Ülker Bisküvi Sanayi Leads This Trio Of Stocks That May Be Underestimated By The Market

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes nearing record highs and positive sentiment driven by strong labor market reports, investors are increasingly on the lookout for opportunities that may be undervalued by the market. In this context, identifying stocks that are underestimated can offer potential value plays, as these companies might not yet reflect their true intrinsic worth amidst current economic dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | US$72.24 | US$144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| Synovus Financial (NYSE:SNV) | US$57.97 | US$115.67 | 49.9% |

| CS Wind (KOSE:A112610) | ₩42100.00 | ₩83493.57 | 49.6% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.71 | CN¥43.37 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.85 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.728 | €5.42 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | US$72.35 | US$143.99 | 49.8% |

| VerticalScope Holdings (TSX:FORA) | CA$9.01 | CA$18.01 | 50% |

Let's dive into some prime choices out of the screener.

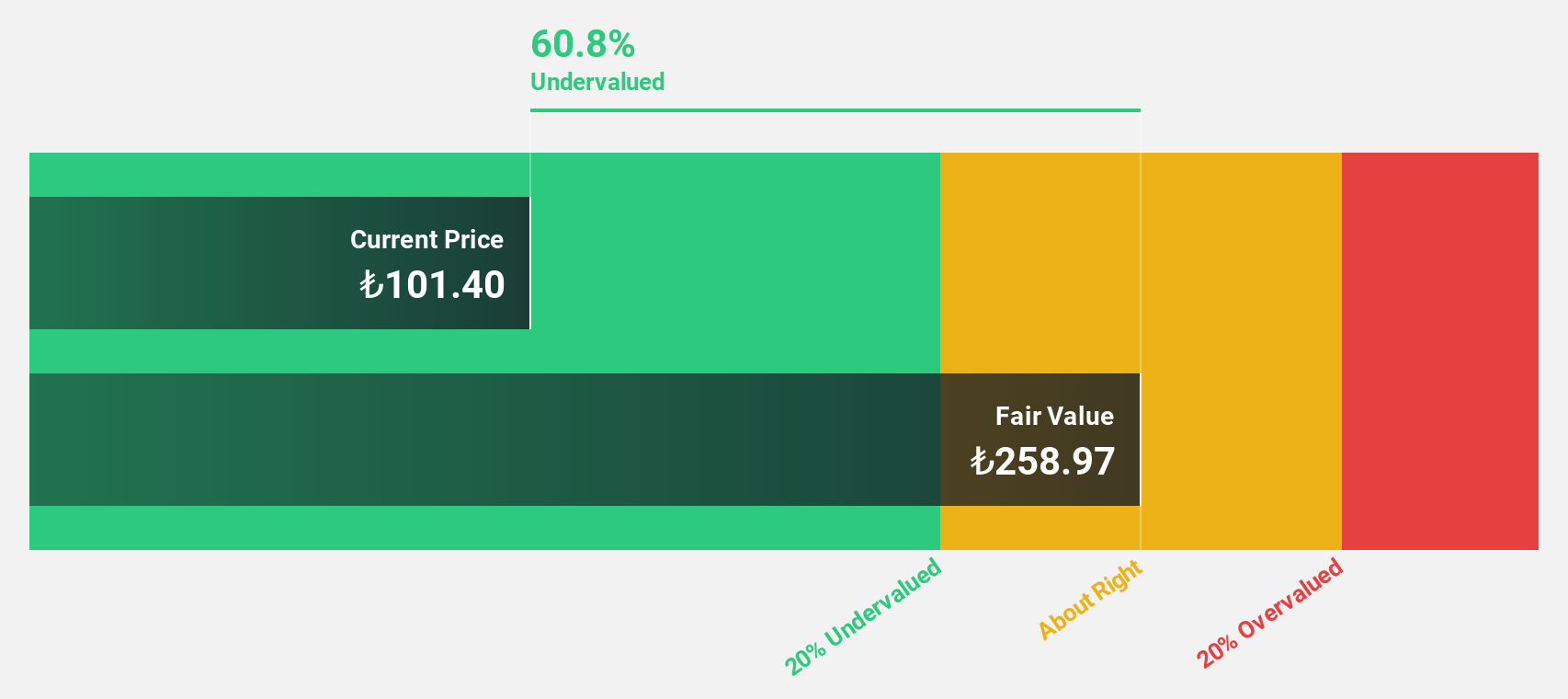

Ülker Bisküvi Sanayi (IBSE:ULKER)

Overview: Ülker Bisküvi Sanayi A.S. manufactures and sells biscuits, chocolates, chocolate-coated biscuits, wafers, and cakes both in Turkey and internationally, with a market cap of TRY40.18 billion.

Operations: The company's revenue from its food processing segment amounts to TRY57.70 billion.

Estimated Discount To Fair Value: 21.6%

Ülker Bisküvi Sanayi is trading at a good value, approximately 21.6% below its estimated fair value of TRY138.72, with the current price at TRY108.8. Despite recent earnings showing a decline in quarterly net income to TRY 470.48 million from TRY 3,052.4 million year-over-year, the company's revenue and earnings are forecast to grow significantly above market averages over the next three years, highlighting potential undervaluation based on cash flows despite debt concerns.

- Our comprehensive growth report raises the possibility that Ülker Bisküvi Sanayi is poised for substantial financial growth.

- Get an in-depth perspective on Ülker Bisküvi Sanayi's balance sheet by reading our health report here.

