Exploring Undiscovered Gems on None Exchange in November 2024

Reviewed by Simply Wall St

In a period marked by fluctuating market sentiment and policy uncertainties under the new Trump administration, small-cap stocks have been navigating a complex landscape. With indices like the Russell 2000 experiencing notable shifts, investors are keenly observing economic indicators that could impact these smaller companies. In such an environment, identifying promising stocks often involves looking for those with strong fundamentals and potential resilience to broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tait Marketing & Distribution | NA | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hat-San Gemi Insaa Bakim Onarim Deniz Nakliyat Sanayi ve Ticaret Anonim Sirketi (IBSE:HATSN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hat-San Gemi Insaa Bakim Onarim Deniz Nakliyat Sanayi ve Ticaret Anonim Sirketi specializes in the construction of vessels and steel for both marine and land applications, with a market capitalization of TRY9.92 billion.

Operations: Hat-San generates revenue primarily from constructing vessels and steel for marine and land applications. The company has a market capitalization of TRY9.92 billion, indicating its significant presence in the industry.

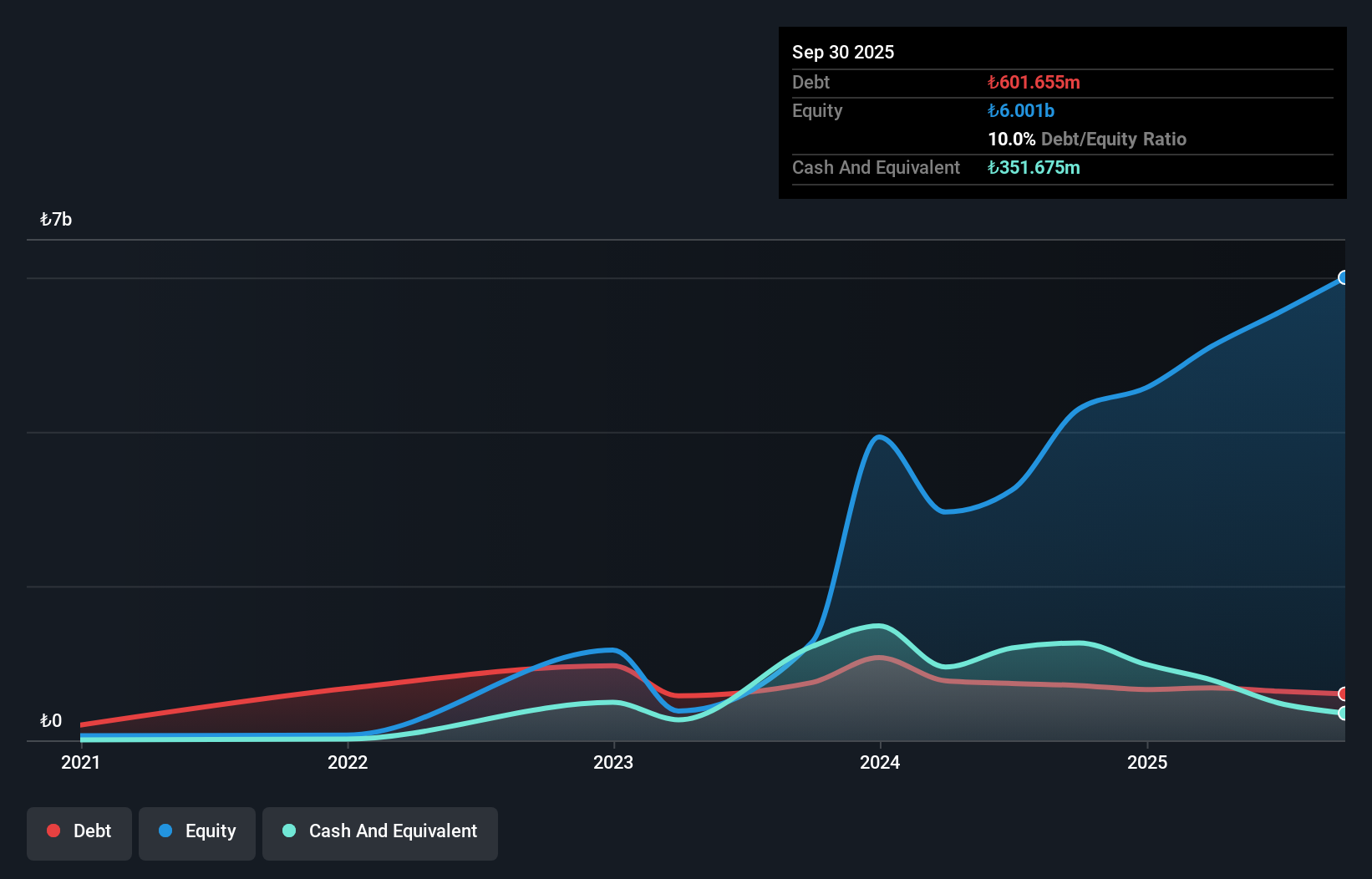

Hat-San, a company with promising potential, has seen its earnings jump by 376% over the past year, outpacing the Machinery industry's growth. Its price-to-earnings ratio stands at 8.5x, which is notably lower than the TR market average of 15x, suggesting it might be undervalued. For the third quarter ending September 2024, Hat-San reported sales of TRY 1.22 billion and a net income of TRY 762.72 million compared to TRY 42.13 million from last year’s same period. Despite fluctuations in quarterly performance, this entity's financial health seems robust with strong cash flow and manageable debt levels.

Fujibo Holdings (TSE:3104)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujibo Holdings, Inc. operates in the manufacturing and sale of polishing pads, industrial chemical products, and textile products both in Japan and internationally, with a market cap of ¥57.85 billion.

Operations: Fujibo Holdings generates revenue primarily from its Abrasive Business, which contributed ¥16.91 billion, followed by the Chemical Industrial Products Business at ¥12.95 billion and the Lifestyle Clothing Business at ¥7.05 billion. The company's net profit margin reflects its efficiency in managing costs relative to its revenue streams.

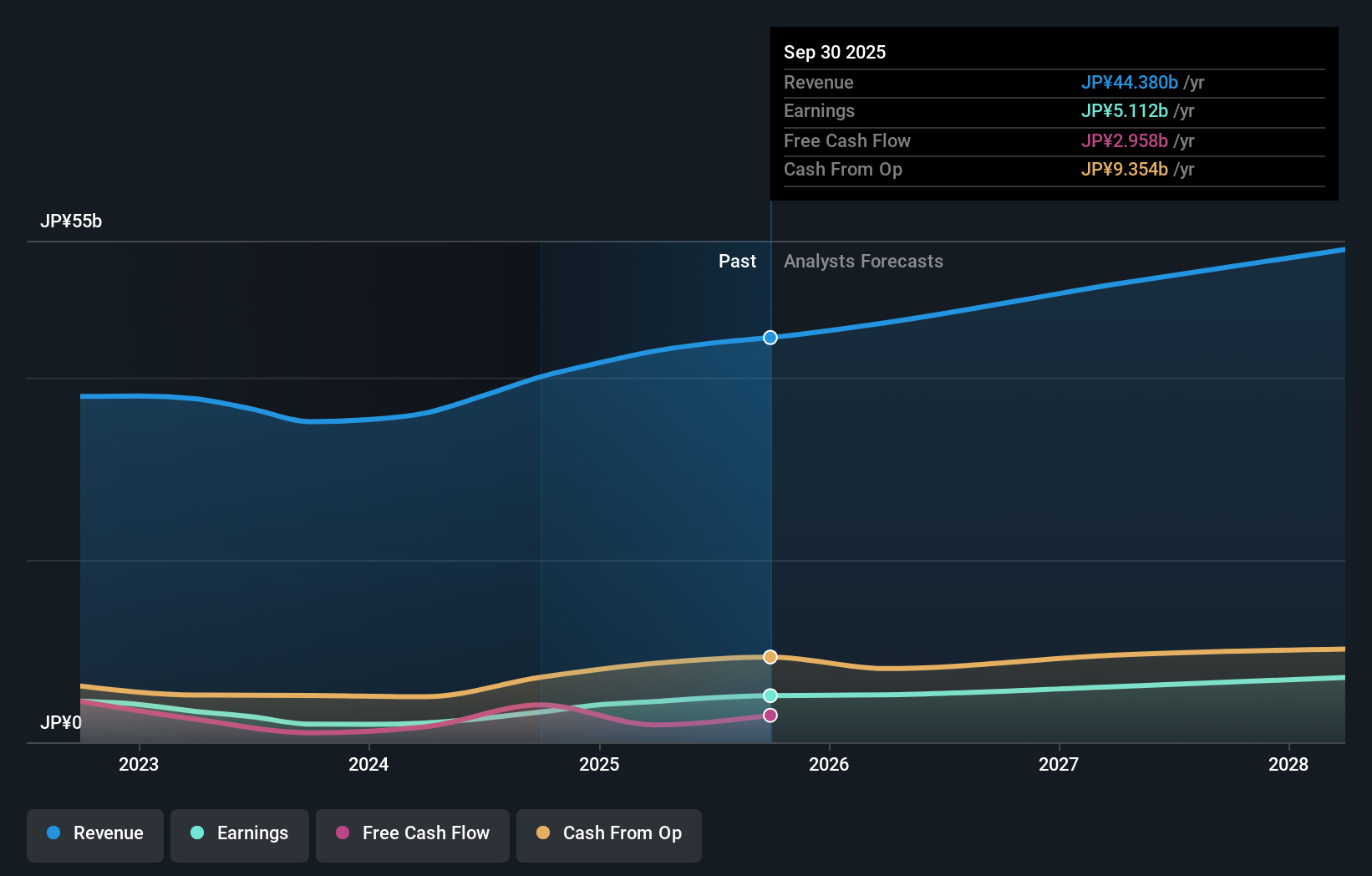

Fujibo Holdings, a smaller player in the luxury sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 67%, outpacing the industry's 17% growth. The company is trading at a significant discount of 58% below its estimated fair value, suggesting potential upside. Fujibo's debt-to-equity ratio improved from 4.3 to 3.1 over five years, highlighting effective debt management. Recent announcements include a dividend increase to JPY 60 per share and an optimistic earnings forecast for fiscal year-end March 2025 with expected net sales of JPY 43.7 billion and operating profit of JPY 6 billion.

- Take a closer look at Fujibo Holdings' potential here in our health report.

Examine Fujibo Holdings' past performance report to understand how it has performed in the past.

Japan System Techniques (TSE:4323)

Simply Wall St Value Rating: ★★★★★★

Overview: Japan System Techniques Co., Ltd. operates in the software industry both domestically and internationally, with a market capitalization of ¥44.29 billion.

Operations: Japan System Techniques Co., Ltd. generates revenue primarily from its DX & SI Business, contributing ¥16.29 billion, followed by the Packaging Business at ¥5.25 billion. The Global Business and Medical Care Big Data segments add ¥3.07 billion and ¥2.86 billion, respectively, to the company's revenue streams.

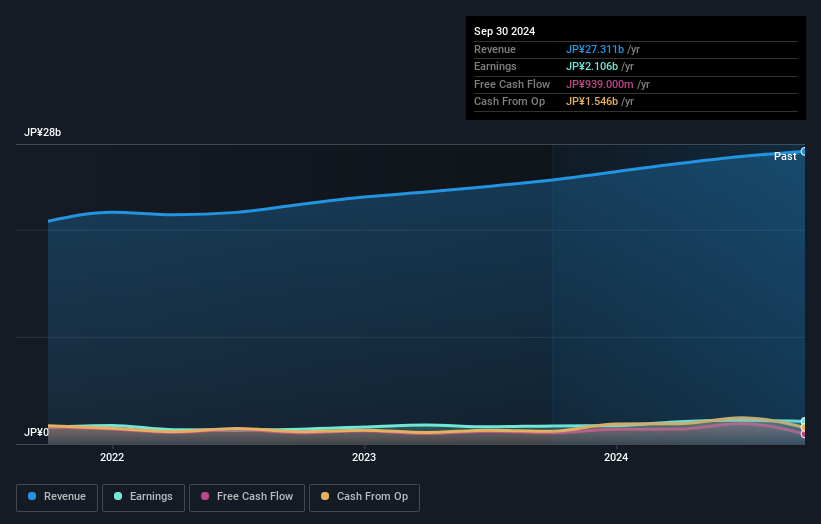

JAST, a promising player in the tech sector, has seen its earnings grow by 24.9% over the past year, outpacing the software industry average of 13.5%. The company boasts a healthy balance sheet with more cash than total debt and an impressive reduction in its debt-to-equity ratio from 32.4% to just 0.5% over five years. Recent initiatives include launching a digital certificate system in collaboration with Seiko Solutions and starting trials for robot-assisted restaurant service with KatsuandKatsu Inc., showcasing JAST's innovative approach to addressing market needs and enhancing operational efficiency across various sectors.

- Dive into the specifics of Japan System Techniques here with our thorough health report.

Explore historical data to track Japan System Techniques' performance over time in our Past section.

Next Steps

- Gain an insight into the universe of 4649 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4323

Japan System Techniques

Engages in the software business in Japan and internationally.

Flawless balance sheet average dividend payer.