- China

- /

- Real Estate

- /

- SZSE:000048

Shenzhen Kingkey Smart Agriculture TimesLtd And 2 Other Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week with moderate gains in major stock indexes, the decline in U.S. consumer confidence and mixed economic indicators have raised questions about future growth prospects. Amidst this backdrop, dividend stocks continue to attract investors seeking stable income streams, offering potential resilience against market volatility and economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

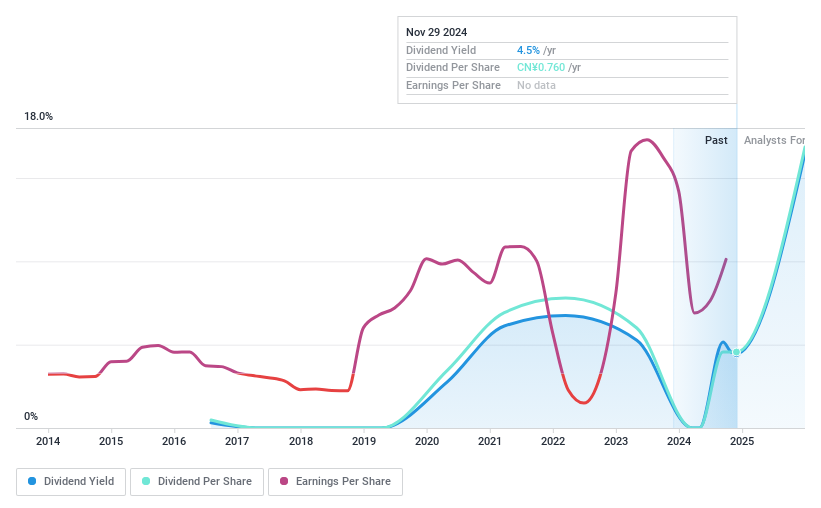

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors within China, with a market capitalization of CN¥9.25 billion.

Operations: Shenzhen Kingkey Smart Agriculture Times Co., Ltd generates revenue from its operations in the real estate and breeding sectors within China.

Dividend Yield: 4.2%

Shenzhen Kingkey Smart Agriculture Times Ltd. offers a dividend yield in the top 25% of the CN market, but its dividend history is volatile with payments not consistently growing over its 8-year track record. The payout ratio is low at 18.2%, suggesting dividends are well covered by earnings, although cash flow coverage sits at a higher 75.4%. Recent financials show declining revenue and net income, which may impact future dividend sustainability despite recent share buybacks amounting to CNY 153.05 million.

- Click to explore a detailed breakdown of our findings in Shenzhen Kingkey Smart Agriculture TimesLtd's dividend report.

- The analysis detailed in our Shenzhen Kingkey Smart Agriculture TimesLtd valuation report hints at an deflated share price compared to its estimated value.

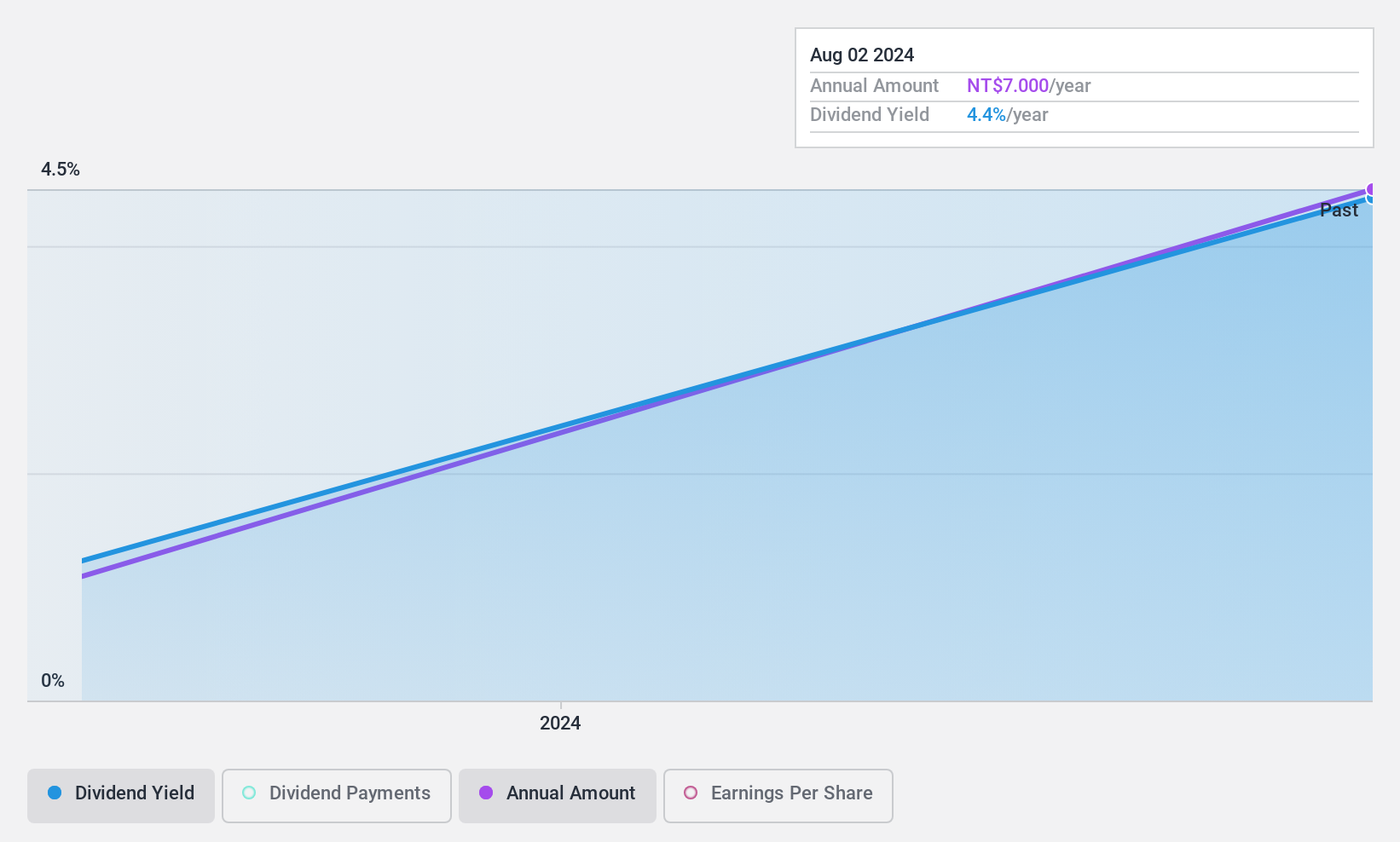

Cica-Huntek Chemical Technology Taiwan (TPEX:6725)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Cica-Huntek Chemical Technology Taiwan Co., Ltd. operates in the chemical technology sector and has a market capitalization of NT$4.95 billion.

Operations: Cica-Huntek Chemical Technology Taiwan Co., Ltd. generates revenue primarily through its Engineering Services segment, which amounts to NT$3.17 billion.

Dividend Yield: 4.5%

Cica-Huntek Chemical Technology Taiwan has recently initiated dividend payments, making it too early to assess reliability or growth. However, dividends are well-covered by earnings and cash flows, with payout ratios at 43.7% and 38.3%, respectively. The stock trades significantly below its estimated fair value, suggesting potential undervaluation. Despite a modest dividend yield of 4.49%, robust earnings growth of 86.3% over the past year supports the sustainability of future payouts in TWD terms.

- Dive into the specifics of Cica-Huntek Chemical Technology Taiwan here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Cica-Huntek Chemical Technology Taiwan is trading behind its estimated value.

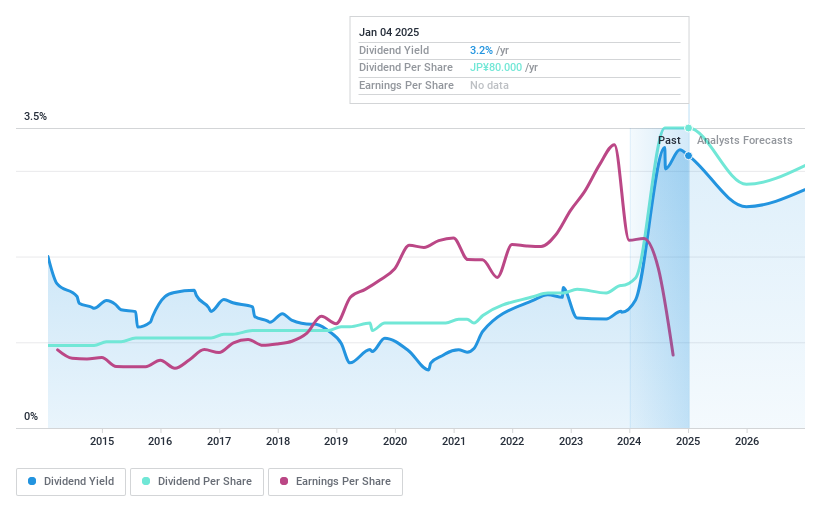

Densan System Holdings (TSE:4072)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Densan System Holdings Co., Ltd. operates in Japan, providing information services and collection agency services, with a market cap of ¥25.97 billion.

Operations: Densan System Holdings Co., Ltd. generates revenue from its Information Service Business, which accounts for ¥36.87 billion, and its Storage Agency Service Business, contributing ¥23.80 billion.

Dividend Yield: 3.2%

Densan System Holdings' dividends are well-supported by earnings and cash flows, with payout ratios of 53.4% and 23.3%, respectively, ensuring sustainability. The dividend yield of 3.18% is stable but below the top tier in Japan's market. Recent guidance indicates a significant increase in dividends to ¥40 per share from ¥19, reflecting growth potential despite lower profit margins this year due to large one-off items affecting financial results.

- Navigate through the intricacies of Densan System Holdings with our comprehensive dividend report here.

- Our valuation report here indicates Densan System Holdings may be overvalued.

Taking Advantage

- Get an in-depth perspective on all 1938 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000048

Shenzhen Kingkey Smart Agriculture TimesLtd

Engages in the real estate and breeding businesses in China.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives