- Japan

- /

- Personal Products

- /

- TSE:4917

3 Japanese Stocks Possibly Undervalued By Up To 41.8%

Reviewed by Simply Wall St

Japan's stock markets have recently seen gains, with the Nikkei 225 Index rising by 5.6% and the TOPIX Index up by 3.7%, buoyed by dovish commentary from the Bank of Japan and optimism surrounding China's stimulus measures. This positive momentum in Japanese equities presents a potential opportunity for investors to explore stocks that may be undervalued, particularly those that could benefit from improved economic conditions and increased demand linked to China's economic activities.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3445.00 | ¥6726.22 | 48.8% |

| Densan System Holdings (TSE:4072) | ¥2678.00 | ¥5309.22 | 49.6% |

| Kotobuki Spirits (TSE:2222) | ¥1791.00 | ¥3434.73 | 47.9% |

| Stella Chemifa (TSE:4109) | ¥4170.00 | ¥8085.03 | 48.4% |

| Taiyo Yuden (TSE:6976) | ¥3027.00 | ¥6028.23 | 49.8% |

| Pilot (TSE:7846) | ¥4495.00 | ¥8862.75 | 49.3% |

| Hibino (TSE:2469) | ¥3480.00 | ¥6942.32 | 49.9% |

| Infomart (TSE:2492) | ¥321.00 | ¥616.38 | 47.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥4140.00 | ¥7836.33 | 47.2% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3260.00 | ¥6060.34 | 46.2% |

Let's uncover some gems from our specialized screener.

SHIFT (TSE:3697)

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan with a market cap of ¥243.85 billion.

Operations: The company's revenue is primarily derived from Software Testing Related Services, which generated ¥68.64 billion, and Software Development Related Services, contributing ¥33.55 billion.

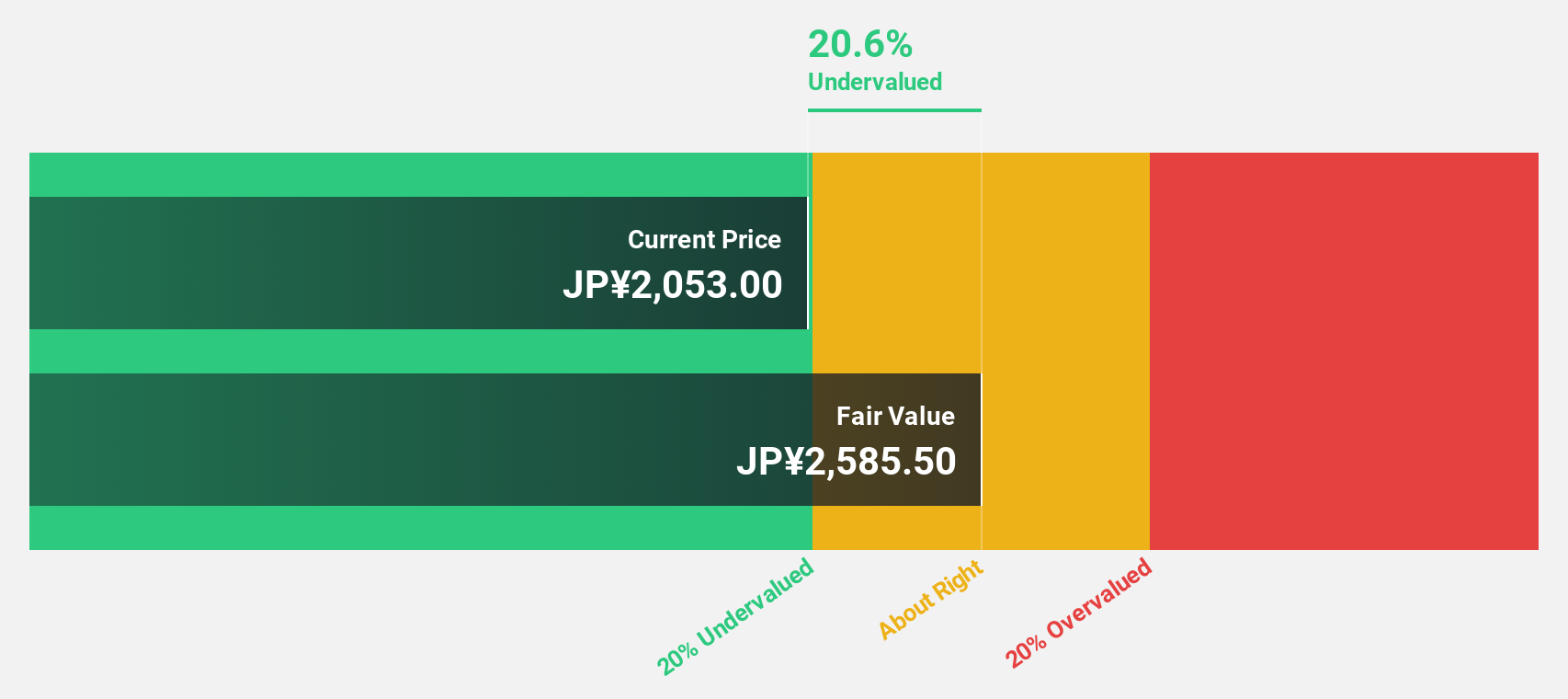

Estimated Discount To Fair Value: 40.3%

SHIFT is trading at ¥13,850, significantly below its estimated fair value of ¥23,218.75, indicating it may be undervalued based on cash flows. Despite recent share price volatility, the company has demonstrated strong earnings growth of 36.3% annually over the past five years and is expected to continue growing profits at 32.2% per year—well above the Japanese market average of 8.7%. This positions SHIFT as a potentially attractive investment opportunity in Japan's undervalued stock segment.

- Our comprehensive growth report raises the possibility that SHIFT is poised for substantial financial growth.

- Navigate through the intricacies of SHIFT with our comprehensive financial health report here.

Mandom (TSE:4917)

Overview: Mandom Corporation manufactures and sells cosmetics, perfumes, and quasi-drugs in Japan, Indonesia, and internationally, with a market cap of ¥56.92 billion.

Operations: The company's revenue segments are comprised of Japan at ¥44.54 billion, Indonesia at ¥18.24 billion, and other overseas markets contributing ¥21.10 billion.

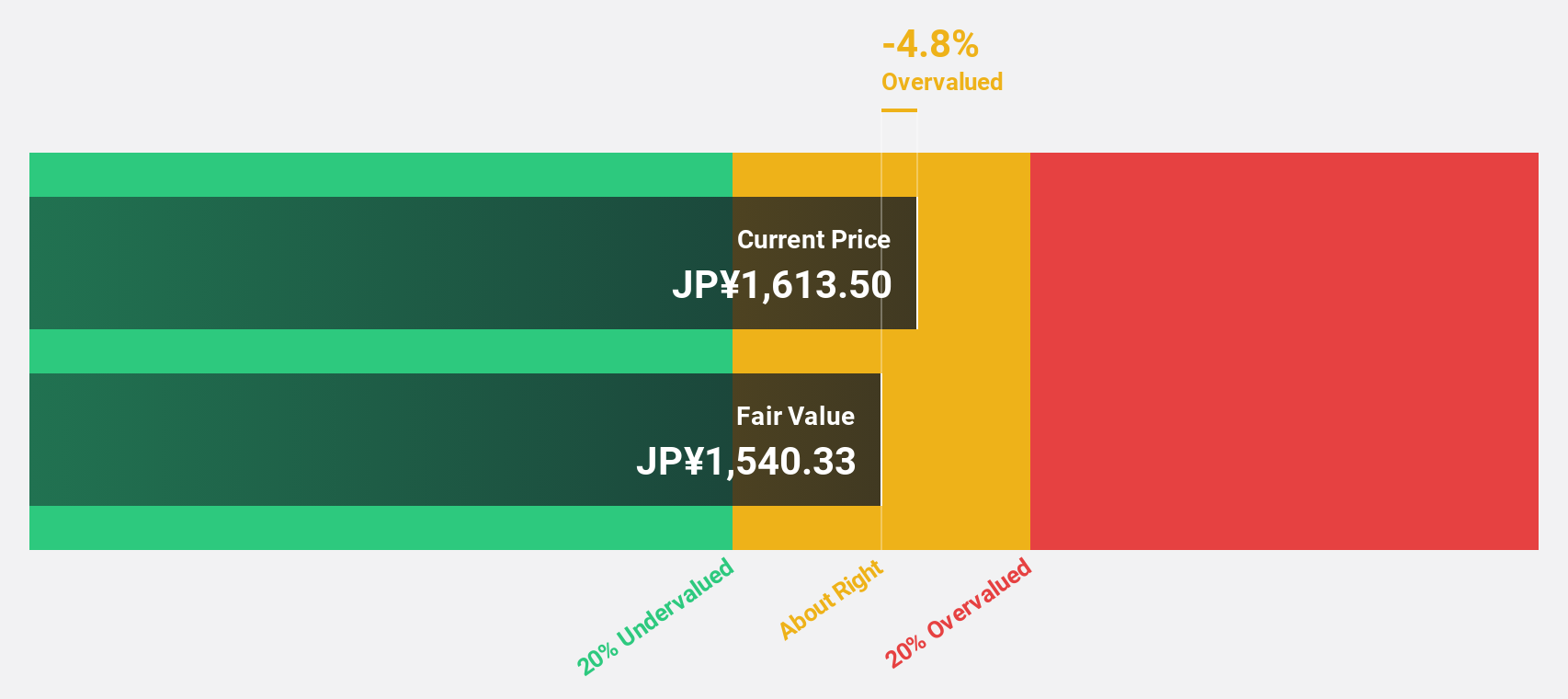

Estimated Discount To Fair Value: 11.3%

Mandom is trading at ¥1,267, slightly below its estimated fair value of ¥1,428.74, suggesting it might be undervalued relative to cash flows. The company offers a reliable dividend yield of 3.16% and has shown strong earnings growth of 91.4% over the past year. Future earnings are expected to grow significantly at 27.6% annually—outpacing the Japanese market average—although revenue growth is moderate at 5.1% per year.

- According our earnings growth report, there's an indication that Mandom might be ready to expand.

- Unlock comprehensive insights into our analysis of Mandom stock in this financial health report.

AGC (TSE:5201)

Overview: AGC Inc. is a global manufacturer and seller of glass, automotive products, electronics, chemicals, and ceramics with a market cap of approximately ¥1.01 trillion.

Operations: The company's revenue segments include Chemicals at ¥581.78 billion, Automotive at ¥510.88 billion, Electronics at ¥340.54 billion, Life Science at ¥122.40 billion, and Architectural Glass at ¥461.20 billion.

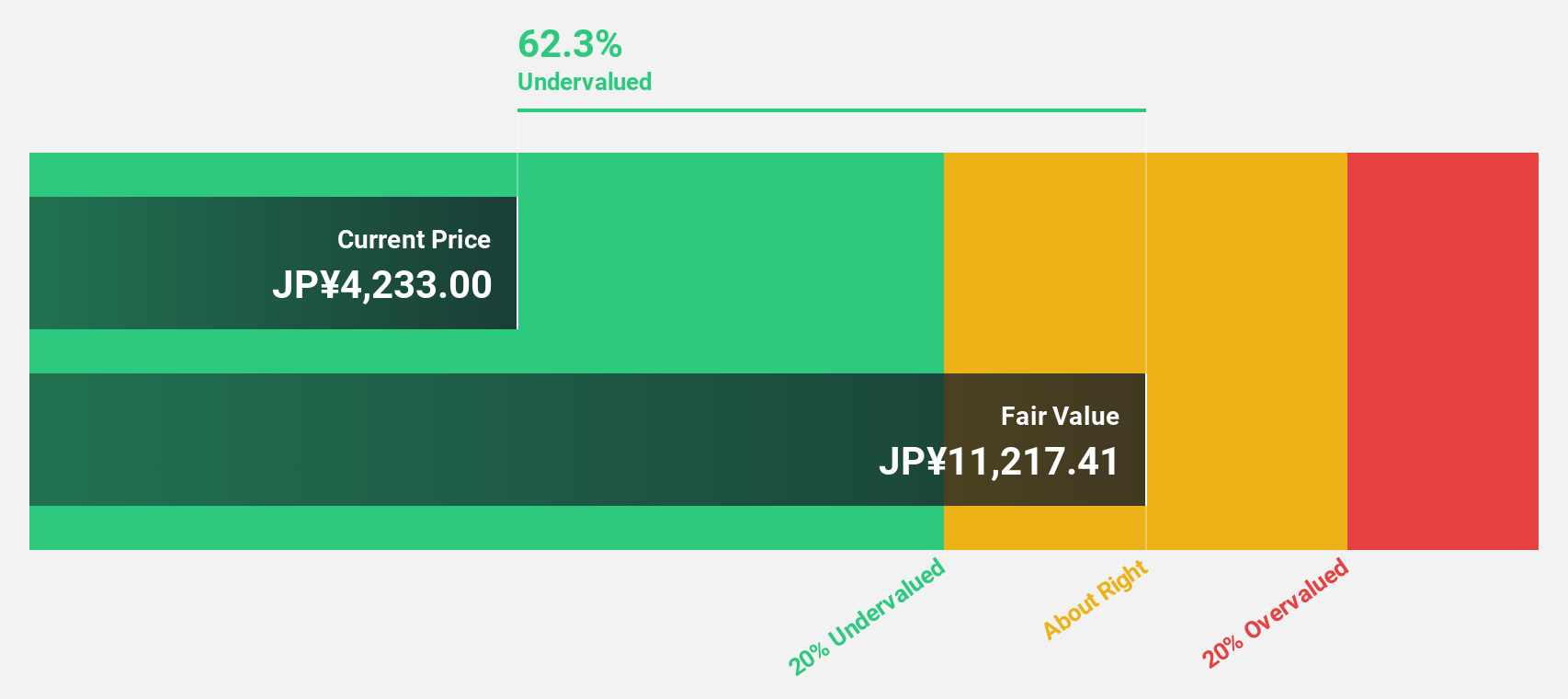

Estimated Discount To Fair Value: 41.8%

AGC is trading at ¥4,745, significantly below its estimated fair value of ¥8,146.71, indicating potential undervaluation based on cash flows. Despite a forecasted annual earnings growth of 67.21%, AGC revised its 2024 guidance downward due to challenges in the biopharmaceuticals and European markets. The recent opening of a technical center in Taiwan underscores AGC's strategic focus on electronics and semiconductors, which may bolster future performance despite current profitability concerns.

- Our expertly prepared growth report on AGC implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on AGC's balance sheet by reading our health report here.

Make It Happen

- Click here to access our complete index of 79 Undervalued Japanese Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4917

Mandom

Engages in the manufacture and sale of cosmetics, perfumes, and quasi-drugs in Japan, Indonesia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.