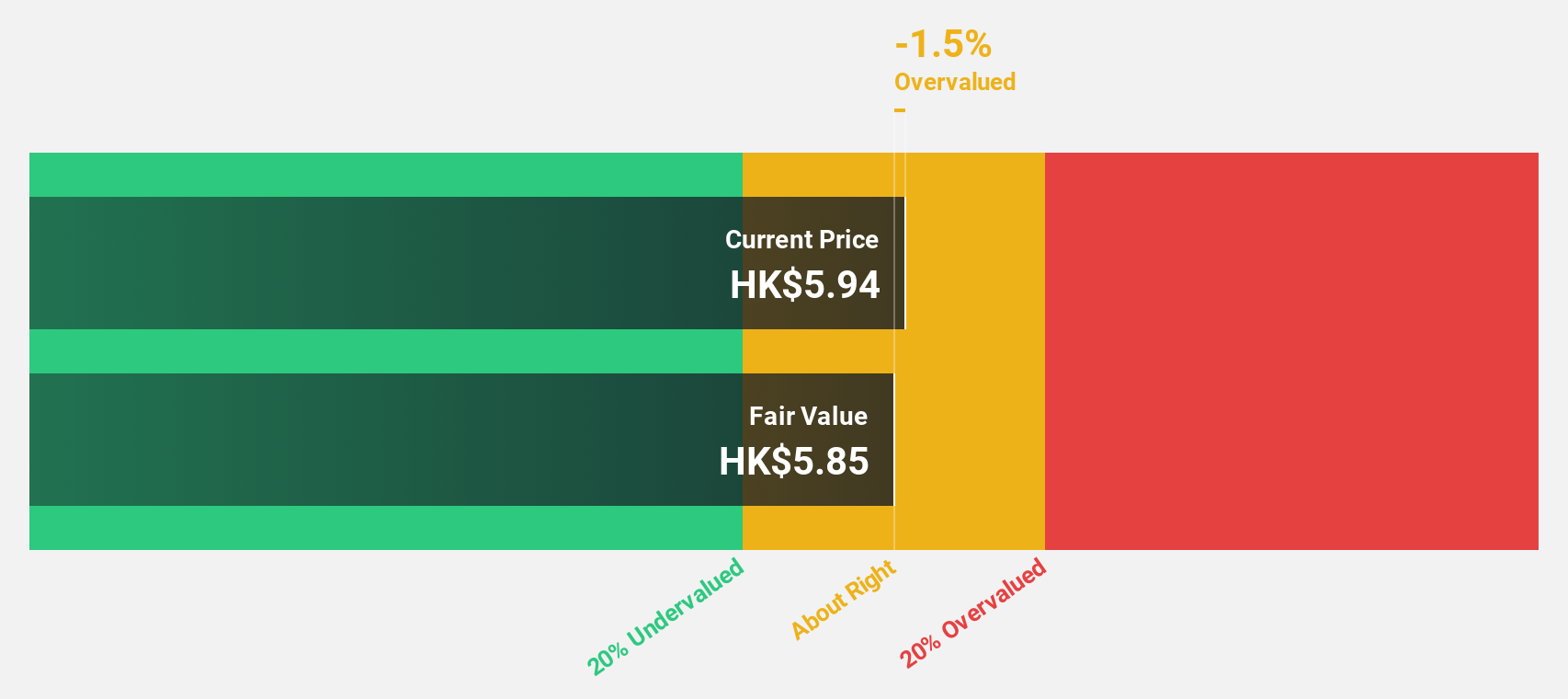

AK Medical Holdings (SEHK:1789)

Overview: AK Medical Holdings Limited is an investment holding company that specializes in the design, development, production, and marketing of orthopedic joint implants and related products both in China and internationally, with a market cap of HK$5.85 billion.

Operations: The company's revenue segments include CN¥989.17 million from orthopedic implants in China and CN¥159.06 million from orthopedic implants in the United Kingdom.

Estimated Discount To Fair Value: 35.9%

AK Medical Holdings is trading at HK$5.21, significantly below its estimated fair value of HK$8.12, suggesting potential undervaluation based on cash flows. Recent earnings reports show steady performance with net income rising to CNY 139.25 million for the half-year ending June 2024, compared to CNY 132.57 million previously. Forecasts indicate robust annual profit growth of over 29%, substantially outpacing Hong Kong market averages, although future return on equity remains modest at a forecasted 12.9%.

- The growth report we've compiled suggests that AK Medical Holdings' future prospects could be on the up.

- Navigate through the intricacies of AK Medical Holdings with our comprehensive financial health report here.

Sansan (TSE:4443)

Overview: Sansan, Inc. is a Japanese company that plans, develops, and sells cloud-based solutions with a market cap of ¥255.59 billion.

Operations: The company's revenue is primarily derived from the Sansan/Bill One Business segment, which generated ¥31.79 billion, and the Eight Business segment, which contributed ¥3.80 billion.

Estimated Discount To Fair Value: 41.8%

Sansan is trading at ¥2,029, significantly below its estimated fair value of ¥3,486.79, highlighting potential undervaluation based on cash flows. Despite recent volatility in share price, earnings grew by 163.2% last year and are forecast to grow annually by 39.78%, outpacing the Japanese market average of 7.9%. However, large one-off items have impacted financial results recently. Analysts agree on a potential stock price increase of 28.6%.

- In light of our recent growth report, it seems possible that Sansan's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Sansan.

Summing It All Up

- Click this link to deep-dive into the 916 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ULKER

Ülker Bisküvi Sanayi

Manufactures, markets, and sells biscuits, chocolates, chocolate coated biscuits, wafers, and cakes in Turkey and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives