High Growth Tech Stocks In Asia Featuring Zhejiang Meorient Commerce Exhibition And Two Others

Reviewed by Simply Wall St

As global markets continue to react to interest rate expectations and advancements in artificial intelligence, Asian tech stocks are capturing investor attention with their potential for high growth. In this dynamic environment, a good stock often demonstrates resilience amid economic shifts and the ability to leverage technological trends such as AI, making companies like Zhejiang Meorient Commerce Exhibition and others noteworthy contenders in the high-growth tech sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.54% | 44.14% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.75% | 30.67% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Meorient Commerce Exhibition Inc. specializes in organizing international trade exhibitions and has a market cap of CN¥4.55 billion.

Operations: The company generates revenue primarily through organizing international trade exhibitions. It has a market capitalization of CN¥4.55 billion.

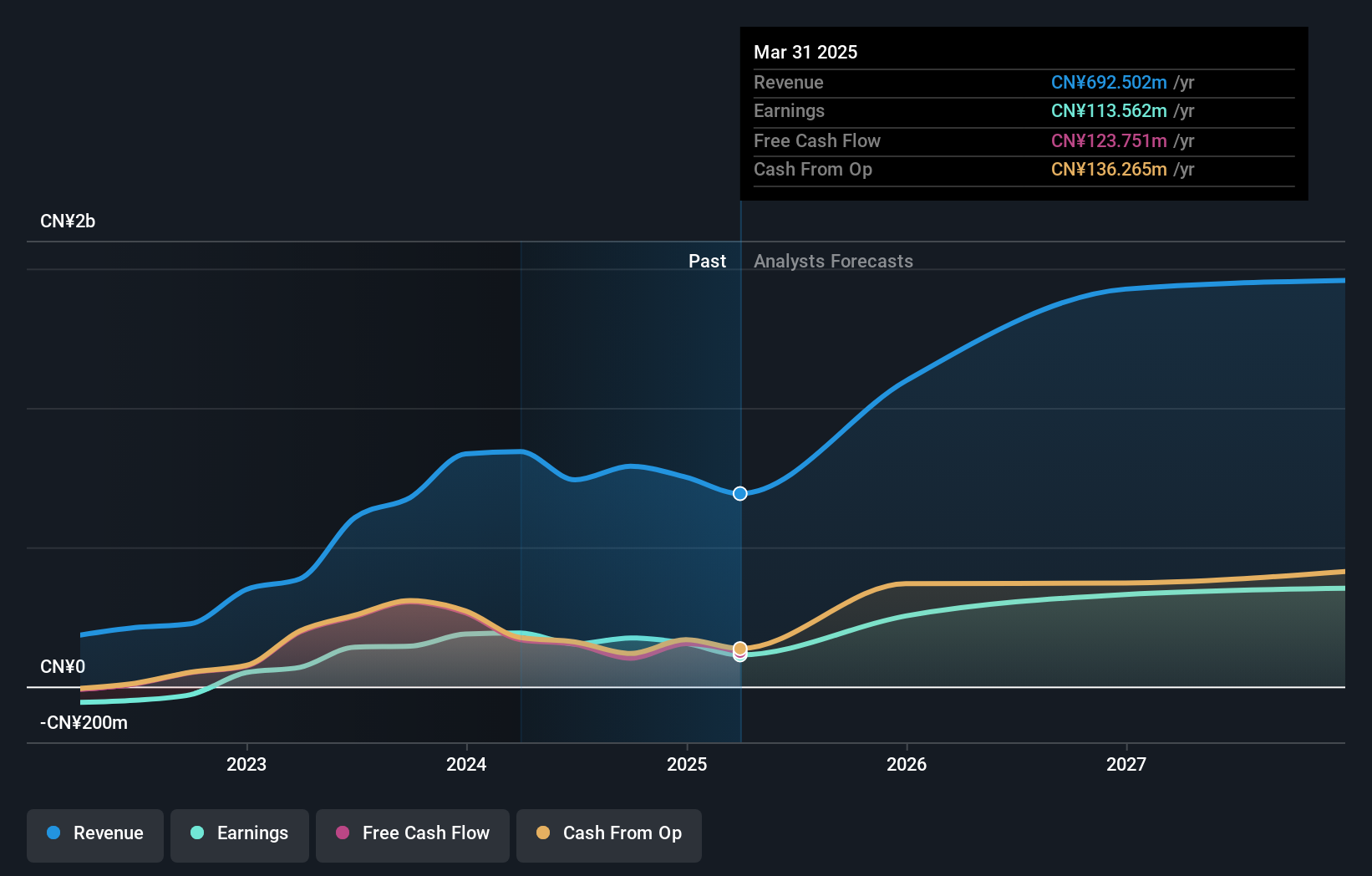

Zhejiang Meorient Commerce Exhibition, despite recent financial contractions with a revenue drop to CNY 240.78 million from CNY 260.11 million and net income decrease to CNY 15.54 million from CNY 40.72 million, is poised for recovery with significant forecasts in earnings growth at 36.84% annually. This contrasts starkly against the broader media industry's negative trends, positioning the company favorably within its sector. The firm's robust projected Return on Equity of 24% further underscores its potential resilience and growth capacity in a challenging market environment.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Meorient Commerce Exhibition.

Learn about Zhejiang Meorient Commerce Exhibition's historical performance.

ULS Group (TSE:3798)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ULS Group, Inc. is a Japanese company specializing in IT consulting and solutions, with a market cap of ¥41.53 billion.

Operations: The company generates revenue primarily from its Consulting Business, amounting to ¥14.16 billion.

ULS Group, despite not leading in high-growth tech sectors in Asia, shows promising dynamics with an 18% annual revenue growth and a notable 20.7% increase in earnings per year. The company's commitment to innovation is evident from its R&D expenses, which have consistently grown, reflecting a strategic focus on developing cutting-edge technologies. With substantial investments in R&D amounting to several million dollars annually, ULS is poised to enhance its competitive edge and sustain growth. Moreover, the firm’s robust projected return on equity at 20.1% underscores its efficient use of capital relative to peers. This financial vigor combined with strategic market positioning suggests ULS Group could play a pivotal role in shaping tech advancements regionally.

- Click to explore a detailed breakdown of our findings in ULS Group's health report.

Explore historical data to track ULS Group's performance over time in our Past section.

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. specializes in the design and manufacturing of metal stamping products across Asia, the United States, and Europe, with a market cap of NT$68.55 billion.

Operations: Fositek Corp. generates revenue primarily from electronic components and parts, totaling NT$9.63 billion. The company operates in key markets including Asia, the United States, and Europe.

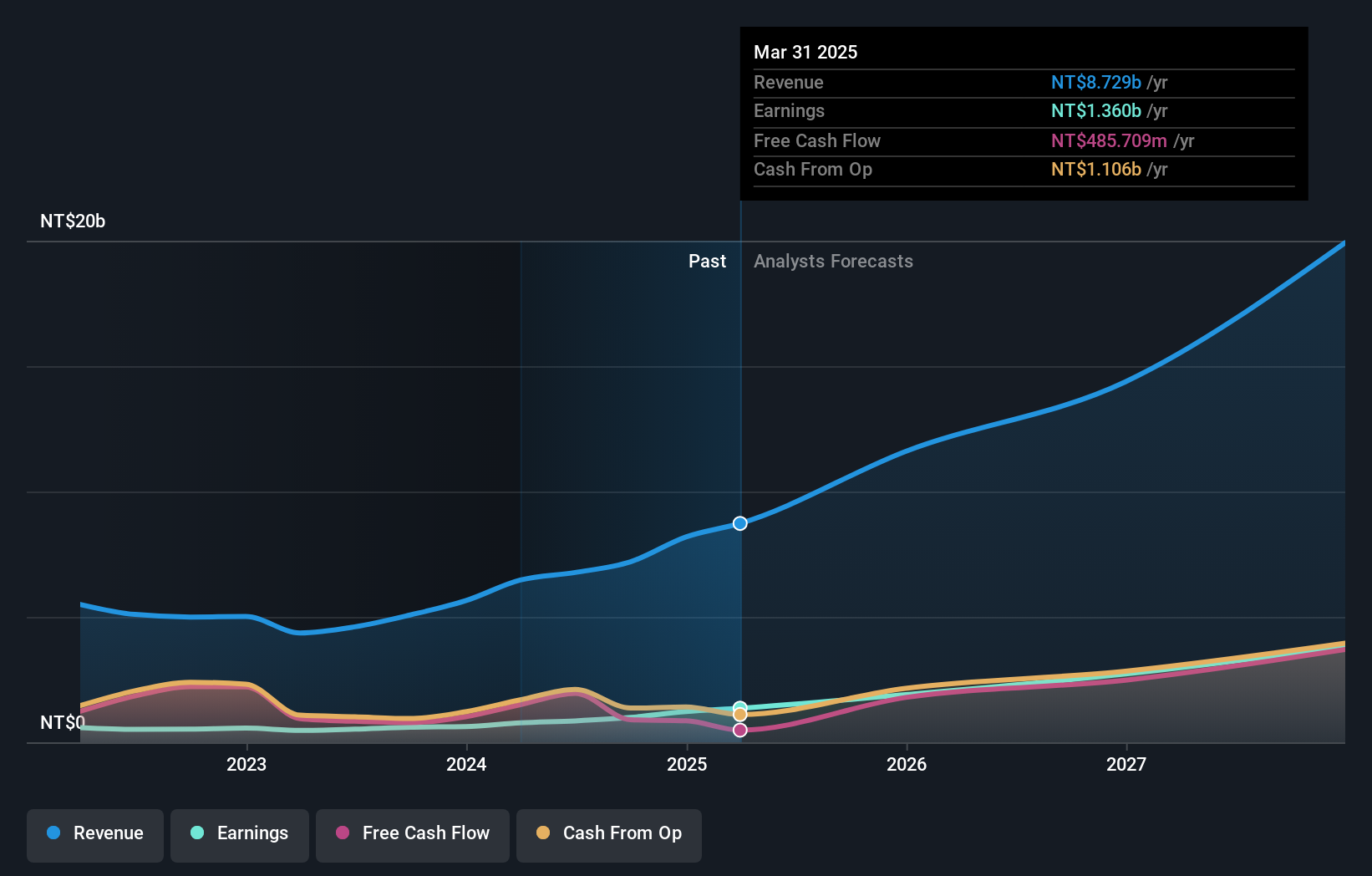

Fositek's recent financial performance underscores its robust position in Asia's tech landscape, with a notable surge in sales to TWD 4.87 billion and net income reaching TWD 686.84 million over the first half of 2025, marking significant year-over-year growths of 42% and 43%, respectively. This upward trajectory is mirrored in its earnings per share, which escalated from TWD 7 to TWD 10.02, reflecting strong profitability and operational efficiency. The company’s aggressive R&D investment strategy not only fuels this growth but also aligns with industry trends towards high-value software solutions, positioning Fositek favorably against regional competitors. With an anticipated annual earnings growth rate of 44%, significantly outpacing the TW market average of nearly 17%, Fositek is poised to capitalize on expanding market opportunities and technological advancements.

- Dive into the specifics of Fositek here with our thorough health report.

Examine Fositek's past performance report to understand how it has performed in the past.

Summing It All Up

- Discover the full array of 189 Asian High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3798

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives