- China

- /

- Personal Products

- /

- SHSE:603235

JiangXi Tianxin Pharmaceutical And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

Amidst heightened global trade tensions and economic uncertainty, Asian markets have been navigating a challenging landscape, with small-cap stocks particularly feeling the pressure as reflected in the significant declines of key indices like the Russell 2000. In such volatile times, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Kanro | NA | 6.17% | 37.33% | ★★★★★★ |

| Hangzhou Seck Intelligent Technology | NA | 15.95% | 6.81% | ★★★★★★ |

| AIC | NA | 25.92% | 57.48% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Zhejiang Hengwei Battery | NA | 9.07% | 10.81% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Dura Tek | 4.98% | 42.18% | 94.37% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

JiangXi Tianxin Pharmaceutical (SHSE:603235)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Tianxin Pharmaceutical Co., Ltd. is a company that produces and sells vitamins in China with a market capitalization of CN¥12.44 billion.

Operations: Tianxin Pharmaceutical's primary revenue stream is derived from the production and sale of vitamins. The company has a market capitalization of CN¥12.44 billion, reflecting its significant presence in the Chinese pharmaceutical market.

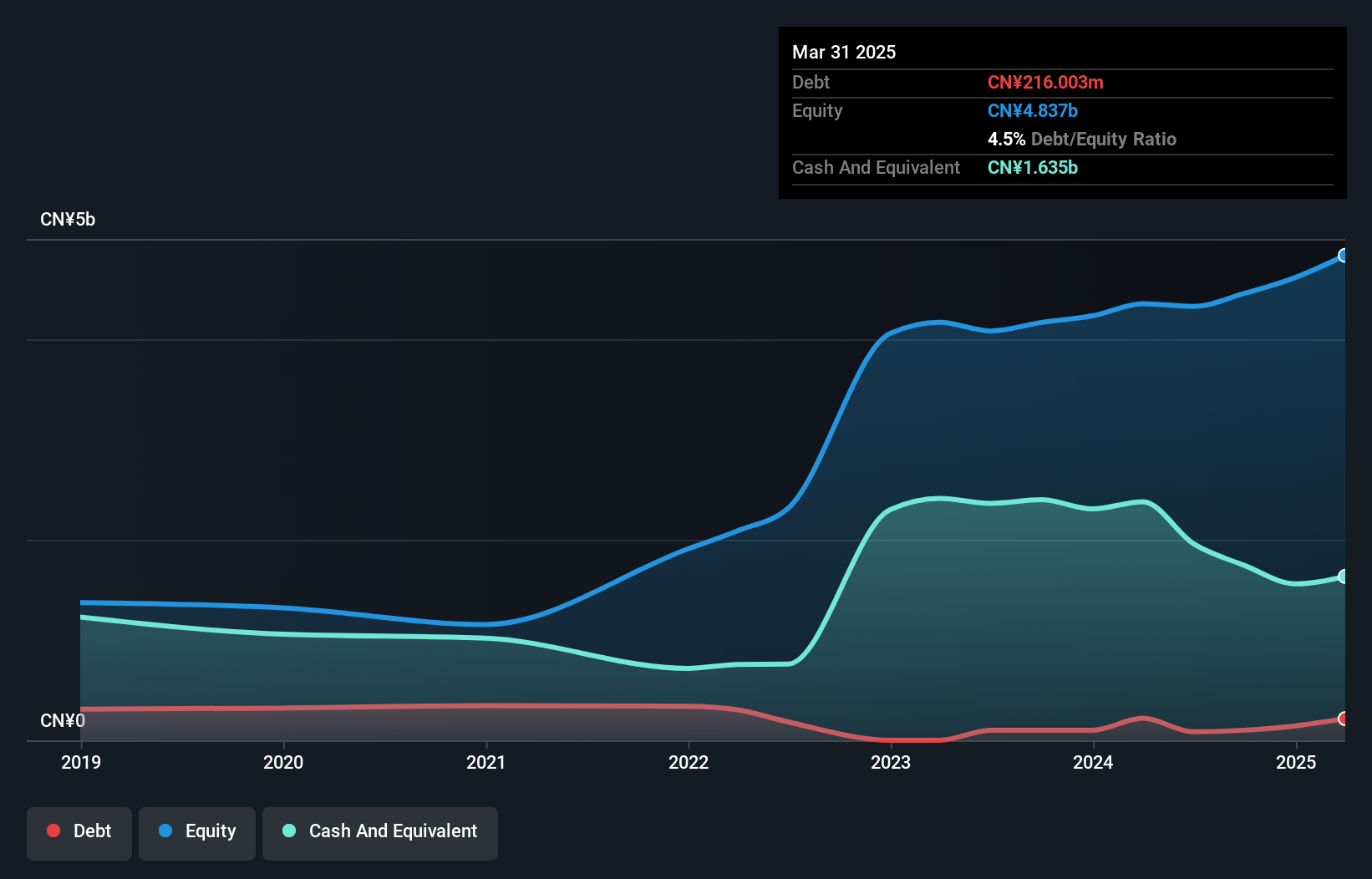

JiangXi Tianxin Pharmaceutical, a smaller player in the market, showcases a mixed financial landscape. Over the past year, earnings surged by 15.2%, outpacing the Personal Products industry's -6% performance. Despite this growth, earnings have decreased by 12.6% annually over five years. The company boasts a favorable debt profile with cash surpassing total debt and an impressive reduction in its debt-to-equity ratio from 23.9% to 2.3%. While free cash flow is negative recently at CNY -367 million as of September 2024, its price-to-earnings ratio of 22x remains attractive compared to the broader CN market's average of 34x.

UTour Group (SZSE:002707)

Simply Wall St Value Rating: ★★★★☆☆

Overview: UTour Group Co., Ltd. operates in the outbound tourism wholesale and retail sector both within China and internationally, with a market cap of CN¥8.30 billion.

Operations: UTour Group generates revenue through its outbound tourism wholesale and retail operations, both domestically and internationally. The company's financial performance is influenced by various cost components associated with these operations.

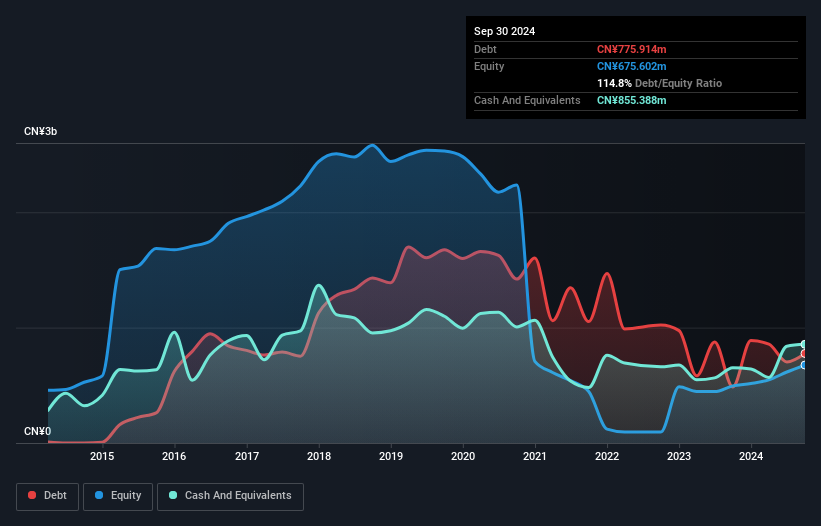

UTour Group, a smaller entity in the hospitality sector, recently turned profitable, setting it apart from an industry that saw a 10.2% earnings drop. The company's debt is well-managed with interest payments covered 9.1 times by EBIT and cash exceeding total debt. Trading at 81% below estimated fair value suggests potential undervaluation, while its high-quality earnings bolster investor confidence. Over five years, the debt-to-equity ratio increased from 66 to 115%, indicating rising leverage but not necessarily risk due to current profitability and positive free cash flow. Recent board changes could signal strategic shifts ahead for UTour Group's growth trajectory.

- Unlock comprehensive insights into our analysis of UTour Group stock in this health report.

Review our historical performance report to gain insights into UTour Group's's past performance.

WingArc1st (TSE:4432)

Simply Wall St Value Rating: ★★★★★★

Overview: WingArc1st Inc. is a Japanese company that develops and sells software and services, with a market cap of ¥122.63 billion.

Operations: WingArc1st generates revenue primarily through its software and services offerings. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market dynamics.

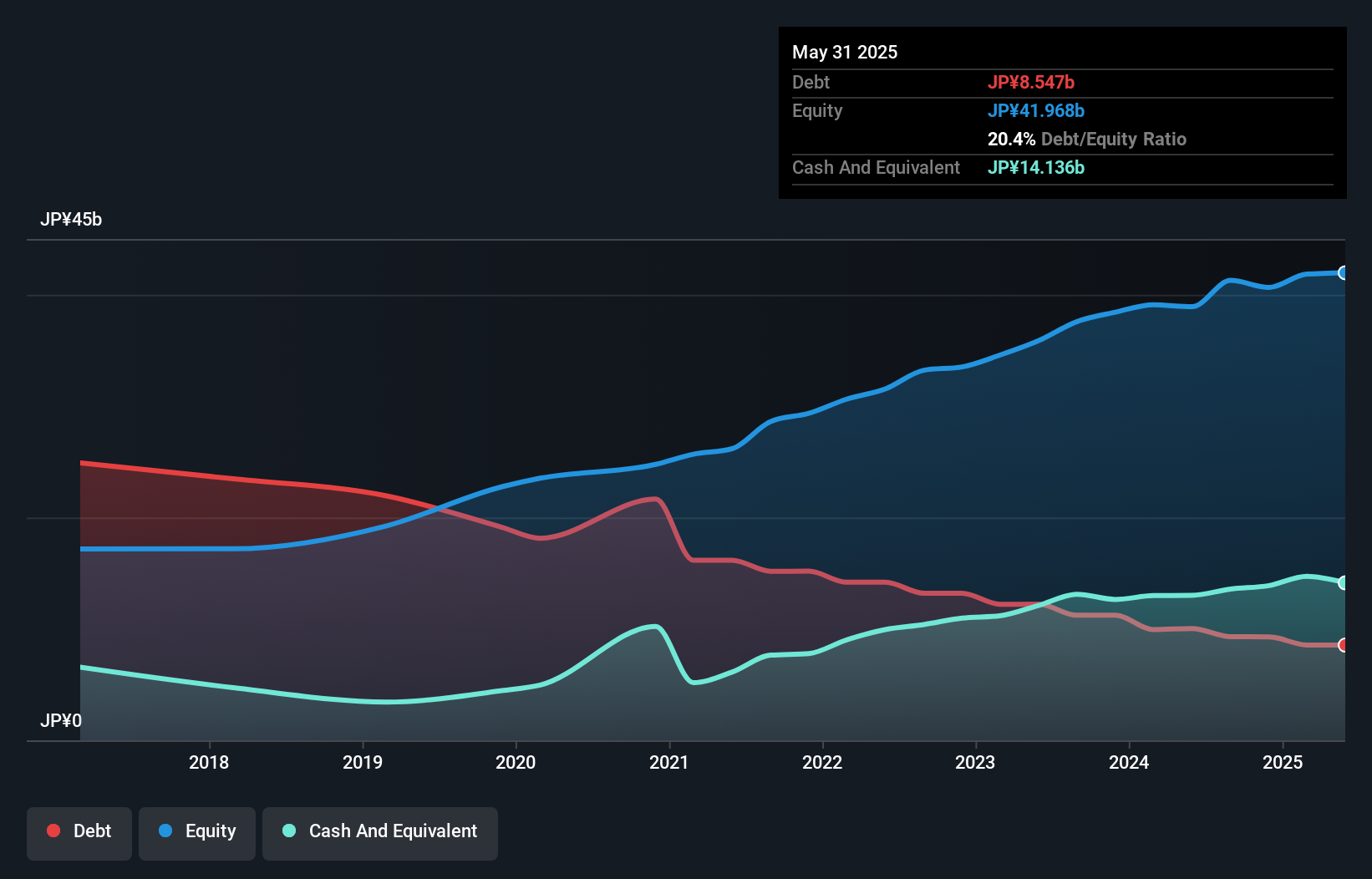

WingArc1st, a nimble player in the software sector, has demonstrated impressive financial health with earnings growth of 12.4% over the past year, outpacing the industry average of 12.2%. The company's debt-to-equity ratio has significantly improved from 84% to 22.9% over five years, indicating strong financial management. Trading at about 5.6% below its estimated fair value suggests potential for investor interest. Recent guidance projects revenue of ¥30 billion and operating profit of ¥8.9 billion for fiscal year ending February 2026, while dividends are set to increase to JPY 52 per share this quarter compared to last year's JPY 42 per share payout, reflecting robust shareholder returns strategy.

Next Steps

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2615 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade JiangXi Tianxin Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603235

JiangXi Tianxin Pharmaceutical

Jiangxi Tianxin Pharmaceutical Co., Ltd. produces and sells vitamins in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives