The Bull Case For Appier Group (TSE:4180) Could Change Following Launch of Autonomous AI Marketing Agents – Learn Why

Reviewed by Sasha Jovanovic

- On September 23, 2025, Appier Group announced the integration of Agentic AI technology across its entire product suite, launching eight specialized AI Agents designed to deliver autonomous marketing and real-time, data-driven insights for advertisers and marketers.

- This roll-out establishes a unified, adaptive marketing framework that enables brands to seamlessly connect and activate previously fragmented datasets through intelligent, self-learning automation.

- We'll explore how Appier's introduction of interconnected, always-on AI Agents may redefine the company's positioning in the AI-powered marketing landscape.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Appier Group's Investment Narrative?

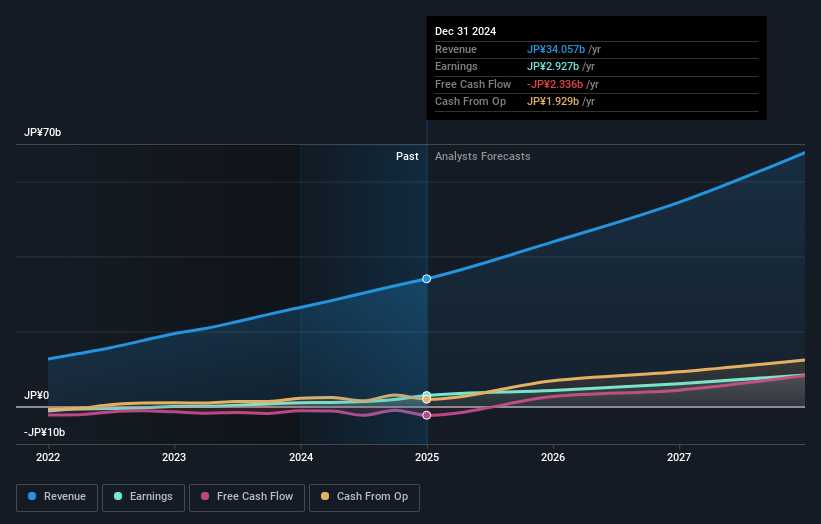

For prospective shareholders, the central belief underpinning Appier Group’s appeal is confidence in its ability to lead the next wave of AI-powered marketing automation. The recent launch of Agentic AI, rolling out eight interconnected, autonomous Agents, marks a significant moment that could shift the company’s short-term catalysts and risks. Previously, growth was fueled by client wins and incremental product upgrades, but this move positions Appier as a unified platform player, aiming to capture bigger budgets and address broader digital marketing needs. The immediate catalyst is whether these Agents generate measurable traction ahead of upcoming earnings, their early adoption and impact on client ROI will be scrutinized closely. However, the scale and sophistication of this rollout also raise the stakes, making execution risk and the ability to translate innovation into revenue even more critical than before. In short, this is a pivotal test between visionary execution and the heightened bar for results that follows transformative announcements.

In contrast, the challenge of achieving quick, meaningful uptake for a major platform upgrade is one risk investors shouldn’t overlook.

Exploring Other Perspectives

Explore 2 other fair value estimates on Appier Group - why the stock might be worth over 2x more than the current price!

Build Your Own Appier Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Appier Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Appier Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Appier Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4180

Appier Group

Operates as AI-native SaaS company in Japan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026