Stock Analysis

- Japan

- /

- Professional Services

- /

- TSE:2181

Exploring Value In Japan: 3 Stocks With Estimated Discounts Ranging From 28.3% To 47.7% On The Japanese Exchange

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, Japan's recent economic activities, including interventions to support the yen and shifts in government bond yields, have painted a complex picture for investors. In such an environment, identifying undervalued stocks becomes crucial as it offers potential opportunities for value investment in a market that is constantly adjusting to both domestic and international pressures.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Persol HoldingsLtd (TSE:2181) | ¥257.80 | ¥492.70 | 47.7% |

| Hibino (TSE:2469) | ¥2700.00 | ¥5204.60 | 48.1% |

| Fujibo Holdings (TSE:3104) | ¥4775.00 | ¥9425.15 | 49.3% |

| West Holdings (TSE:1407) | ¥2226.00 | ¥4189.24 | 46.9% |

| Macromill (TSE:3978) | ¥866.00 | ¥1672.14 | 48.2% |

| Yokowo (TSE:6800) | ¥2089.00 | ¥3905.30 | 46.5% |

| DKS (TSE:4461) | ¥3705.00 | ¥7153.70 | 48.2% |

| Atrae (TSE:6194) | ¥893.00 | ¥1716.11 | 48% |

| ULVAC (TSE:6728) | ¥10885.00 | ¥20652.04 | 47.3% |

| freee K.K (TSE:4478) | ¥2709.00 | ¥5237.42 | 48.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Persol HoldingsLtd (TSE:2181)

Overview: Persol Holdings Co., Ltd. operates globally, offering human resource services under the PERSOL brand, with a market capitalization of approximately ¥584.99 billion.

Operations: Persol Holdings' revenue is generated from several segments including BPO at ¥110.80 billion, Career at ¥128.28 billion, Technology at ¥102.38 billion, Asia Pacific at ¥412.77 billion, and Staffing (excluding BPO) at ¥575.80 billion.

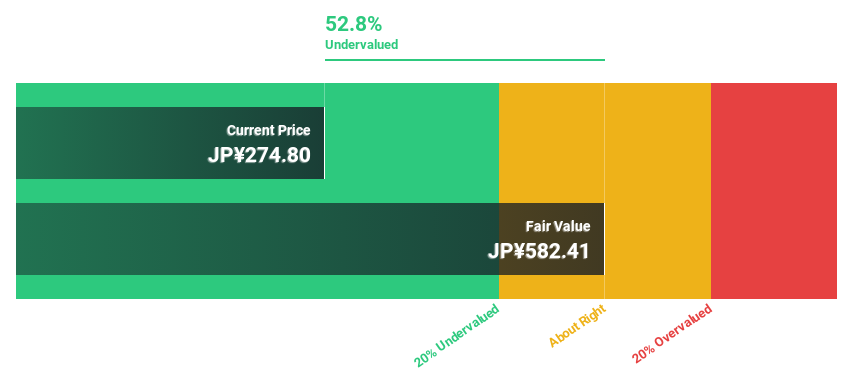

Estimated Discount To Fair Value: 47.7%

Persol Holdings Ltd. is recognized for its strong cash flow position, trading at ¥257.8, significantly below the estimated fair value of ¥492.7, indicating a potential undervaluation based on DCF analysis. Despite a fluctuating dividend track record and slower revenue growth forecast at 5.4% annually compared to higher market averages, its earnings are expected to increase by 11.36% annually. Recent buyback activities underscore confidence in financial health, with ¥3.59 billion spent on repurchasing shares.

- Our expertly prepared growth report on Persol HoldingsLtd implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Persol HoldingsLtd's balance sheet health report.

Sumitomo Chemical Company (TSE:4005)

Overview: Sumitomo Chemical Company, Limited operates globally in various sectors including chemicals and plastics, energy and functional materials, IT-related chemicals, health and crop sciences, pharmaceuticals, with a market capitalization of approximately ¥616.42 billion.

Operations: The company operates across diverse sectors such as chemicals and plastics, energy and functional materials, IT-related chemicals, health and crop sciences, and pharmaceuticals.

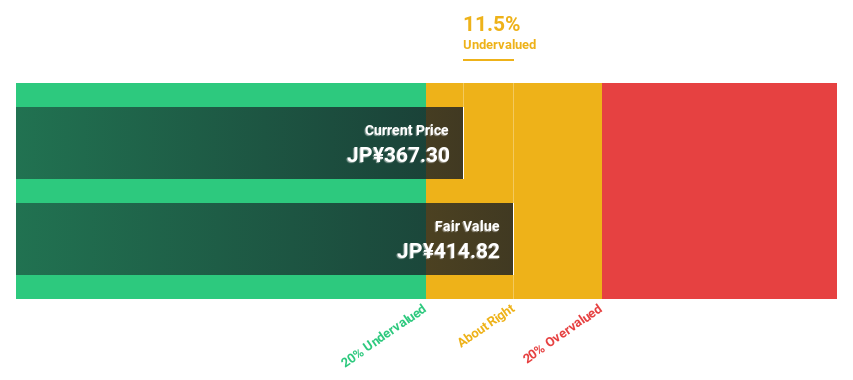

Estimated Discount To Fair Value: 28.3%

Sumitomo Chemical Company, recently impacted by index adjustments and strategic alliances, appears undervalued based on cash flow analysis. Trading at ¥376.8 against a fair value of ¥525.81, it suggests significant undervaluation. While the company is set to become profitable with expected substantial earnings growth, its debt levels are concerning as they are poorly covered by operating cash flows. Recent collaborations aim to enhance global reach in eco-friendly technologies, potentially boosting future performance despite current financial leverage issues.

- Our growth report here indicates Sumitomo Chemical Company may be poised for an improving outlook.

- Click here to discover the nuances of Sumitomo Chemical Company with our detailed financial health report.

Plus Alpha ConsultingLtd (TSE:4071)

Overview: Plus Alpha Consulting Co., Ltd. offers marketing solutions and has a market capitalization of ¥84.67 billion.

Operations: The firm generates revenue through providing marketing solutions.

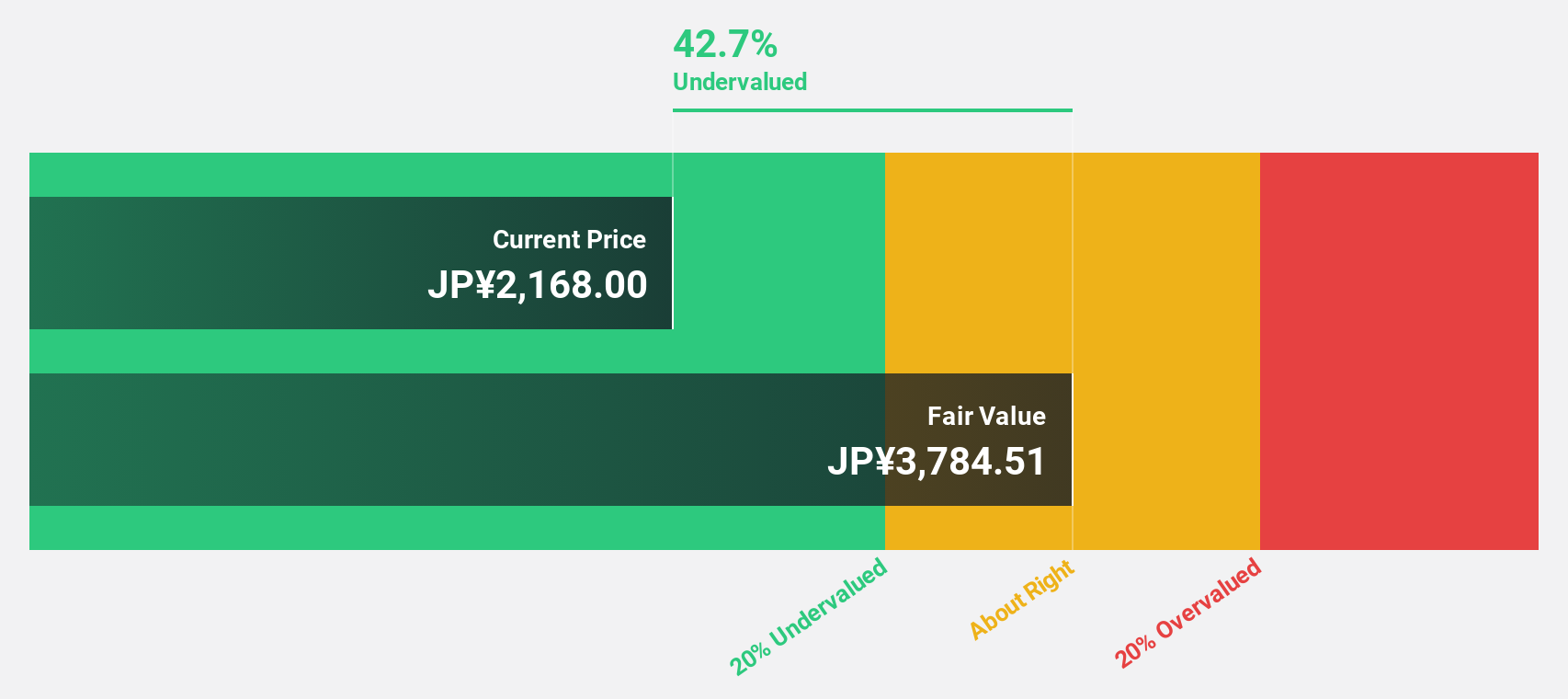

Estimated Discount To Fair Value: 45.7%

Plus Alpha Consulting Ltd., significantly undervalued based on discounted cash flow, is trading at ¥2001, well below the estimated fair value of ¥3682.86. Despite a highly volatile share price recently, analysts expect a substantial 62.9% increase in stock price. The company's revenue and earnings growth are projected to outpace the Japanese market substantially, with forecasts of 15.9% and 21% per year respectively. However, shareholder dilution over the past year poses a concern amidst these positive growth indicators.

- Upon reviewing our latest growth report, Plus Alpha ConsultingLtd's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Plus Alpha ConsultingLtd with our comprehensive financial health report here.

Key Takeaways

- Reveal the 94 hidden gems among our Undervalued Japanese Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Persol HoldingsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2181

Persol HoldingsLtd

Persol Holdings Co., Ltd. provides human resource services under the PERSOL brand worldwide.

Flawless balance sheet with solid track record and pays a dividend.