- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7732

High Growth Tech Stocks in Japan for October 2024

Reviewed by Simply Wall St

In Japan, recent political developments and monetary policy shifts have influenced market dynamics, with the Nikkei 225 Index and TOPIX Index experiencing notable declines. As investors navigate these changes, identifying high-growth tech stocks becomes crucial, focusing on companies that can adapt to evolving economic conditions and leverage technological advancements for sustained growth.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. is a Japanese company specializing in software quality assurance and testing solutions, with a market capitalization of ¥253.79 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing related services, contributing ¥68.64 billion, and software development related services, which add ¥33.55 billion to its income stream.

SHIFT, a Japanese tech firm, is demonstrating robust growth metrics that align with the dynamic demands of the high-growth technology sector. With a notable 19.5% annual revenue increase, SHIFT outpaces the broader Japanese market's 4.2% expansion rate. This performance is underpinned by significant investment in R&D, which has been strategically ramped up to fuel innovation and maintain competitive edge in software development—a sector increasingly pivoting towards SaaS models for enhanced recurring revenue streams. Moreover, SHIFT's earnings are projected to surge by an impressive 32.2% annually, eclipsing the domestic market forecast of 8.7%, signaling strong future prospects despite its highly volatile share price over recent months.

- Unlock comprehensive insights into our analysis of SHIFT stock in this health report.

Explore historical data to track SHIFT's performance over time in our Past section.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market capitalization of ¥164.34 billion.

Operations: The company specializes in delivering cloud-based software services focused on accounting and HR management within Japan. Its business model primarily generates revenue through subscription fees for its software solutions, catering to small and medium-sized enterprises. The cost structure mainly includes research and development, marketing, and administrative expenses.

Amidst a backdrop of leadership changes and strategic amendments, freee K.K. is poised to navigate the evolving landscape of Japan's tech sector. With an anticipated revenue growth of 18.2% per year, the company outstrips the domestic market's average of 4.2%. This growth trajectory is bolstered by a projected surge in earnings by 74.1% annually, signaling robust future prospects despite recent volatility in its share price. The firm's commitment to innovation is evident from its R&D expenses, crucial for maintaining competitiveness and fostering advancements in their software solutions for small businesses—a segment increasingly reliant on sophisticated yet user-friendly platforms for operational efficiency.

- Click to explore a detailed breakdown of our findings in freee K.K's health report.

Evaluate freee K.K's historical performance by accessing our past performance report.

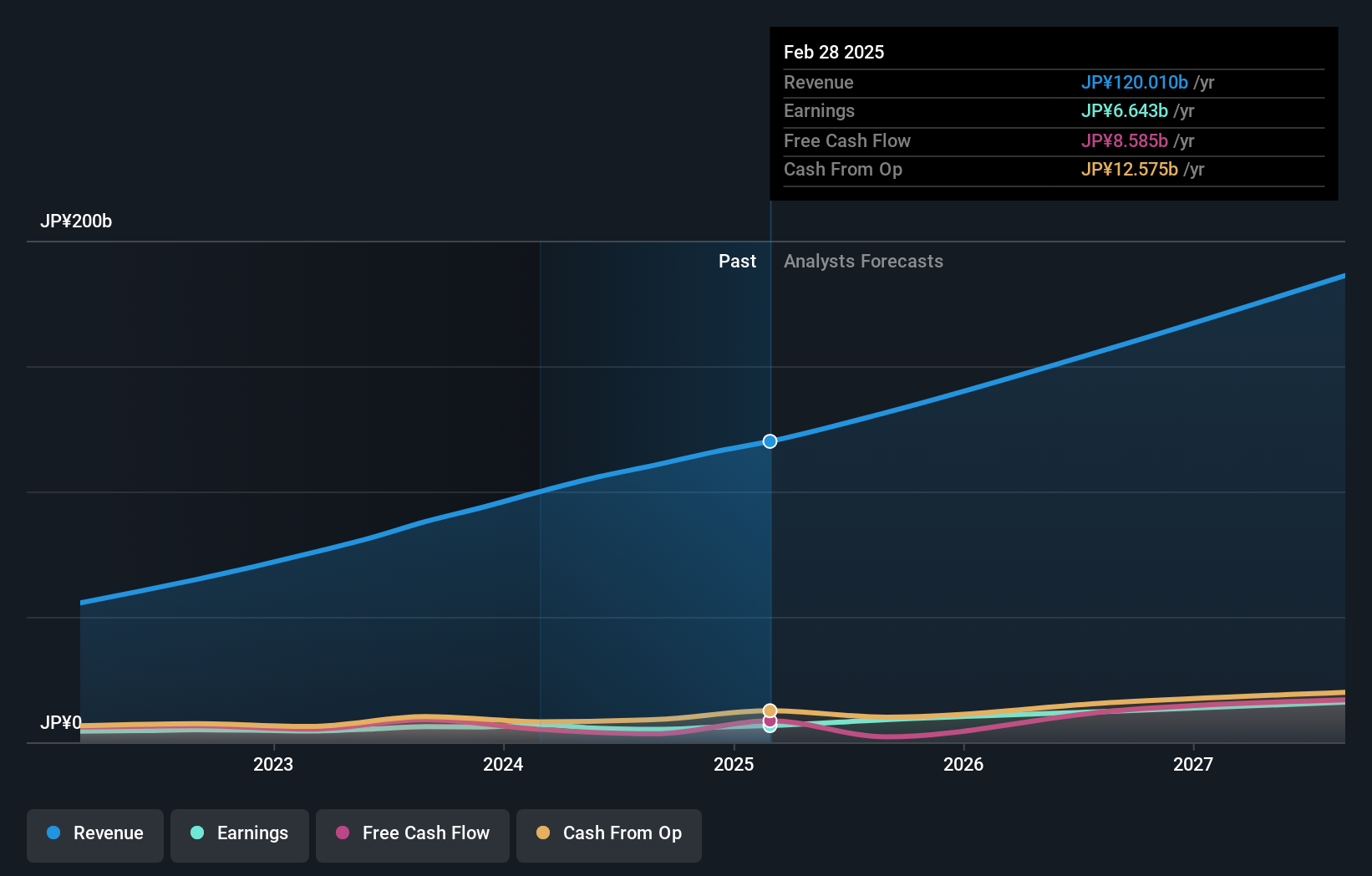

Topcon (TSE:7732)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topcon Corporation, with a market cap of ¥171.35 billion, operates globally in the development, manufacturing, and sale of positioning systems, eye care solutions, and smart infrastructure products.

Operations: Topcon generates revenue primarily from its Positioning Business and Eye Care Business, with the Positioning segment contributing significantly more at ¥148.60 billion compared to ¥67.89 billion from Eye Care.

Topcon, navigating through a challenging landscape, anticipates a robust revenue uptick of 5.4% annually, outpacing the broader Japanese market's growth. This optimism is underscored by an expected surge in earnings at an annual rate of 24.8%, reflecting strategic shifts and operational efficiencies. Despite recent setbacks including a significant one-off loss of ¥2.8 billion impacting financials, Topcon's commitment to R&D remains unwavering with substantial investments aimed at driving future innovations in its core segments. These efforts are pivotal as they lay the groundwork for sustained competitive advantage and market share expansion in the evolving tech industry of Japan.

- Get an in-depth perspective on Topcon's performance by reading our health report here.

Assess Topcon's past performance with our detailed historical performance reports.

Where To Now?

- Discover the full array of 120 Japanese High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topcon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7732

Topcon

Develops, manufactures, and sells positioning, eye care, and smart infrastructure products in Japan and internationally.

Reasonable growth potential slight.