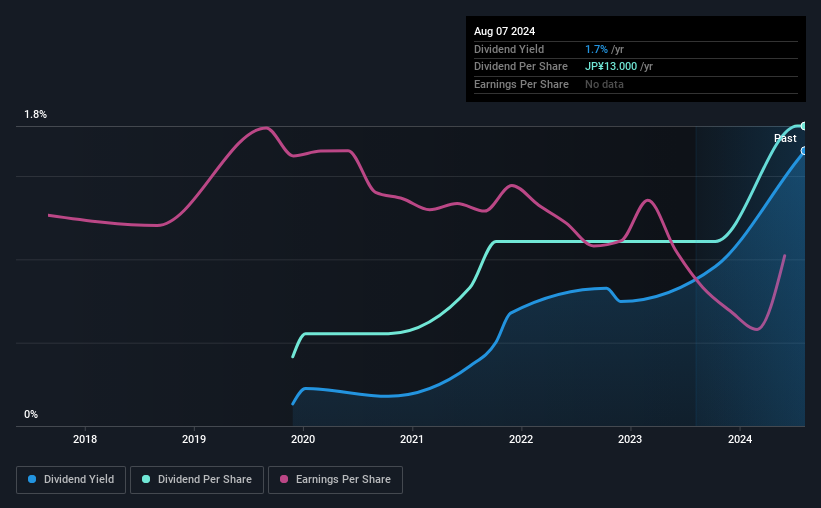

WITZ Corporation (TSE:4440) has announced that it will be increasing its dividend from last year's comparable payment on the 29th of November to ¥13.00. This takes the annual payment to 1.7% of the current stock price, which is about average for the industry.

See our latest analysis for WITZ

WITZ's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. However, prior to this announcement, WITZ's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, EPS could fall by 10.4% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 44%, which is definitely feasible to continue.

WITZ Doesn't Have A Long Payment History

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The annual payment during the last 5 years was ¥3.00 in 2019, and the most recent fiscal year payment was ¥13.00. This means that it has been growing its distributions at 34% per annum over that time. WITZ has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. WITZ's EPS has fallen by approximately 10% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Our Thoughts On WITZ's Dividend

Overall, we always like to see the dividend being raised, but we don't think WITZ will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for WITZ (of which 1 is significant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if WITZ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4440

WITZ

Engages in the service design and software development businesses in Japan.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026