Amid a backdrop of mixed performances in global markets, smaller-cap indexes have recently outperformed, with the S&P MidCap 400 and Russell 2000 posting gains even as larger indices like the Dow Jones Industrial Average and Nasdaq Composite faced declines. This trend highlights the potential for high growth tech stocks in Asia to capture investor interest, particularly those that can navigate trade uncertainties and leverage innovation to drive growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.04% | ★★★★★★ |

| Zhongji Innolight | 25.13% | 25.49% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Fengyuzhu Culture Technology (SHSE:603466)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Fengyuzhu Culture Technology Co., Ltd. is a company with a market cap of CN¥6.11 billion, focusing on cultural technology and creative design services.

Operations: Fengyuzhu Culture Technology specializes in providing cultural technology solutions and creative design services. The company's revenue model is centered around these core offerings, with a focus on integrating technology into cultural experiences.

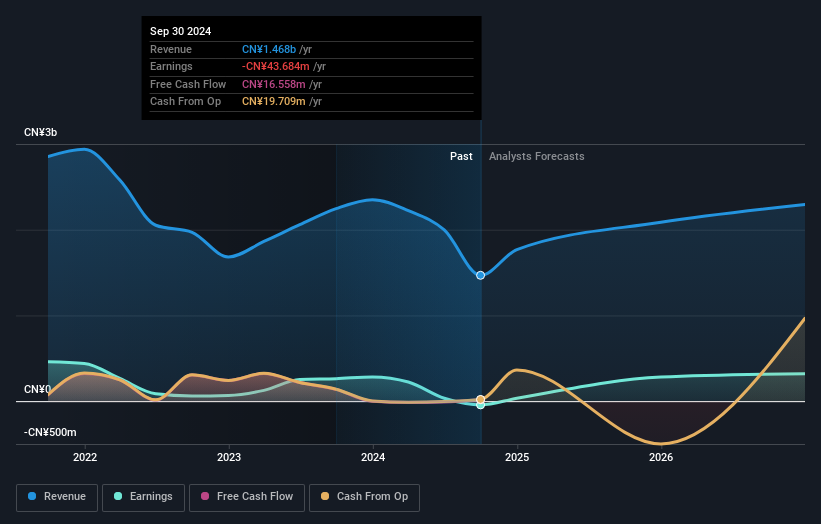

Shanghai Fengyuzhu Culture Technology has demonstrated a robust turnaround in its financial performance, with first-quarter sales soaring to CNY 382.3 million from CNY 294.52 million year-over-year, and net income reaching CNY 40.27 million compared to a net loss previously. This growth is underpinned by an aggressive R&D strategy, which is critical given the competitive tech landscape in Asia. The company's revenue growth rate at 22.1% annually outpaces the Chinese market average of 12.6%, signaling strong market capture and scalability potential despite current unprofitability. With earnings expected to grow by an impressive 63.6% annually, Shanghai Fengyuzhu is positioning itself as a significant player in the region's tech scene, leveraging innovation and strategic market adaptations.

Guomai Technologies (SZSE:002093)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guomai Technologies, Inc. operates in China offering services in internet of things technology, consulting and design, science park operations and development, as well as education services with a market cap of CN¥11.69 billion.

Operations: The company generates revenue through its internet of things technology services, consulting and design, science park operations and development, and education services in China.

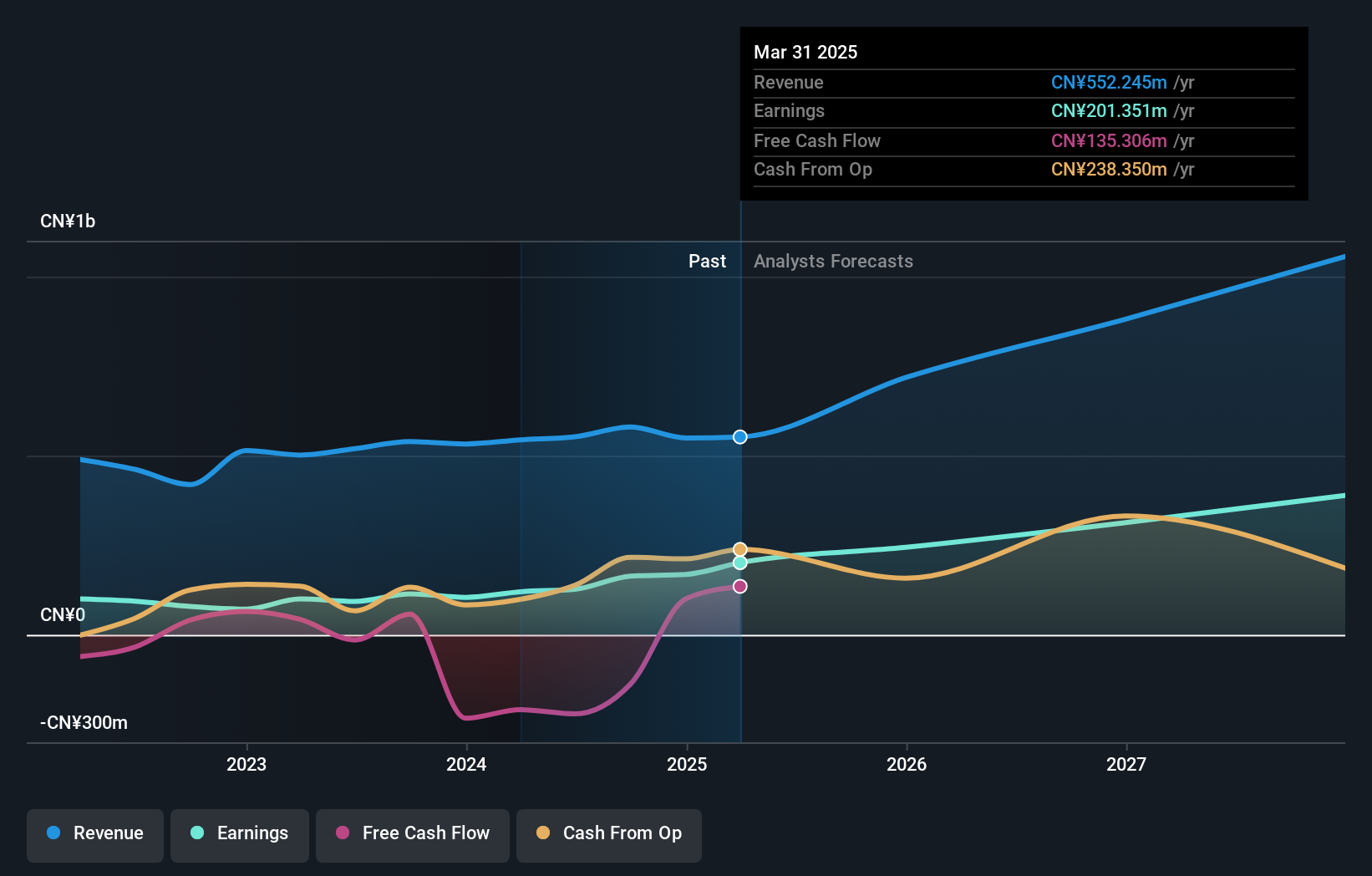

Guomai Technologies has recently reported a notable increase in both sales and net income, with sales rising to CNY 549.42 million from CNY 532.66 million, and net income surging to CNY 168.61 million from CNY 104.46 million year-over-year. This financial uplift is supported by a solid earnings growth rate of 27.6% annually, surpassing the broader Chinese market's average of 23.6%. Despite a highly volatile share price in recent months, Guomai's aggressive pursuit in innovation is evident with R&D investments aligning closely with its revenue growth at an impressive rate of 23.4% annually, significantly outpacing the industry standard growth rate of -10.6%. The company’s strategic focus on enhancing its technological capabilities could position it well for sustained growth amidst Asia's competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Guomai Technologies' health report.

Examine Guomai Technologies' past performance report to understand how it has performed in the past.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baudroie, Inc. is a company that delivers optimal IT solutions in Japan with a market capitalization of ¥90.37 billion.

Operations: The company generates revenue primarily through its IT Infrastructure Business, which accounts for ¥11.65 billion.

