneuvers such as converting subsidiaries to wholly-owned entities and anticipating revenue between JPY 39.5 billion and JPY 42 billion for FY2024. This reflects a robust annual revenue growth forecast of 19.7%, outpacing Japan's average of 4.2%. The company's commitment to R&D is evident from the projected operating losses, which are integral to its long-term strategy to secure profitability, expected within three years with an earnings growth rate of 57.7% annually. Recent executive changes and substantial financial forecasts underscore a period of significant restructuring aimed at enhancing operational efficiency and market competitiveness in the tech sector.

- Delve into the full analysis health report here for a deeper understanding of Money Forward.

Gain insights into Money Forward's historical performance by reviewing our past performance report.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥181.54 billion.

Operations: The company's primary revenue stream is its platform business, which generated ¥27.09 billion. It focuses on delivering cloud-based solutions tailored to accounting and HR needs in Japan.

Freee K.K., poised for significant transformation, recently announced a strategic issuance of new restricted shares to bolster its financial structure and support expansive growth. Despite its current unprofitable status, the company is navigating through volatile market conditions with an impressive projected annual revenue growth of 18.5%, substantially outpacing Japan's average of 4.2%. This growth is underpinned by a robust forecast in earnings, expected to surge by 71.4% annually over the next three years, signaling strong future profitability. The firm's dedication to innovation is reflected in its R&D investments aimed at enhancing product offerings and competitive edge in the tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of freee K.K.

Explore historical data to track freee K.K's performance over time in our Past section.

Seize The Opportunity

- Dive into all 1255 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3994

Money Forward

Provides financial solutions for individuals, financial institutions, and corporations primarily in Japan.

Good value with reasonable growth potential.

Market Insights

Community Narratives