3 Global Stocks Estimated To Be Trading At A Discount Of Up To 14.6%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and trade uncertainties, investors are keenly observing the economic signals from major economies. With large-cap tech stocks under pressure and smaller-cap indexes showing resilience, the focus has shifted to identifying opportunities amid volatility. In such an environment, finding stocks that are potentially undervalued can be particularly appealing, as they may offer value relative to their current trading prices despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Auras Technology (TPEX:3324) | NT$455.50 | NT$904.95 | 49.7% |

| Pegasus (TSE:6262) | ¥465.00 | ¥919.55 | 49.4% |

| Lindab International (OM:LIAB) | SEK186.80 | SEK371.19 | 49.7% |

| AeroEdge (TSE:7409) | ¥1875.00 | ¥3720.86 | 49.6% |

| Rakus (TSE:3923) | ¥2188.00 | ¥4351.48 | 49.7% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €23.09 | 50% |

| Rise Consulting Group (TSE:9168) | ¥923.00 | ¥1823.66 | 49.4% |

| BalnibarbiLtd (TSE:3418) | ¥1118.00 | ¥2235.57 | 50% |

| Aozora Bank (TSE:8304) | ¥1859.50 | ¥3690.73 | 49.6% |

| SAMG Entertainment (KOSDAQ:A419530) | ₩36100.00 | ₩72091.68 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

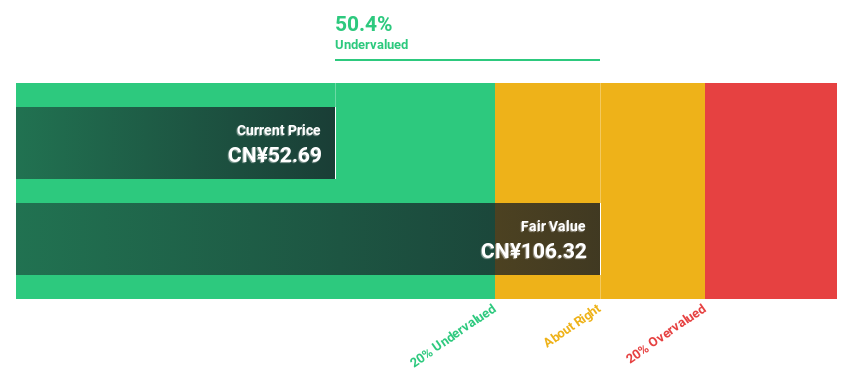

iFLYTEKLTD (SZSE:002230)

Overview: iFLYTEK CO., LTD. provides artificial intelligence (AI) technology services in China and has a market cap of CN¥102.02 billion.

Operations: The company's revenue segments include AI technology services in China.

Estimated Discount To Fair Value: 33%

iFLYTEK is trading at a significant discount, 34.3% below its estimated fair value of CN¥67.7, suggesting it may be undervalued based on cash flows. Despite a forecasted slower revenue growth rate of 17.6% per year compared to the market's 12.6%, its earnings are expected to grow significantly at 58.75% annually over the next three years, outpacing the market's 23.6%. Recent product innovations like Spark WallEX could further enhance its growth prospects in emerging markets such as the Middle East.

- According our earnings growth report, there's an indication that iFLYTEKLTD might be ready to expand.

- Click to explore a detailed breakdown of our findings in iFLYTEKLTD's balance sheet health report.

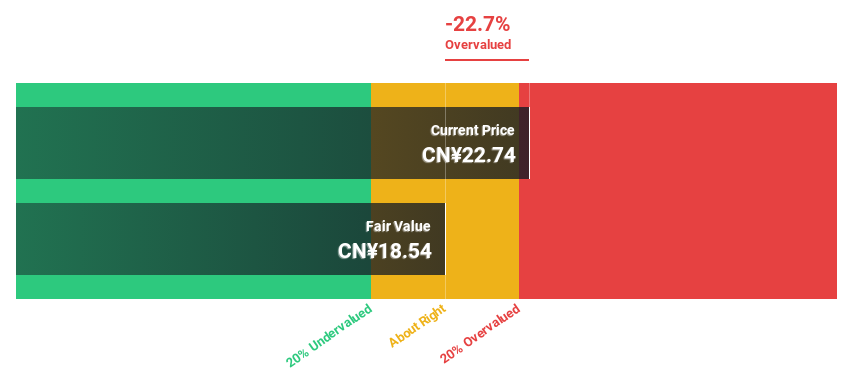

Lens Technology (SZSE:300433)

Overview: Lens Technology Co., Ltd. is a company involved in the production and sale of electronic components in China, with a market cap of CN¥98.54 billion.

Operations: The company's revenue segment consists of the production and sale of electronic components, generating CN¥71.46 billion.

Estimated Discount To Fair Value: 14.6%

Lens Technology's current share price of CN¥19.87 is below its estimated fair value of CN¥23.74, indicating potential undervaluation based on cash flows. Despite a volatile share price, earnings are projected to grow significantly at 25% annually over the next three years, surpassing the market average. Recent financials show a rise in Q1 revenue and net income compared to last year, while a new share repurchase program could support shareholder value amidst an unstable dividend track record.

- Our expertly prepared growth report on Lens Technology implies its future financial outlook may be stronger than recent results.

- Take a closer look at Lens Technology's balance sheet health here in our report.

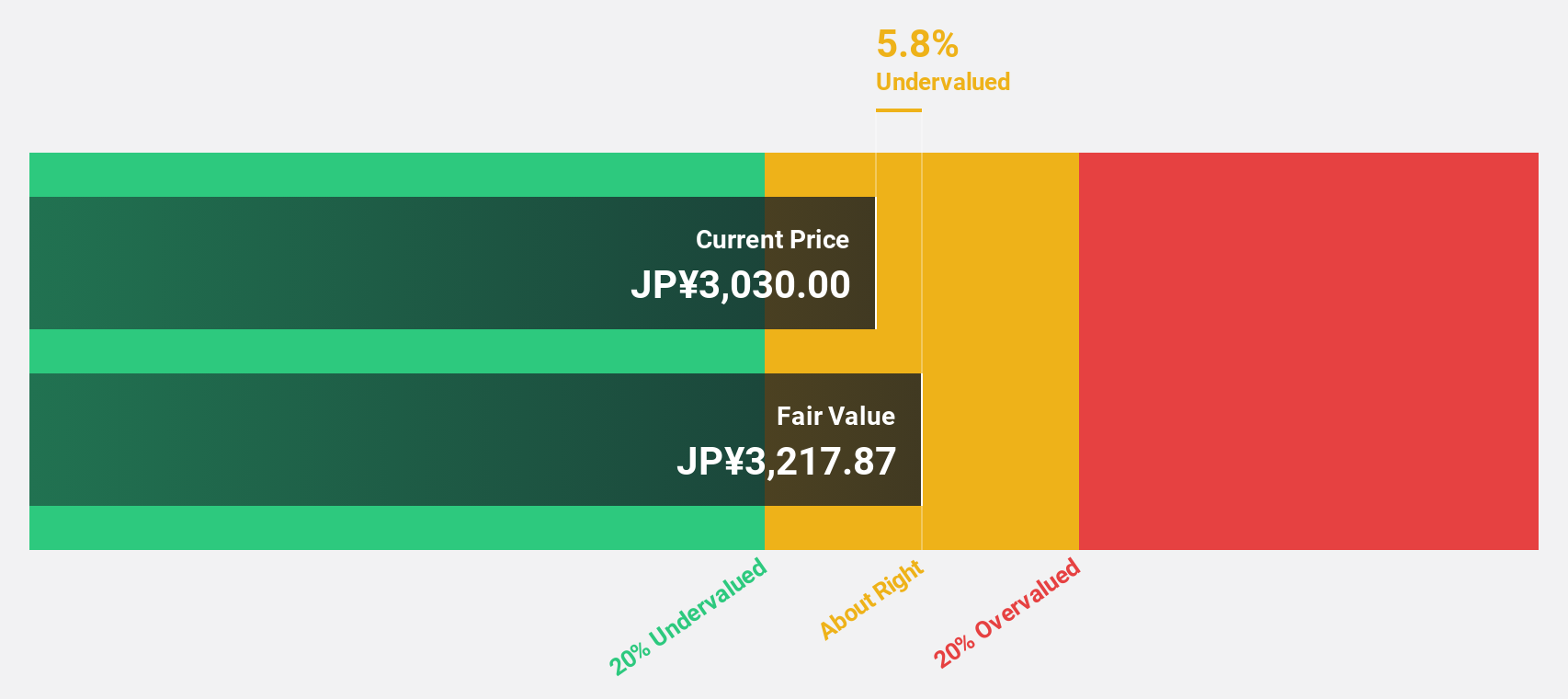

baudroieinc (TSE:4413)

Overview: Baudroie, Inc. offers optimal IT solutions in Japan and has a market cap of ¥84.95 billion.

Operations: The company generates revenue of ¥11.65 billion from its IT Infrastructure Business segment in Japan.

Estimated Discount To Fair Value: 5.8%

Baudroie, Inc.'s share price of ¥5,490 is below its estimated fair value of ¥6,198.36, suggesting undervaluation based on cash flows. Earnings and revenue are forecast to grow significantly at over 25% annually, outpacing the Japanese market. Recent dividend guidance affirms a JPY 15.16 per share payout for fiscal year ending February 2026. Despite high volatility in the past three months, a completed share buyback may enhance shareholder value.

- Our comprehensive growth report raises the possibility that baudroieinc is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of baudroieinc.

Seize The Opportunity

- Gain an insight into the universe of 467 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade iFLYTEKLTD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives