Stock Analysis

- Japan

- /

- Professional Services

- /

- TSE:4792

3 High-Yield Dividend Stocks On The Japanese Exchange With Up To 3.9% Yield

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Japanese stocks recently retreated from their record highs, influenced by speculation around foreign exchange market interventions and a stronger yen. This dynamic landscape underscores the appeal of high-yield dividend stocks, which can offer investors potential stability and consistent returns in uncertain times.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.66% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.47% | ★★★★★★ |

| Globeride (TSE:7990) | 3.83% | ★★★★★★ |

| G-Tekt (TSE:5970) | 3.68% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.50% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.13% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.46% | ★★★★★★ |

| Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 378 stocks from our Top Japanese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Shinnihon (TSE:1879)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shinnihon Corporation, a construction company based in Japan, has a market capitalization of approximately ¥101.83 billion.

Operations: Shinnihon Corporation generates its revenue primarily through construction activities in Japan.

Dividend Yield: 3%

Shinnihon Corporation has demonstrated a mixed track record in dividend reliability, with notable volatility over the past decade. Despite this, recent increases and subsequent reductions in dividends reflect a dynamic approach to shareholder returns. The company's dividend is currently lower than the top quartile of Japanese dividend payers, with a yield of 3.04%. However, both earnings and cash flows provide solid coverage for these dividends, evidenced by low payout ratios of 15.3% and 27%, respectively. This financial structure suggests cautious optimism for future dividend sustainability despite past inconsistencies.

- Click here to discover the nuances of Shinnihon with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Shinnihon shares in the market.

YAMADA Consulting GroupLtd (TSE:4792)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: YAMADA Consulting Group Ltd. offers a range of consulting services across Japan, Asia, the United States, and other international markets, with a market capitalization of ¥43.84 billion.

Operations: YAMADA Consulting Group Ltd. generates its revenues primarily from a variety of consulting services across multiple regions including Japan, Asia, the United States, and other global markets.

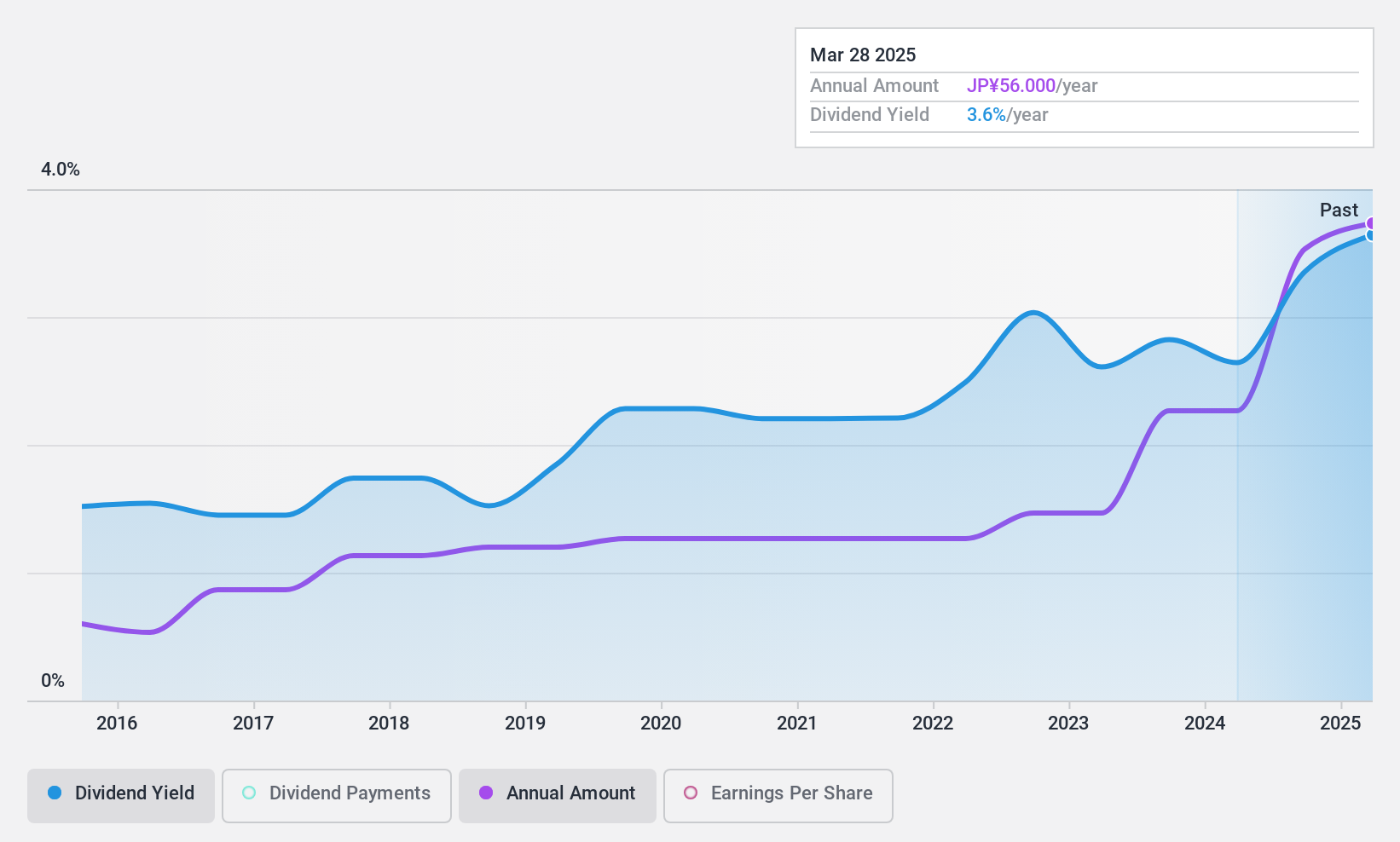

Dividend Yield: 3.3%

YAMADA Consulting Group Co., Ltd. has shown inconsistent dividend reliability with a volatile history over the past decade, though dividends have grown, including a recent increase from JPY 33.00 to JPY 43.00 per share for the fiscal year ended March 31, 2024. Despite a lower yield (3.3%) compared to top Japanese dividend stocks, both earnings and cash flow adequately cover payouts, with payout ratios of 47.9% and 39.7% respectively, suggesting sustainability underpinned by a Price-To-Earnings ratio favorable against industry averages (15.3x versus 17.4x).

- Navigate through the intricacies of YAMADA Consulting GroupLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that YAMADA Consulting GroupLtd's share price might be on the expensive side.

AIT (TSE:9381)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AIT Corporation is a comprehensive logistics company operating mainly in China and Southeast Asia, with a market capitalization of ¥47.20 billion.

Operations: AIT Corporation generates ¥10.88 billion in revenue from China and ¥43.94 billion from Japan in its logistics operations.

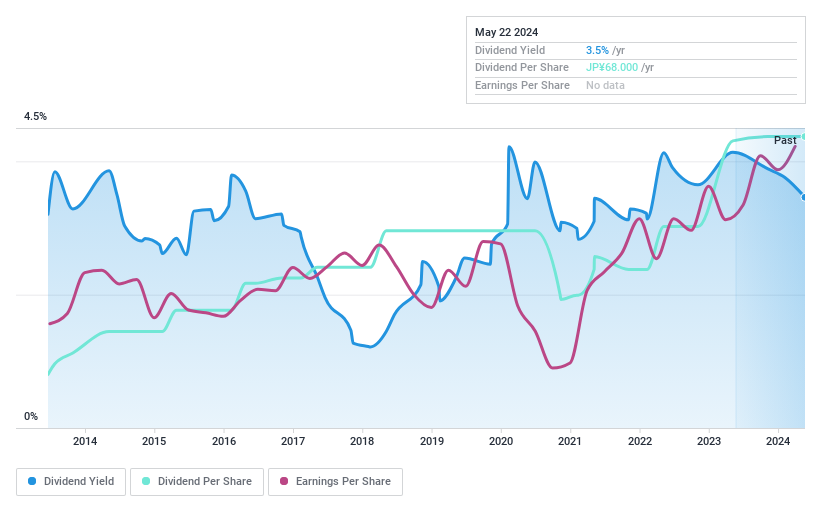

Dividend Yield: 4%

AIT Corporation's dividend sustainability is supported by a payout ratio of 62.9% and a cash payout ratio of 61.3%, indicating that both earnings and cash flows sufficiently cover dividend payments. However, the company's dividend track record over the past decade has been unstable and volatile, reflecting inconsistency in payment amounts. Despite these fluctuations, dividends have seen growth over this period. Currently, AIT's dividend yield stands at 3.98%, positioning it in the top quartile of Japanese market payers.

- Click here and access our complete dividend analysis report to understand the dynamics of AIT.

- Insights from our recent valuation report point to the potential overvaluation of AIT shares in the market.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 375 Top Japanese Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether YAMADA Consulting GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4792

YAMADA Consulting GroupLtd

Provides various consulting services in Japan, Asia, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.