Stock Analysis

High Insider Ownership Growth Stocks On The Japanese Exchange

Reviewed by Simply Wall St

Amid a backdrop of heightened market speculation and currency interventions in Japan, investors are closely monitoring the movements within the Japanese exchange. In such an environment, identifying growth companies with high insider ownership can offer insights into firms where leadership is deeply invested in their success. A good stock in this context often demonstrates strong alignment between company executives and shareholder interests, potentially enhancing stability and confidence among investors during turbulent market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.5% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| freee K.K (TSE:4478) | 23.9% | 72.9% |

We're going to check out a few of the best picks from our screener tool.

S Foods (TSE:2292)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S Foods Inc. operates in Japan, focusing on the manufacture, wholesale, retail, and food servicing of meat-related products with a market capitalization of approximately ¥93.13 billion.

Operations: The company's revenue is generated from manufacturing, wholesaling, retailing, and food servicing of meat-related products.

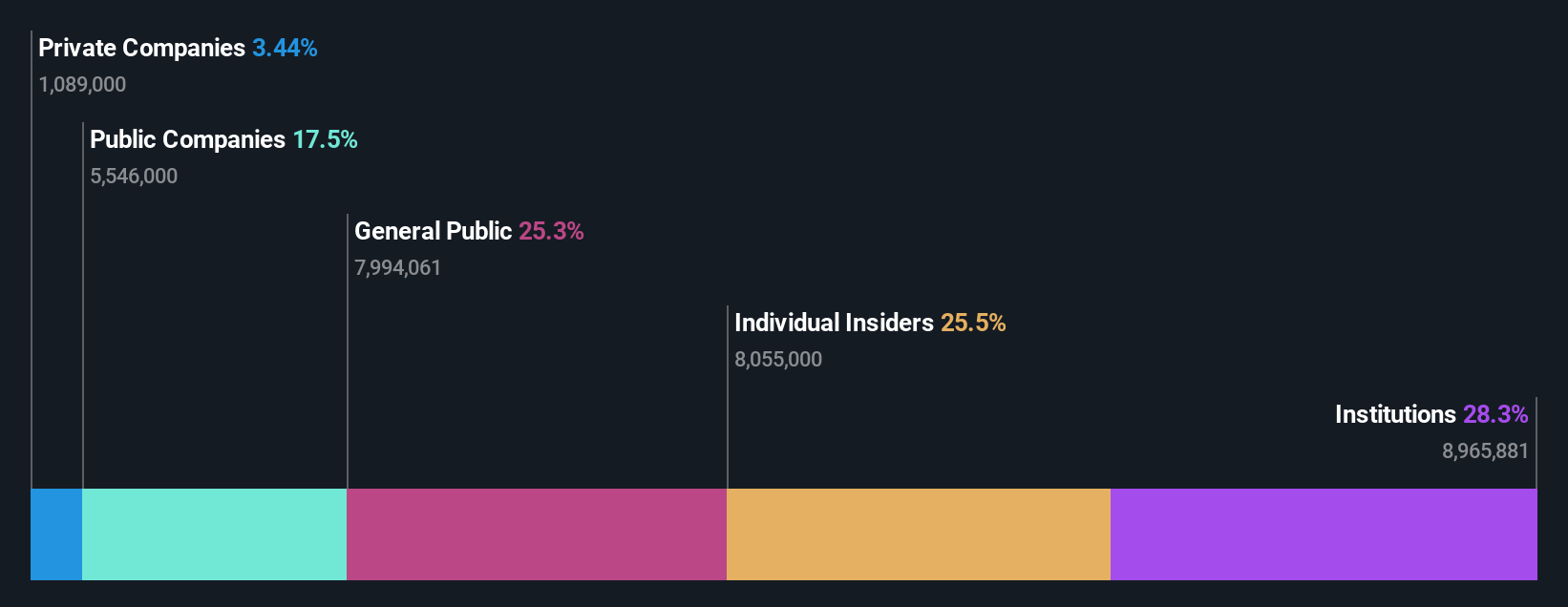

Insider Ownership: 25.5%

S Foods, a growth company in Japan with high insider ownership, is trading at a significant discount of 36.3% below its estimated fair value. While its revenue growth of 8.5% per year surpasses the Japanese market average of 4.4%, it lags behind more aggressive growth benchmarks. The company's earnings are expected to rise by an impressive 20.07% annually over the next three years, although its profit margins have declined from last year's 2.7% to 1.4%. Additionally, S Foods' dividend coverage is weak, with payouts not well supported by free cash flows.

- Dive into the specifics of S Foods here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of S Foods shares in the market.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

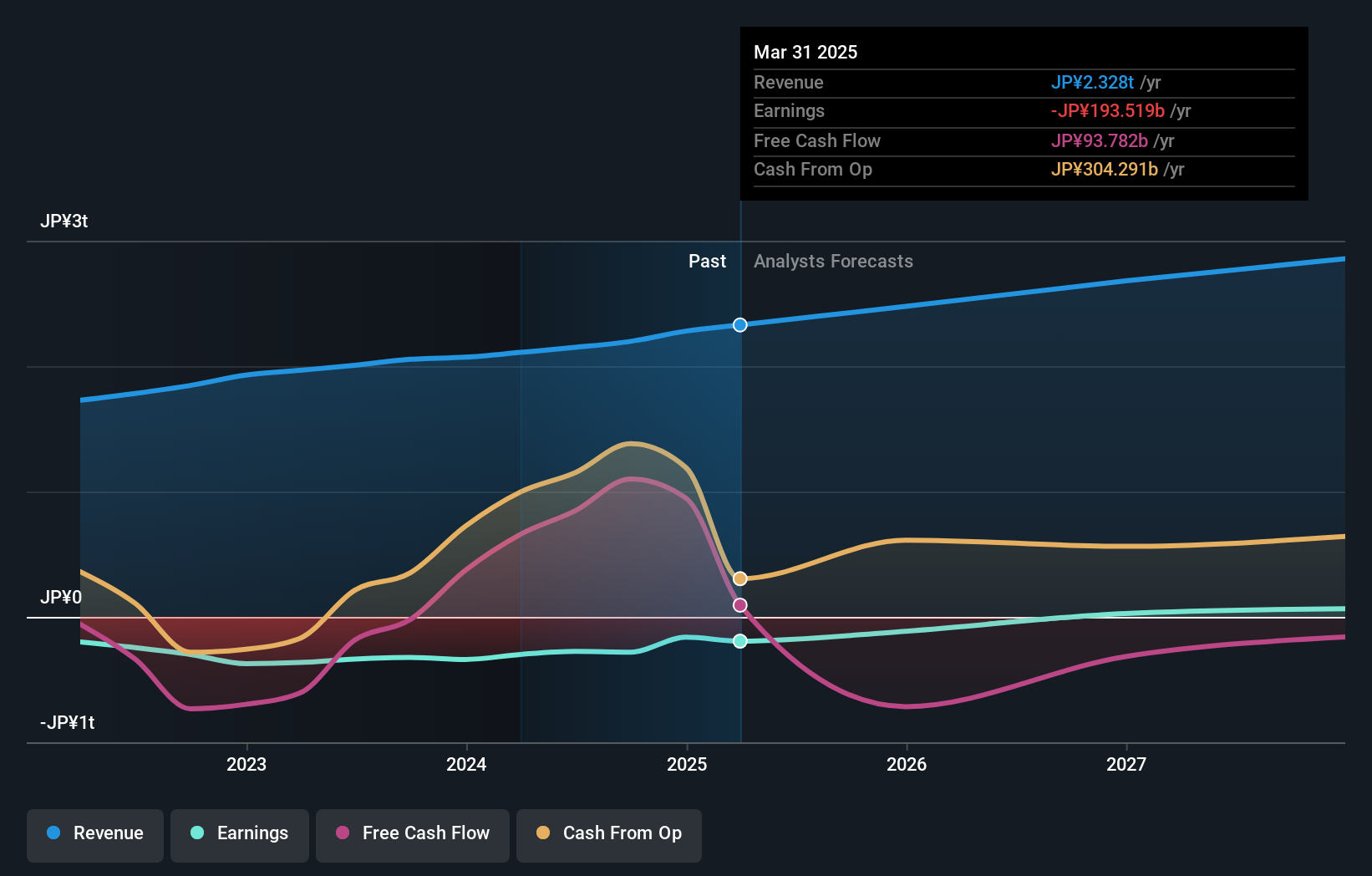

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally, with a market capitalization of approximately ¥1.95 trillion.

Operations: The company generates revenue through its diverse operations in online retail, financial services, digital media, and telecommunications.

Insider Ownership: 17.3%

Rakuten Group, a Japanese growth company with high insider ownership, is poised for notable expansion. The firm is projected to transition to profitability within three years, outpacing average market growth. Despite trading 78.1% below its estimated fair value, Rakuten's revenue is expected to increase by 7.8% annually—faster than the Japanese market average of 4.4%. However, its forecasted Return on Equity of 8.9% remains modest, reflecting some challenges in achieving higher profitability efficiencies.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Rakuten Group is priced lower than what may be justified by its financials.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

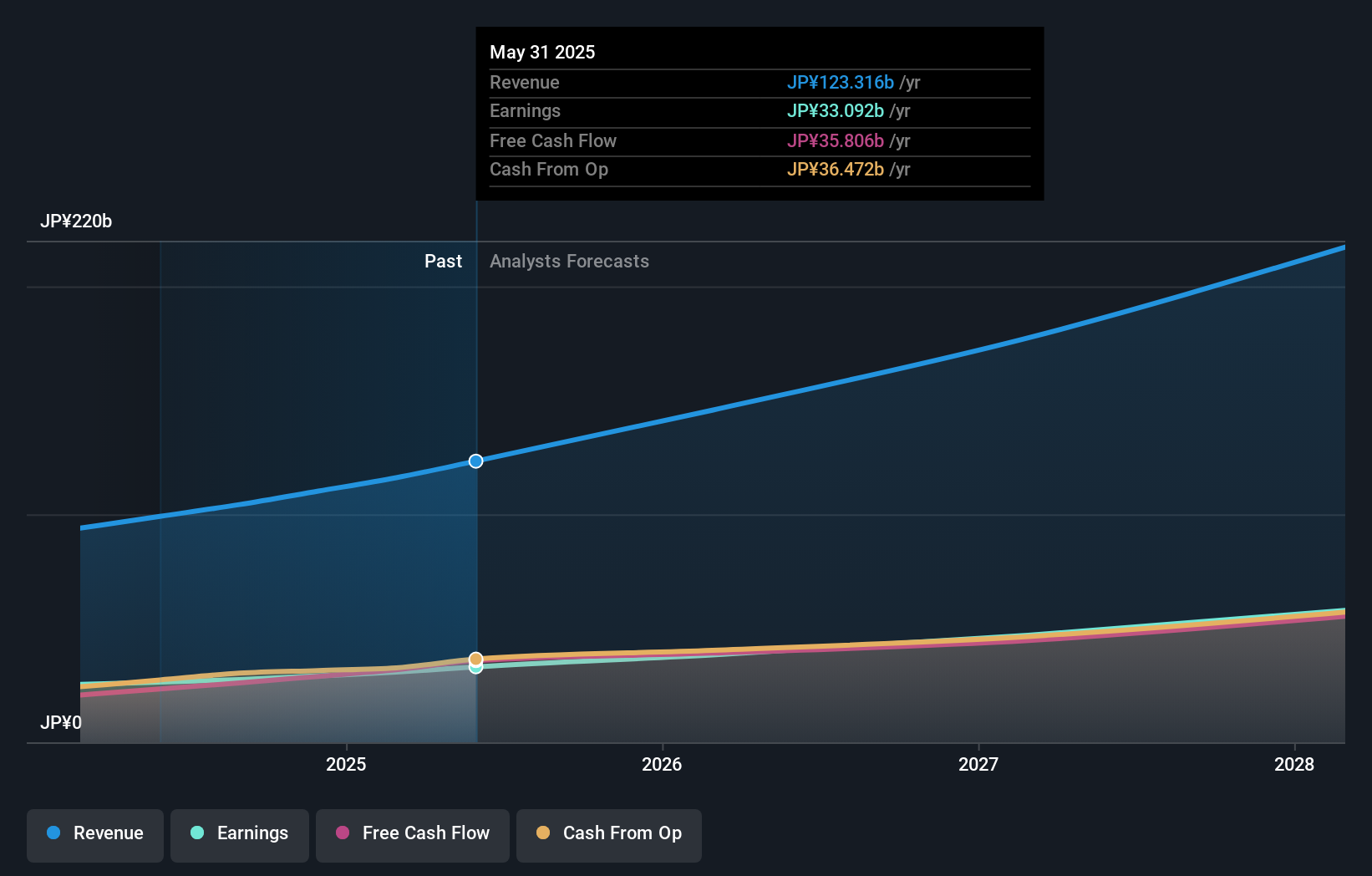

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan and has a market capitalization of approximately ¥659.53 billion.

Operations: The firm generates its revenue primarily from consulting services across diverse sectors in Japan.

Insider Ownership: 13.9%

BayCurrent Consulting, a Japanese growth company with high insider ownership, is experiencing robust earnings and revenue growth. The firm's earnings are expected to increase by 18.7% annually, outpacing the Japanese market forecast of 9%. Similarly, its revenue growth rate of 18.2% also exceeds the market average of 4.4%. Despite this positive outlook, BayCurrent's share price has been highly volatile recently. Additionally, the company completed a significant share buyback program in May 2024 for ¥3.6 billion.

- Navigate through the intricacies of BayCurrent Consulting with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report BayCurrent Consulting implies its share price may be lower than expected.

Key Takeaways

- Dive into all 96 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Rakuten Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.