Investors bid Datasection (TSE:3905) up JP¥1.6b despite increasing losses YoY, taking three-year CAGR to 31%

Datasection Inc. (TSE:3905) shareholders might understandably be very concerned that the share price has dropped 32% in the last quarter. But in three years the returns have been great. In three years the stock price has launched 122% higher: a great result. So the recent fall in the share price should be viewed in that context. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the stock has added JP¥1.6b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Datasection

Datasection wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Datasection's revenue trended up 17% each year over three years. That's pretty nice growth. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 31% per year over three years. The business has made good progress on the top line, but the market is extrapolating the growth. Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

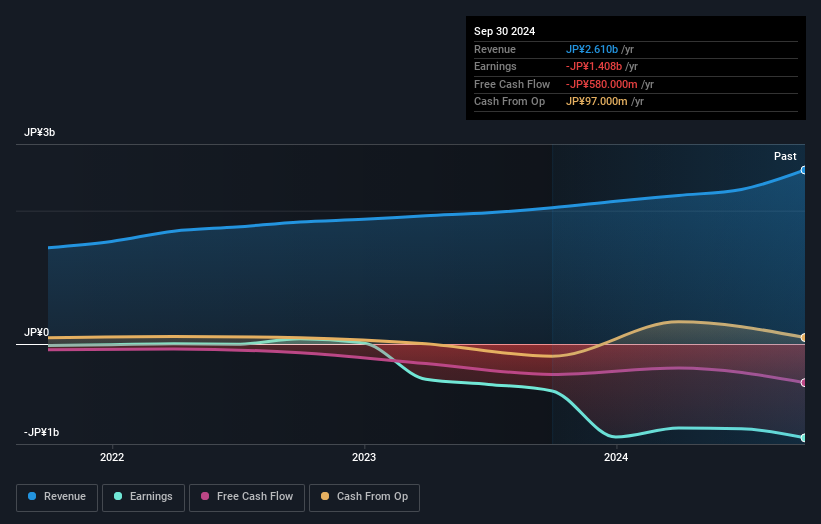

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Datasection shareholders have received a total shareholder return of 26% over one year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Datasection (2 are a bit concerning!) that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3905

Datasection

Provides solutions for social media analysis, retail marketing, and artificial intelligence development in Japan, Chile, and Colombia.

Low with imperfect balance sheet.

Market Insights

Community Narratives