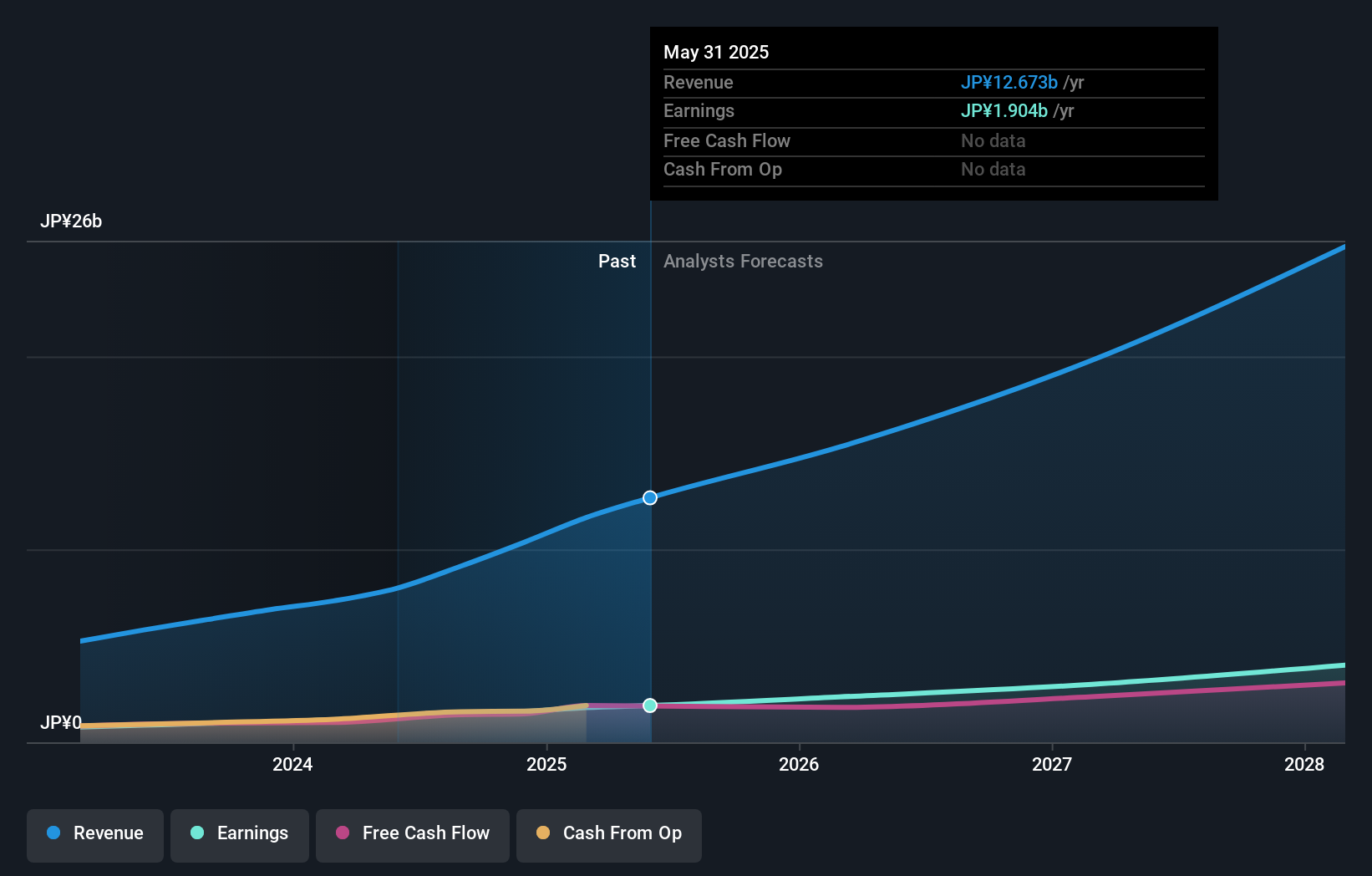

Baudroieinc, a contender in Asia's tech arena, has demonstrated robust financial performance with a 26.2% annual revenue growth and a 25.6% increase in earnings. This growth trajectory is supported by strategic R&D investments that are crucial for maintaining competitive advantage; the company invested significantly in innovation, aligning closely with its revenue upsurge. Moreover, recent corporate activities including a substantial share buyback program completed in February 2025 and forward-looking earnings guidance suggest proactive management and confidence in sustained profitability. These elements collectively underscore Baudroieinc’s potential to thrive amidst the dynamic technological landscape of Asia.

- Navigate through the intricacies of baudroieinc with our comprehensive health report here.

Gain insights into baudroieinc's past trends and performance with our Past report.

Seize The Opportunity

- Delve into our full catalog of 495 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603466

Shanghai Fengyuzhu Culture Technology

Shanghai Fengyuzhu Culture Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives