Strong week for Kudan (TSE:4425) shareholders doesn't alleviate pain of five-year loss

This week we saw the Kudan Inc. (TSE:4425) share price climb by 11%. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. In fact, the share price has tumbled down a mountain to land 72% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The real question is whether the business can leave its past behind and improve itself over the years ahead.

On a more encouraging note the company has added JP¥1.3b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

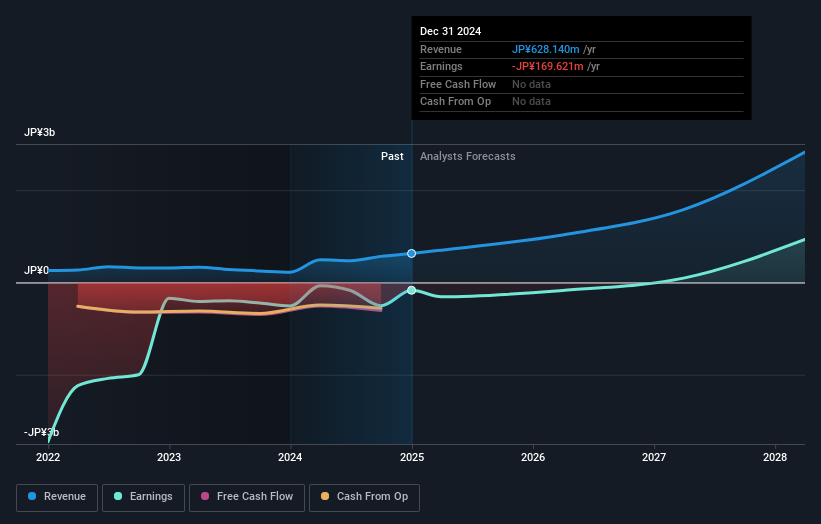

Given that Kudan didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, Kudan saw its revenue increase by 14% per year. That's a fairly respectable growth rate. So it is unexpected to see the stock down 11% per year in the last five years. The market can be a harsh master when your company is losing money and revenue growth disappoints.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Kudan's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Kudan shareholders are down 37% for the year. Unfortunately, that's worse than the broader market decline of 4.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Kudan better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Kudan (including 1 which shouldn't be ignored) .

Of course Kudan may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

If you're looking to trade Kudan, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kudan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4425

Kudan

Engages in the research and development, and provision of computer software algorithms and embedded technologies classified as artificial perception that are machine equivalent of human eyes primarily in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives