In a week marked by market fluctuations due to uncertainties surrounding the incoming Trump administration and rising long-term interest rates, investors are seeking stability amid sector-specific volatility. As financials and energy stocks benefit from deregulation hopes while healthcare faces challenges, dividend stocks offering reliable yields can provide a steady income stream in such unpredictable times. Selecting high-quality dividend stocks involves considering factors like consistent earnings, strong cash flow, and a history of stable or growing payouts—qualities that can offer resilience against broader market shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Orkla (OB:ORK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orkla ASA operates in branded consumer goods, industrial, and financial investment sectors with a market cap of NOK99.36 billion.

Operations: Orkla ASA's revenue segments include Portfolio Companies such as Orkla Foods Europe (NOK20.59 billion), Orkla Food Ingredients (NOK19.09 billion), Orkla Confectionery & Snacks (NOK9.55 billion), and others, along with Financial Investments like Hydro Power (NOK1.31 billion).

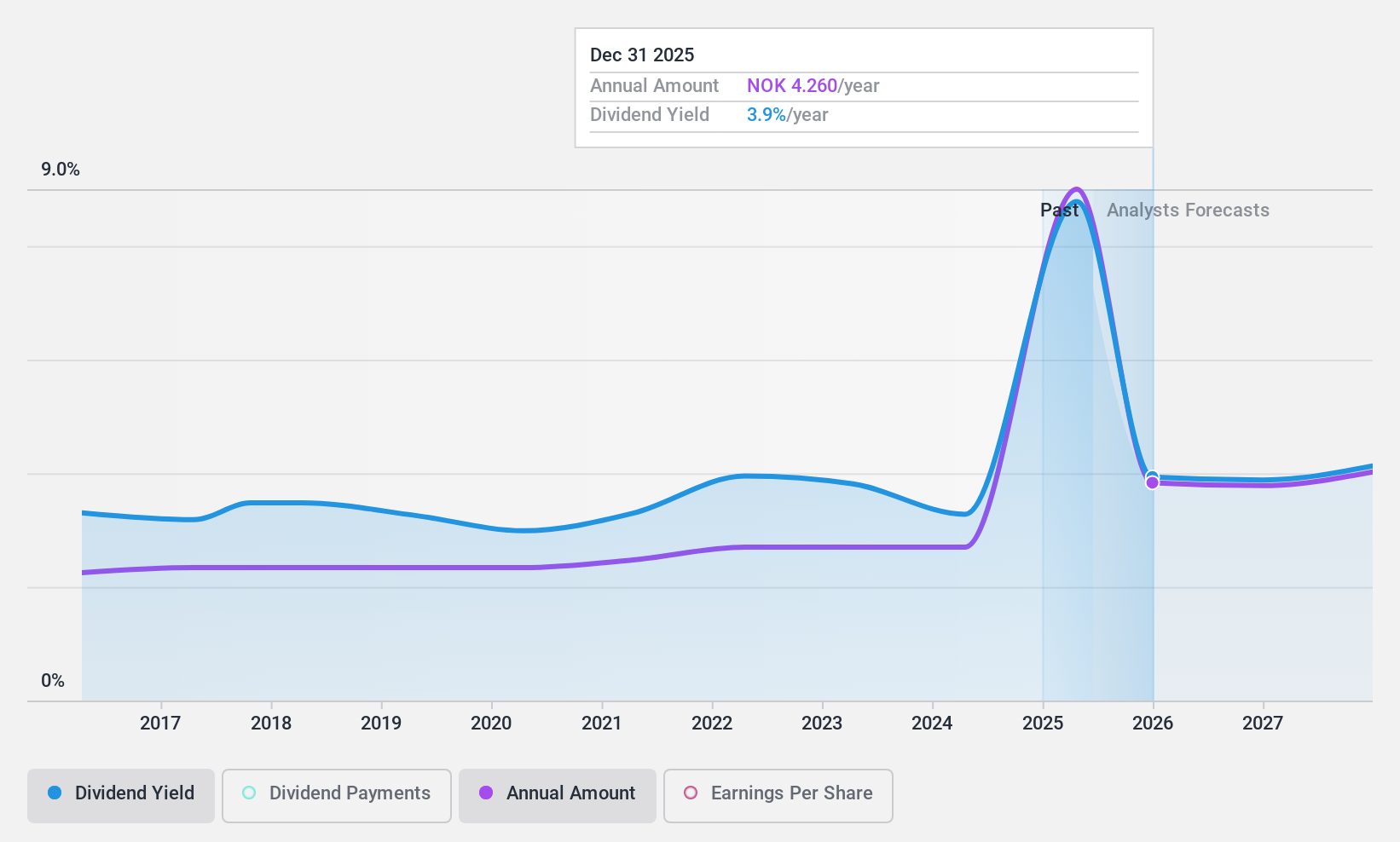

Dividend Yield: 3%

Orkla ASA's dividend sustainability is supported by a payout ratio of 52.6% and a cash payout ratio of 46%, indicating dividends are well-covered by earnings and cash flows. Although its dividend yield of 3.02% is lower than top-tier Norwegian payers, Orkla has maintained stable and reliable dividends over the past decade, with consistent growth in payments. Recent earnings showed an increase in nine-month net income to NOK 4.7 billion, despite a quarterly decline.

- Unlock comprehensive insights into our analysis of Orkla stock in this dividend report.

- Our expertly prepared valuation report Orkla implies its share price may be too high.

HIMACS (TSE:4299)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HIMACS, Ltd. operates in Japan offering defined valued processes for various system lifecycles, with a market cap of ¥16.21 billion.

Operations: HIMACS, Ltd.'s revenue segments are not detailed in the provided text.

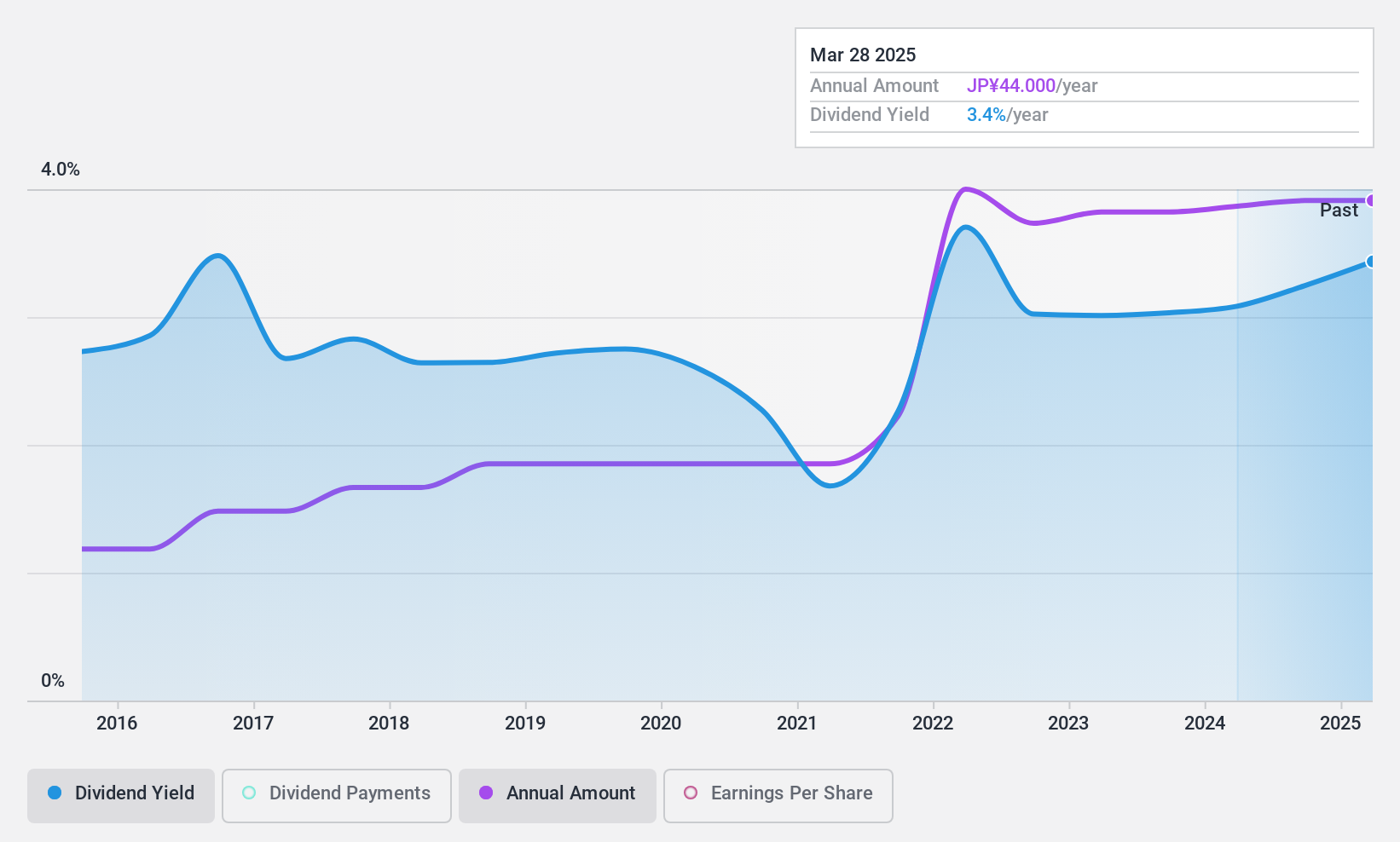

Dividend Yield: 3.1%

HIMACS offers a stable dividend profile with a 3.17% yield, supported by a low payout ratio of 20.3% and cash payout ratio of 46.3%, ensuring dividends are well-covered by earnings and cash flows. Dividends have consistently grown over the past decade, with recent increases to JPY 22 per share for Q2 2024. The company projects robust financial performance for the fiscal year ending March 2025, indicating potential for continued dividend reliability.

- Click to explore a detailed breakdown of our findings in HIMACS' dividend report.

- Our valuation report unveils the possibility HIMACS' shares may be trading at a discount.

SIIX (TSE:7613)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SIIX Corporation focuses on the sale and distribution of electronic components both in Japan and internationally, with a market cap of ¥54.43 billion.

Operations: SIIX Corporation generates revenue from various regions, with ¥103.89 billion from Japan, ¥27.16 billion from Europe, ¥76.21 billion from the Americas, ¥85.60 billion from Greater China, and ¥115.45 billion from Southeast Asia.

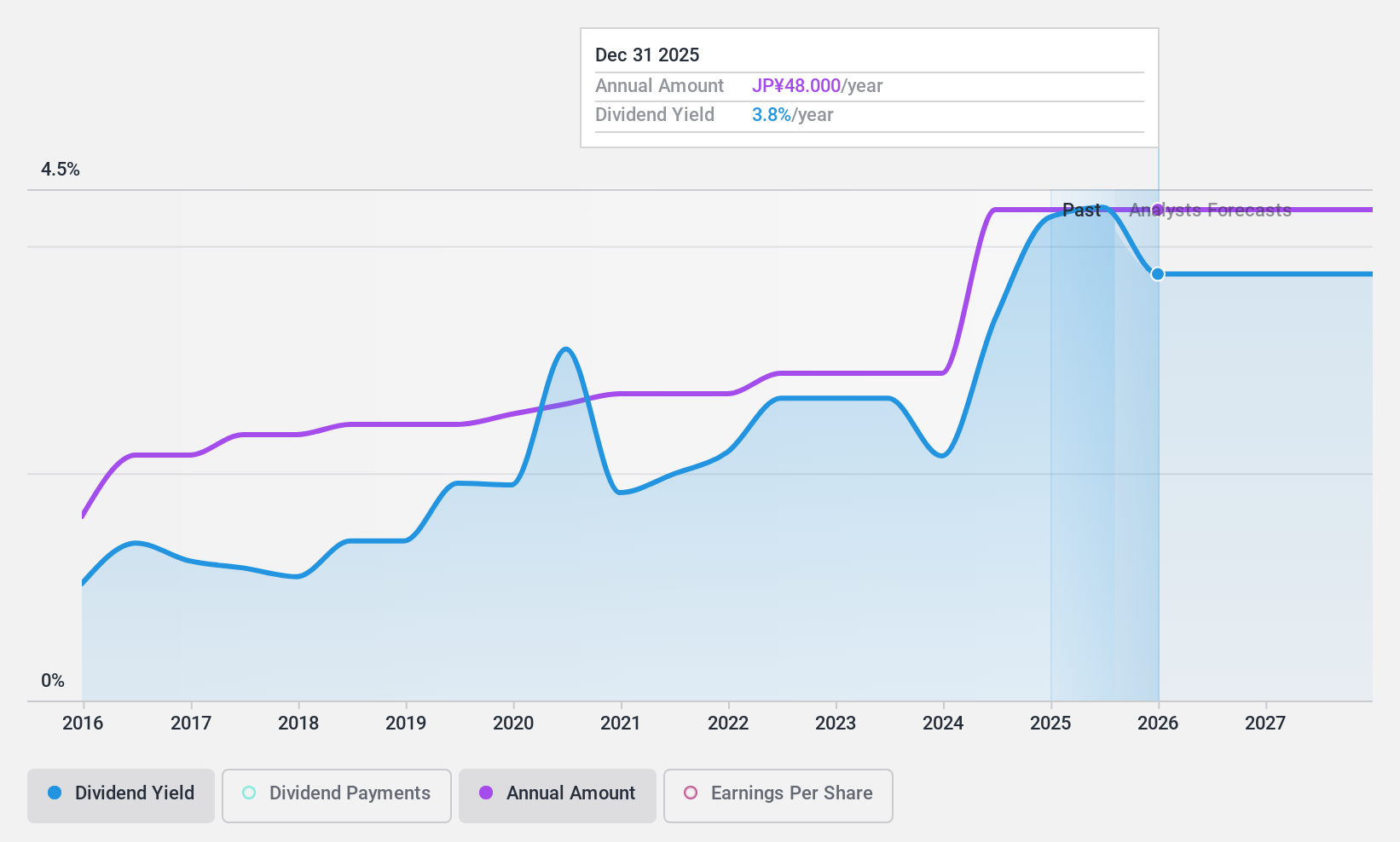

Dividend Yield: 4.2%

SIIX Corporation's dividends are appealing, with a 4.15% yield placing it in the top 25% of Japan's dividend payers. Over the past decade, dividends have grown steadily and remain stable due to a low payout ratio of 44.6% and a cash payout ratio of 18.4%, ensuring coverage by earnings and cash flows. Trading at 28.5% below estimated fair value suggests potential for capital appreciation alongside reliable dividend income.

- Delve into the full analysis dividend report here for a deeper understanding of SIIX.

- Insights from our recent valuation report point to the potential undervaluation of SIIX shares in the market.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1957 Top Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HIMACS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4299

HIMACS

Provides defined valued processes for various system lifecycles in Japan.

Flawless balance sheet established dividend payer.