As global markets navigate a period of cautious optimism marked by recent rate cuts from the Federal Reserve and political uncertainties, investors are keenly observing the broader economic landscape. Amidst this backdrop, dividend stocks present an attractive option for those seeking income stability and potential growth, especially in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

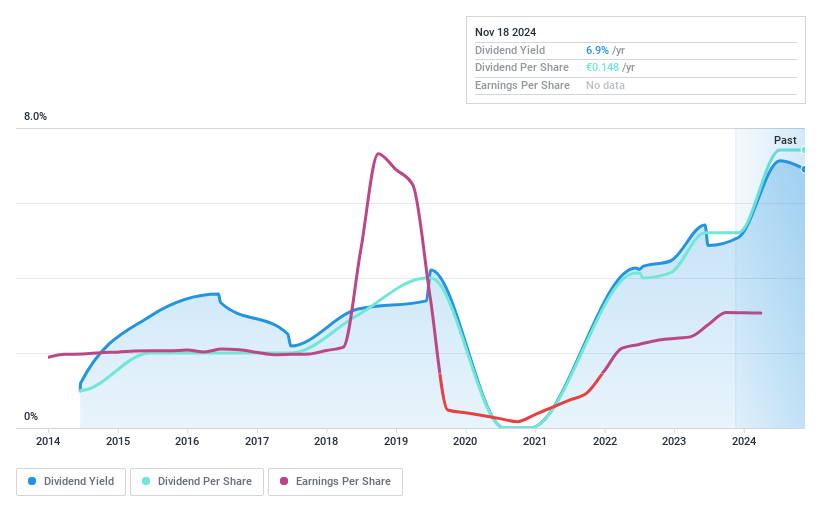

Piquadro (BIT:PQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piquadro S.p.A. is an Italian company that designs, manufactures, sells, and markets leather accessories and travel products both domestically and internationally with a market cap of €96.82 million.

Operations: Piquadro S.p.A.'s revenue is primarily derived from its segments: Lancel (€69.18 million), Piquadro (€82.34 million), and The Bridge (€35.84 million).

Dividend Yield: 7.2%

Piquadro's dividend payments have shown volatility over the past decade, yet they are currently well-covered by both earnings and cash flows, with payout ratios of 61.8% and 46.1%, respectively. Despite an unstable track record, dividends have grown over the last ten years. The company trades at a discount to its estimated fair value and offers a competitive yield of 7.24%, ranking in the top quartile of Italian dividend payers. Recent earnings growth supports sustainability prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Piquadro.

- Our comprehensive valuation report raises the possibility that Piquadro is priced lower than what may be justified by its financials.

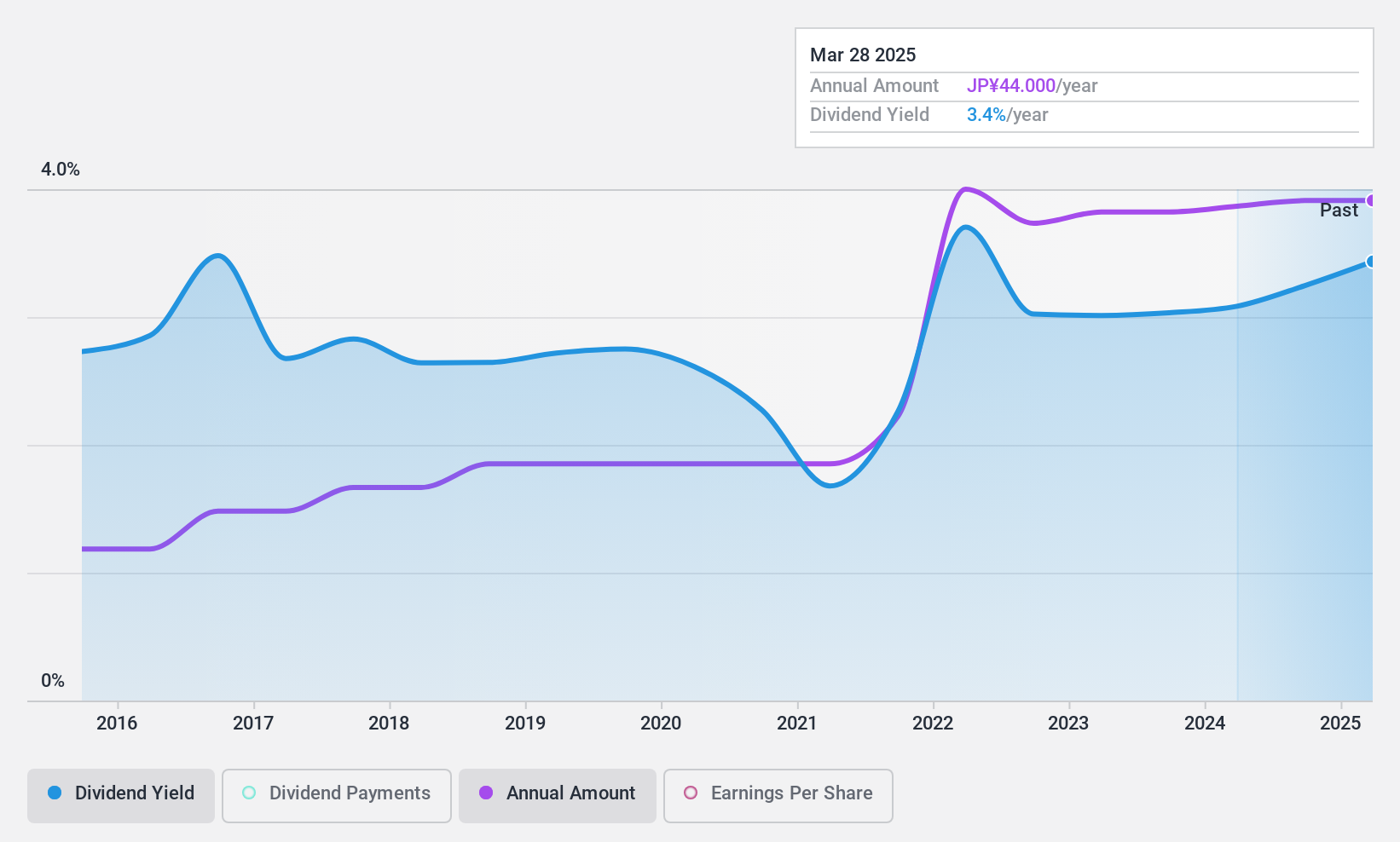

HIMACS (TSE:4299)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HIMACS, Ltd. operates in Japan, offering defined value processes for various system lifecycles, with a market cap of ¥16.02 billion.

Operations: HIMACS, Ltd. generates revenue through its Value Solution Services segment, amounting to ¥17.51 billion.

Dividend Yield: 3.2%

HIMACS offers a stable dividend, recently increasing to JPY 22.00 per share. Its dividends are well-covered by earnings and cash flows, with payout ratios of 40.6% and 46.3%, respectively. Although the yield of 3.18% is below Japan's top quartile, the company's consistent dividend growth over ten years enhances its appeal. Trading slightly below fair value, HIMACS projects strong financials with expected net sales of JPY 18.6 billion for fiscal year-end March 2025.

- Click to explore a detailed breakdown of our findings in HIMACS' dividend report.

- According our valuation report, there's an indication that HIMACS' share price might be on the cheaper side.

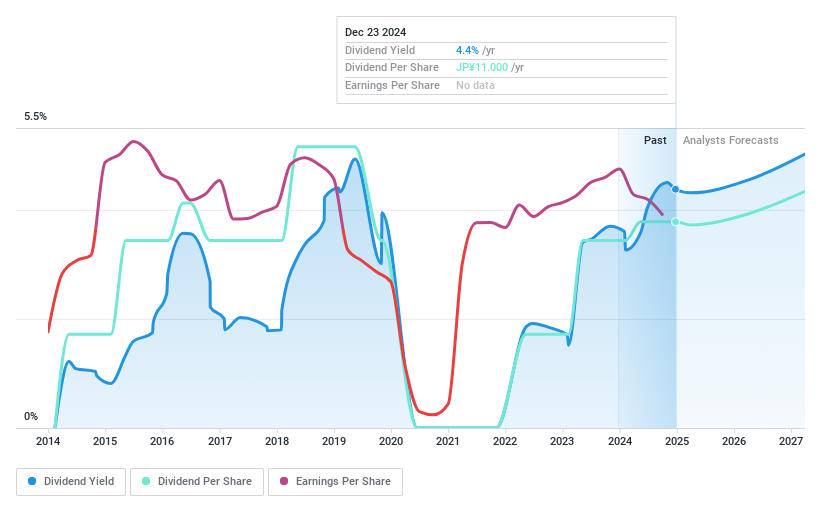

NTN (TSE:6472)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NTN Corporation, along with its subsidiaries, manufactures and sells bearings, drive shafts, and precision equipment both in Japan and internationally; it has a market cap of ¥132.25 billion.

Operations: NTN Corporation's revenue segments include the manufacture and sale of bearings, drive shafts, and precision equipment in Japan and internationally.

Dividend Yield: 4.4%

NTN's dividend yield of 4.4% is appealing, yet it's not well-covered by earnings due to a high payout ratio of 190.5%, indicating sustainability concerns. Although dividends have grown over the past decade, they remain volatile and unreliable. The company trades at a significant discount to its estimated fair value, but profit margins have declined from last year. Recent events include an ESG briefing and upcoming Q2 earnings results announcement for fiscal year 2025.

- Get an in-depth perspective on NTN's performance by reading our dividend report here.

- Our valuation report unveils the possibility NTN's shares may be trading at a discount.

Seize The Opportunity

- Navigate through the entire inventory of 1968 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HIMACS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4299

HIMACS

Provides defined valued processes for various system lifecycles in Japan.

Flawless balance sheet established dividend payer.