- Japan

- /

- Auto Components

- /

- TSE:6463

Discovering Three Undiscovered Gems With Strong Foundations

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap indices have faced significant challenges amid cautious Federal Reserve commentary and political uncertainties, with the S&P 600 experiencing notable declines. As investors navigate this complex environment, identifying stocks with robust fundamentals becomes crucial for uncovering potential opportunities amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SAKURA Internet (TSE:3778)

Simply Wall St Value Rating: ★★★★★☆

Overview: SAKURA Internet Inc. is a Japanese company that offers cloud computing services, with a market capitalization of ¥166.40 billion.

Operations: SAKURA Internet generates revenue primarily from its Internet Infrastructure Business, which reported ¥24.75 billion. The company's cost structure and profitability metrics are not detailed in the provided information, but these factors would typically influence its overall financial performance.

SAKURA Internet, a nimble player in the tech space, has shown impressive financial strides with earnings soaring 99.7% over the past year, outpacing the IT industry's 10.1% growth. The company's debt to equity ratio has significantly improved from 107% to 40.1% over five years, reflecting prudent financial management. Despite recent shareholder dilution and share price volatility, SAKURA's interest payments are well-covered by EBIT at a robust 9.8x coverage. Looking ahead, they anticipate net sales of JPY 29 billion and an operating profit of JPY 2.6 billion for the fiscal year ending March 2025, indicating continued momentum in their operations.

- Get an in-depth perspective on SAKURA Internet's performance by reading our health report here.

Examine SAKURA Internet's past performance report to understand how it has performed in the past.

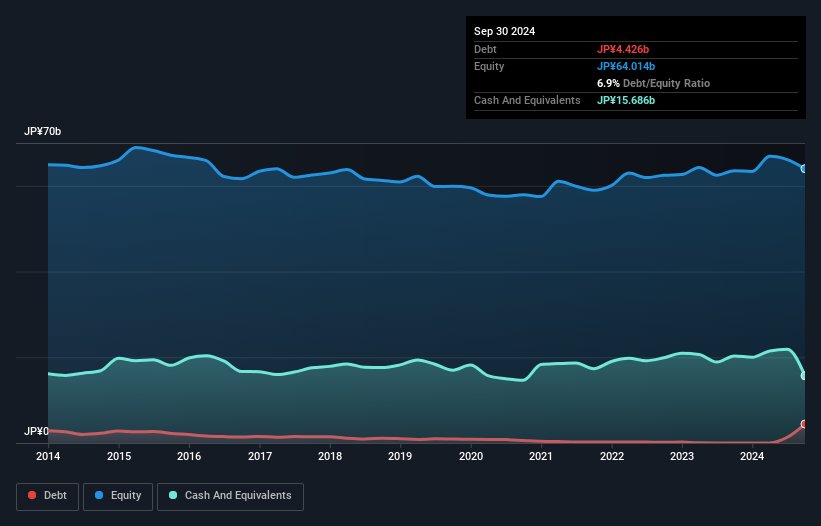

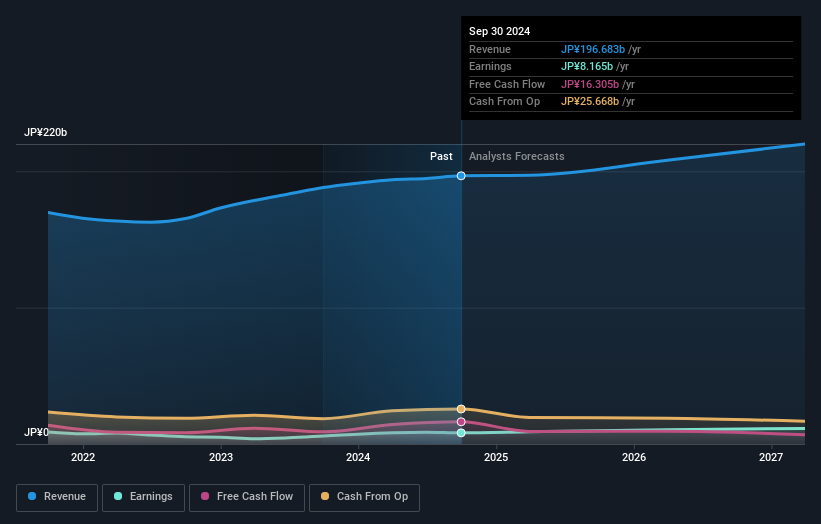

Riso Kagaku (TSE:6413)

Simply Wall St Value Rating: ★★★★★☆

Overview: Riso Kagaku Corporation is a multinational company engaged in the printing equipment, real estate, and other sectors, with a market capitalization of ¥207.98 billion.

Operations: Riso Kagaku derives most of its revenue from the printing equipment segment, contributing ¥76.21 billion, followed by real estate at ¥1.07 billion.

Riso Kagaku, a modestly sized player in the tech industry, has demonstrated solid earnings growth of 5.6% over the past year, outpacing the broader tech sector's 3.3%. Despite an increased debt-to-equity ratio from 1.6 to 6.9 over five years, it holds more cash than its total debt, suggesting prudent financial management. Recently completed share buybacks totaling ¥699.87 million reflect strategic capital management efforts amid fluctuating business environments. The company reported sales of ¥38 billion and net income of ¥1.78 billion for the half-year ending September 2024, with basic earnings per share at ¥27.23.

- Click here to discover the nuances of Riso Kagaku with our detailed analytical health report.

Understand Riso Kagaku's track record by examining our Past report.

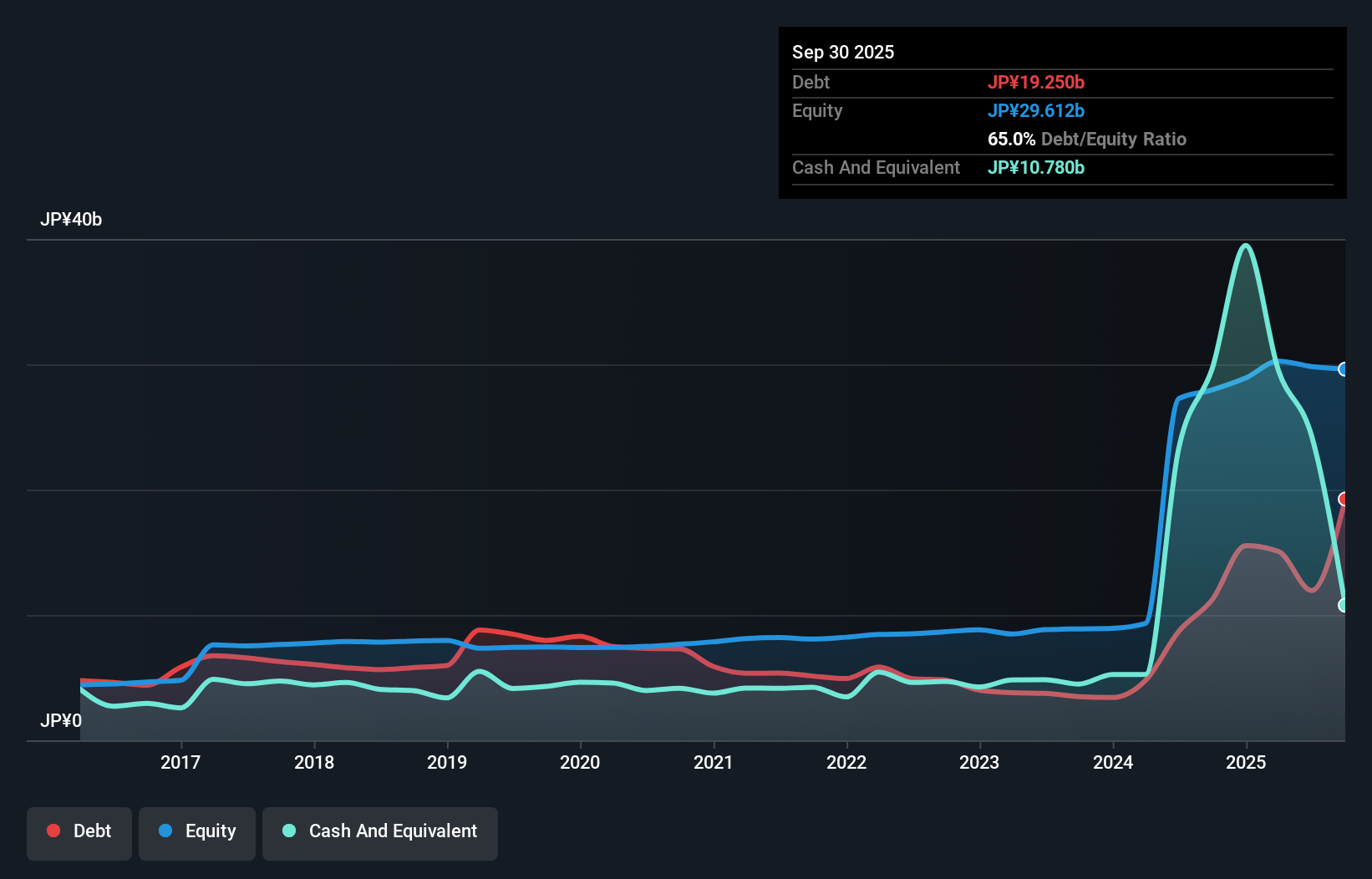

TPR (TSE:6463)

Simply Wall St Value Rating: ★★★★★★

Overview: TPR Co., Ltd. engages in the development and sale of engine components worldwide, with a market capitalization of ¥82.36 billion.

Operations: TPR Co., Ltd. generates revenue primarily from its FALTEC Co., Ltd. Group and various regional segments, with notable contributions from Asia at ¥50.99 billion and Japan at ¥60.05 billion.

TPR Co., Ltd. stands out with a price-to-earnings ratio of 10.1x, undercutting the JP market's average of 13.5x, indicating potential value for investors. The company reported earnings growth of 39% over the past year, significantly surpassing the Auto Components industry's average growth rate of 3.8%. Additionally, TPR has reduced its debt-to-equity ratio from 29% to 16% over five years, showcasing improved financial health. Recently, TPR announced a dividend increase to JPY 50 per share and plans to repurchase up to 700,000 shares by March 2025 to enhance shareholder value and capital efficiency.

- Click here and access our complete health analysis report to understand the dynamics of TPR.

Evaluate TPR's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Delve into our full catalog of 4628 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6463

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives