Japanese Stocks Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

In October 2024, Japan's stock markets experienced a decline, with the Nikkei 225 Index falling by 1.58% and the broader TOPIX Index losing 0.64%, amid easing domestic inflation and speculation about the Bank of Japan's interest rate decisions. This environment presents opportunities for investors to explore stocks trading below their estimated value, as identifying undervalued stocks can be key in navigating fluctuating market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3445.00 | ¥6689.20 | 48.5% |

| Akatsuki (TSE:3932) | ¥2017.00 | ¥3730.35 | 45.9% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥3925.00 | ¥7698.38 | 49% |

| Pilot (TSE:7846) | ¥4693.00 | ¥8886.98 | 47.2% |

| Management SolutionsLtd (TSE:7033) | ¥1950.00 | ¥3840.76 | 49.2% |

| S-Pool (TSE:2471) | ¥369.00 | ¥693.65 | 46.8% |

| Adventure (TSE:6030) | ¥3975.00 | ¥7416.87 | 46.4% |

| KeePer Technical Laboratory (TSE:6036) | ¥4220.00 | ¥7829.06 | 46.1% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3355.00 | ¥5979.89 | 43.9% |

| Mercari (TSE:4385) | ¥2389.50 | ¥4312.29 | 44.6% |

Here's a peek at a few of the choices from the screener.

Sansan (TSE:4443)

Overview: Sansan, Inc. is a company that plans, develops, and sells cloud-based solutions in Japan with a market capitalization of ¥295.64 billion.

Operations: The company generates revenue primarily from its Sansan/Bill One Business, which accounts for ¥31.79 billion, and its Eight Business, contributing ¥3.80 billion.

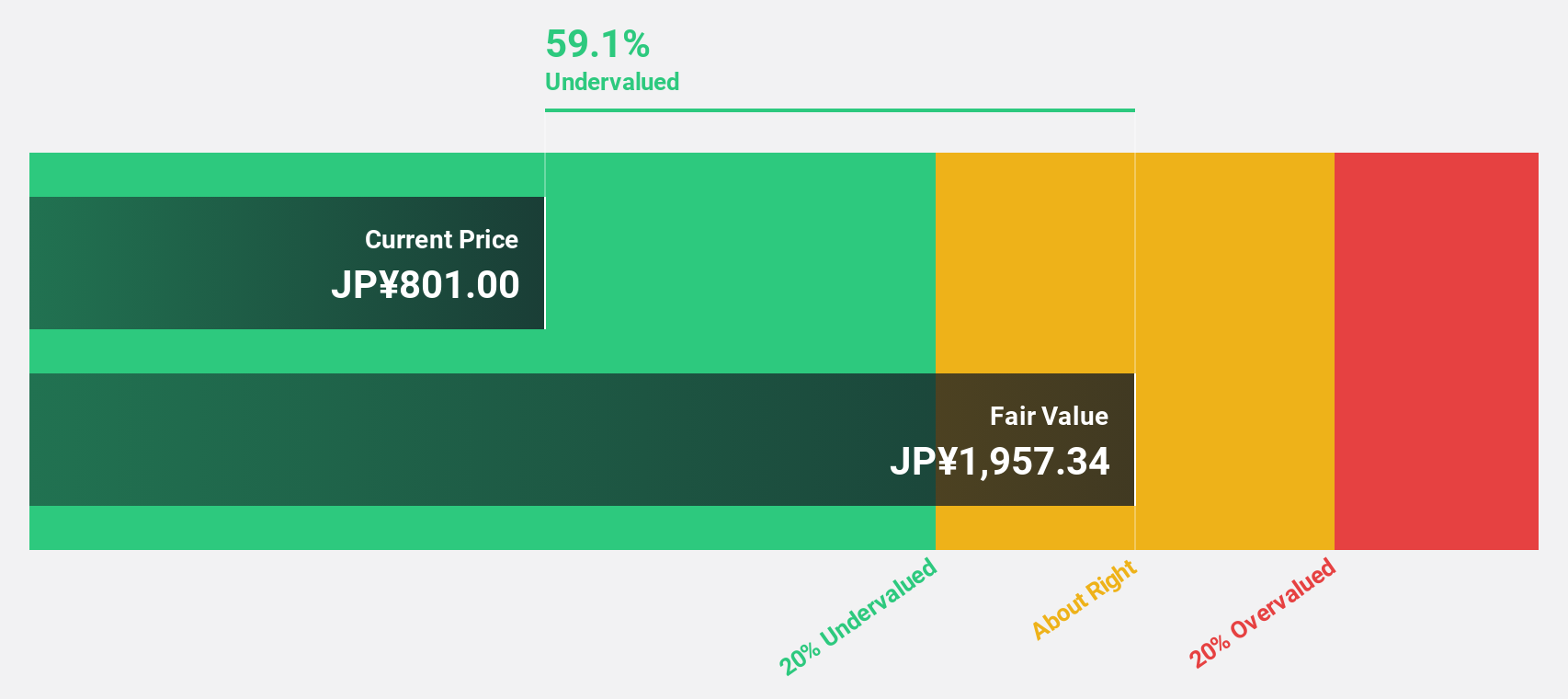

Estimated Discount To Fair Value: 35%

Sansan is currently trading at ¥2,347, significantly below its estimated fair value of ¥3,608.94, indicating it may be undervalued based on cash flows. The company's earnings are expected to grow significantly at 39.3% annually over the next three years, outpacing the Japanese market's growth rate of 8.7%. Despite large one-off items affecting financial results, Sansan's high forecasted return on equity and recent share buyback demonstrate potential for strong future performance.

- Insights from our recent growth report point to a promising forecast for Sansan's business outlook.

- Take a closer look at Sansan's balance sheet health here in our report.

Takara Bio (TSE:4974)

Overview: Takara Bio Inc. operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, other parts of Asia, the United States, Europe, and internationally with a market cap of approximately ¥128.24 billion.

Operations: The company's revenue segments include the Drug Discovery Company, which generated ¥42.82 billion.

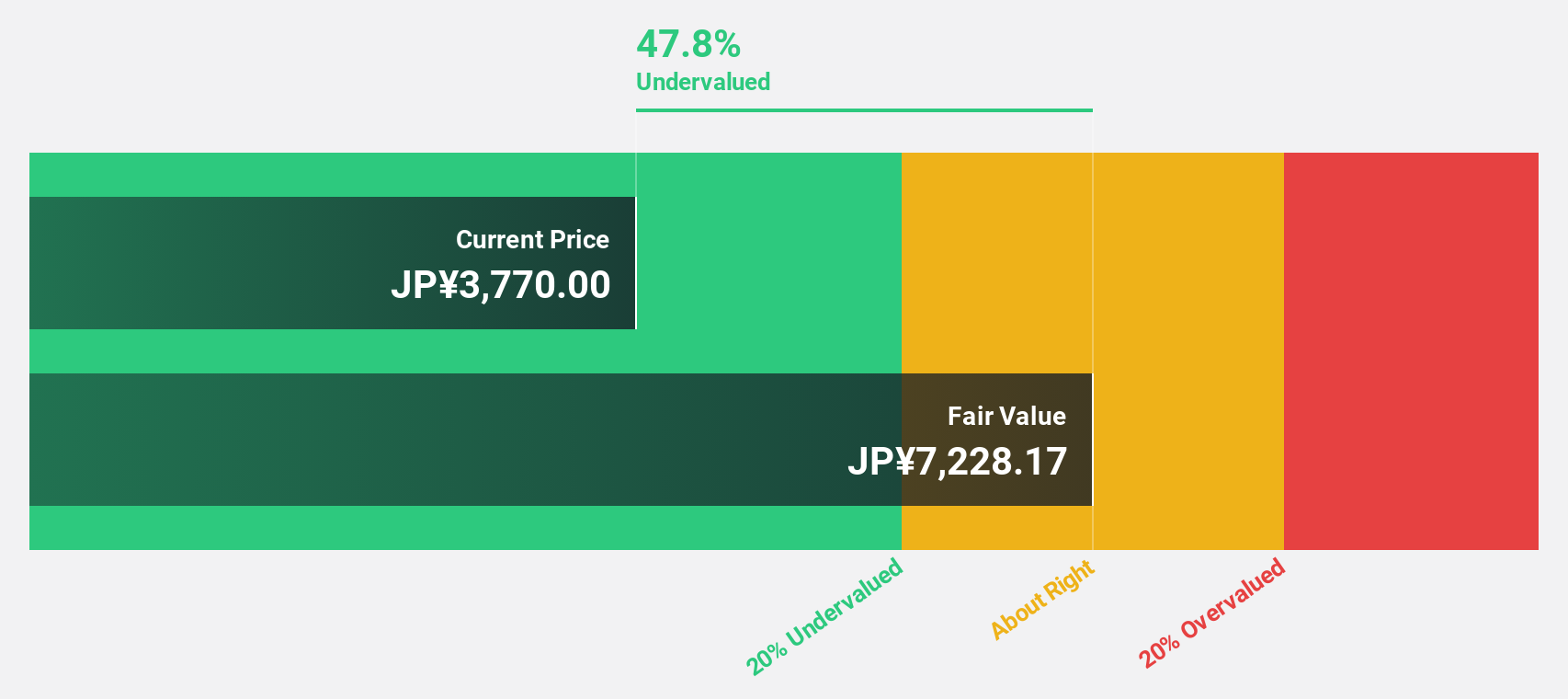

Estimated Discount To Fair Value: 35.3%

Takara Bio is trading at ¥1,065, well below its estimated fair value of ¥1,647.29, highlighting its potential undervaluation based on cash flows. Forecasts indicate earnings growth of 30.2% annually over the next three years, surpassing the Japanese market's 8.7%. However, profit margins have decreased significantly from last year’s 17% to 0.3%, and return on equity is expected to remain low at 4.4%. Recent guidance projects modest sales and profit increases for FY2025.

- In light of our recent growth report, it seems possible that Takara Bio's financial performance will exceed current levels.

- Get an in-depth perspective on Takara Bio's balance sheet by reading our health report here.

Strike CompanyLimited (TSE:6196)

Overview: Strike Company, Limited offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan, with a market cap of ¥86.12 billion.

Operations: The company generates revenue from its M&A Intermediary Business, amounting to ¥17.97 billion.

Estimated Discount To Fair Value: 32.7%

Strike Company Limited, trading at ¥4,485, is significantly below its fair value estimate of ¥6,662.58. Its earnings are forecast to grow 18.1% annually, outpacing the Japanese market's 8.7%. Despite this growth and a substantial dividend increase to ¥85 per share for FY2024/9, the company faces challenges with a volatile share price and an unstable dividend history. Recent executive appointments aim to strengthen corporate strategy and advisory functions.

- Our earnings growth report unveils the potential for significant increases in Strike CompanyLimited's future results.

- Click to explore a detailed breakdown of our findings in Strike CompanyLimited's balance sheet health report.

Next Steps

- Investigate our full lineup of 83 Undervalued Japanese Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud- based solutions in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives