As global markets face headwinds from rising U.S. Treasury yields and tepid economic growth, investors are increasingly looking for stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream, especially those with solid fundamentals and attractive yields up to 5.1%.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Jiangsu Linyang Energy (SHSE:601222)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Linyang Energy Co., Ltd. manufactures and supplies energy meters, system products, and accessories both in China and internationally, with a market cap of CN¥14.82 billion.

Operations: Jiangsu Linyang Energy Co., Ltd. generates revenue primarily from the sale of energy meters and system products and accessories, serving both domestic and international markets.

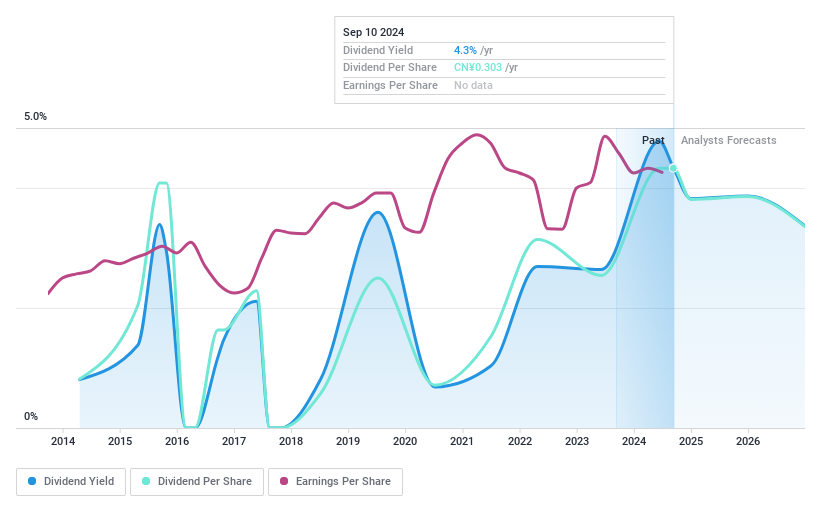

Dividend Yield: 4.1%

Jiangsu Linyang Energy's dividend yield of 4.11% places it in the top 25% of CN market payers, yet its dividends have been unreliable and volatile over the past decade. While earnings cover dividend payments with a payout ratio of 56.1%, high cash payout ratio (390.9%) indicates unsustainable cash flow coverage. Despite solid earnings growth and a favorable price-to-earnings ratio at 13.8x, investors should be cautious about dividend stability and sustainability concerns.

- Take a closer look at Jiangsu Linyang Energy's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Jiangsu Linyang Energy is priced lower than what may be justified by its financials.

Nachi-Fujikoshi (TSE:6474)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nachi-Fujikoshi Corp. is a machinery manufacturer with operations in Japan, the rest of Asia, China, the Americas, and Europe, and it has a market cap of ¥73.49 billion.

Operations: Nachi-Fujikoshi Corp. generates revenue from its machinery manufacturing operations across various regions, including Japan, the rest of Asia, China, the Americas, and Europe.

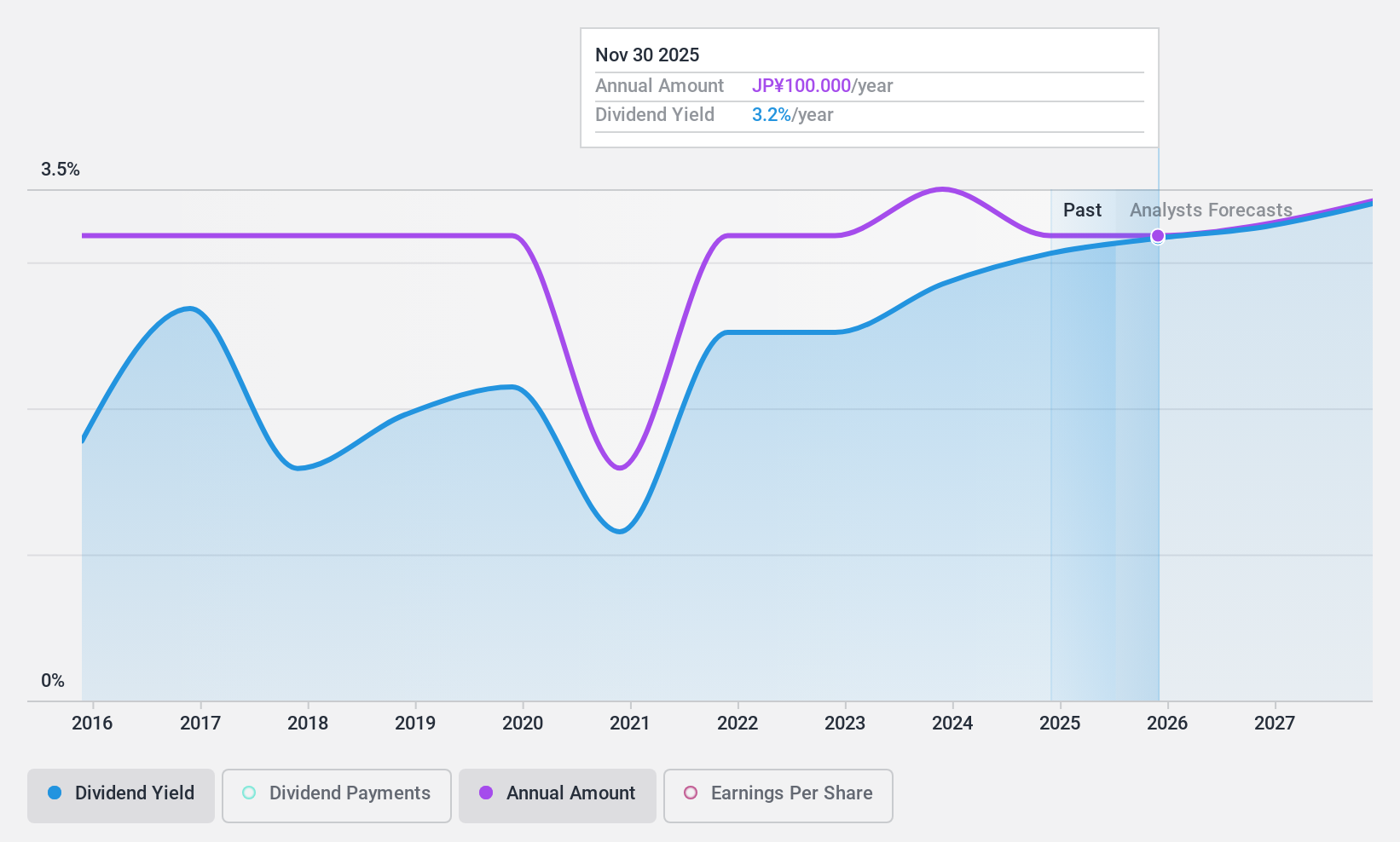

Dividend Yield: 3.1%

Nachi-Fujikoshi's dividend payments are supported by a low cash payout ratio of 31.5%, indicating strong coverage by free cash flow, though the earnings payout ratio is higher at 87%. Despite a history of volatility in its dividends over the past decade, there has been some growth. Recent share buybacks totaling ¥172.33 million suggest efforts to manage capital flexibly amidst business changes, but profit margins have declined from the previous year, potentially impacting future payouts.

- Navigate through the intricacies of Nachi-Fujikoshi with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Nachi-Fujikoshi's share price might be too optimistic.

Alltek Technology (TWSE:3209)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Alltek Technology Corporation is a communication components distributor and solution provider operating in Taiwan, China, and internationally, with a market cap of NT$9.39 billion.

Operations: Alltek Technology Corporation's revenue segments include NT$29.39 billion from Alltek Technology Corp., NT$0.95 billion from Gaosen Technology, Inc., and NT$18.89 billion from Alltek Group Corp and Alltek Technology (H.K.) Limited.

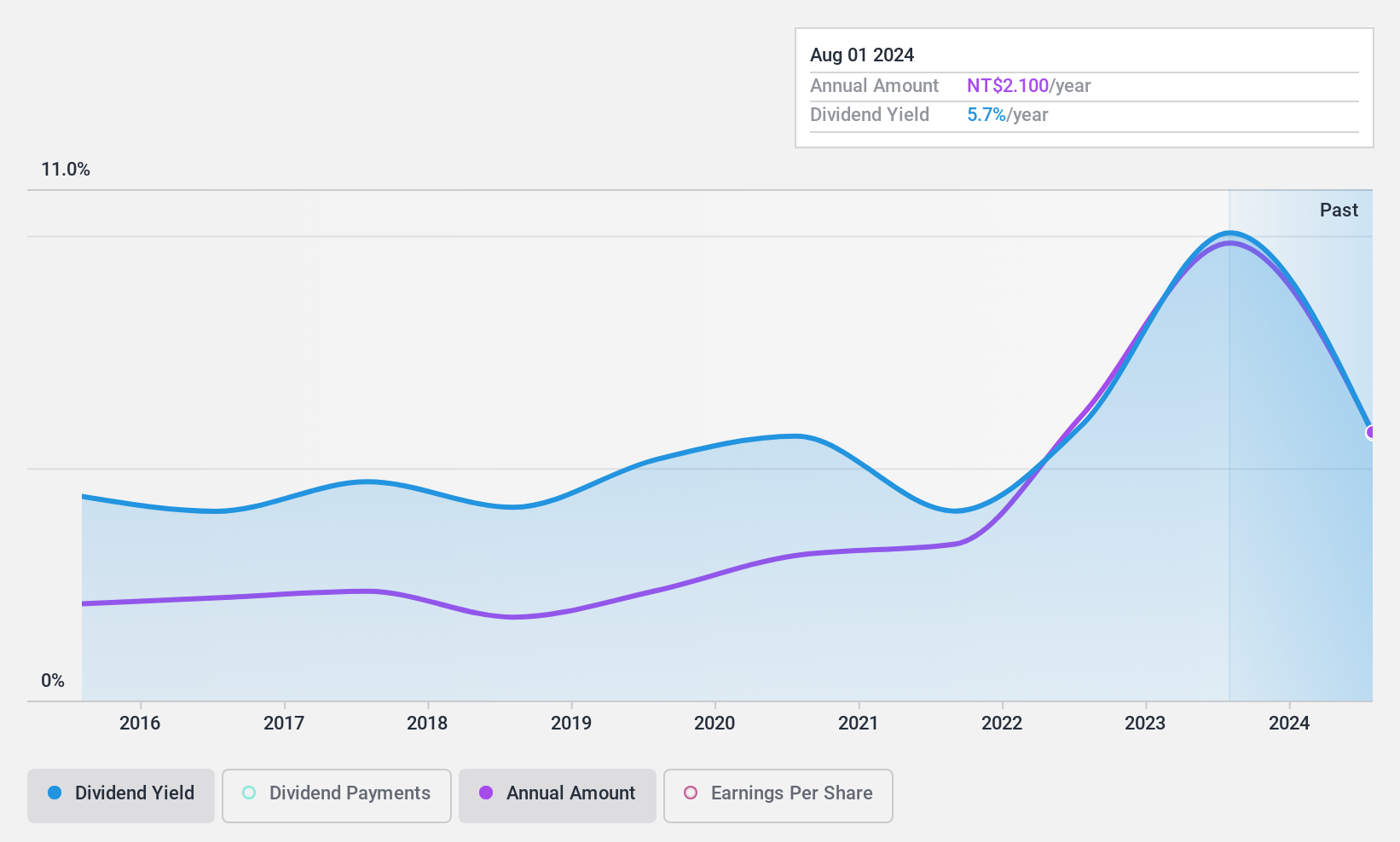

Dividend Yield: 5.2%

Alltek Technology's dividend yield of 5.2% ranks in the top 25% of Taiwan's market, though its dividend history has been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows with a payout ratio of 72.3% and a cash payout ratio of 22.9%. Recent earnings improvements show net income growth, yet sales have declined year-on-year, which could affect future stability in payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Alltek Technology.

- In light of our recent valuation report, it seems possible that Alltek Technology is trading behind its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 2016 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nachi-Fujikoshi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6474

Nachi-Fujikoshi

Operates as a machinery manufacturer in Japan, rest of Asia, China, the Americas, and Europe.

Flawless balance sheet average dividend payer.