- Japan

- /

- Metals and Mining

- /

- TSE:5481

3 Dividend Stocks To Consider With Up To 5.9% Yield

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have put pressure on U.S. stocks and led to a mixed performance across major indices. As investors navigate these challenging conditions, dividend stocks with attractive yields can offer a potential source of steady income amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

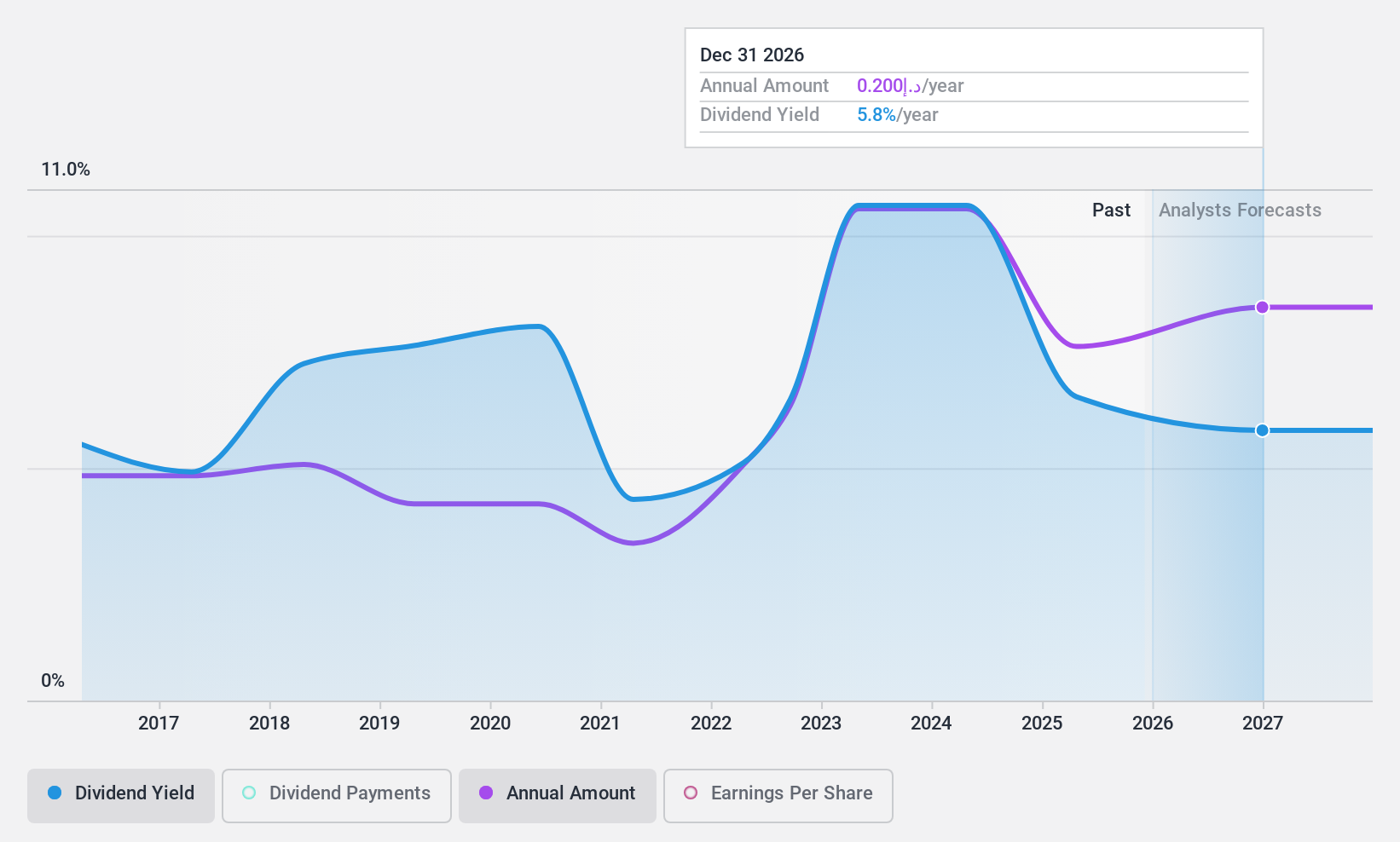

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED8.97 billion.

Operations: Dubai Investments PJSC generates revenue from three main segments: Property (AED2.26 billion), Manufacturing, Contracting and Services (AED1.19 billion), and Investments (AED253.17 million).

Dividend Yield: 5.9%

Dubai Investments PJSC has a reasonable dividend payout ratio of 55.4%, indicating dividends are covered by earnings, and a cash payout ratio of 38.9% suggests strong coverage by cash flows. However, the dividend yield of 5.92% is lower than top-tier payers in the AE market, and its dividends have been unreliable over the past decade with volatility in payments. Despite recent revenue growth, profit margins have decreased significantly from last year’s levels.

- Unlock comprehensive insights into our analysis of Dubai Investments PJSC stock in this dividend report.

- Upon reviewing our latest valuation report, Dubai Investments PJSC's share price might be too optimistic.

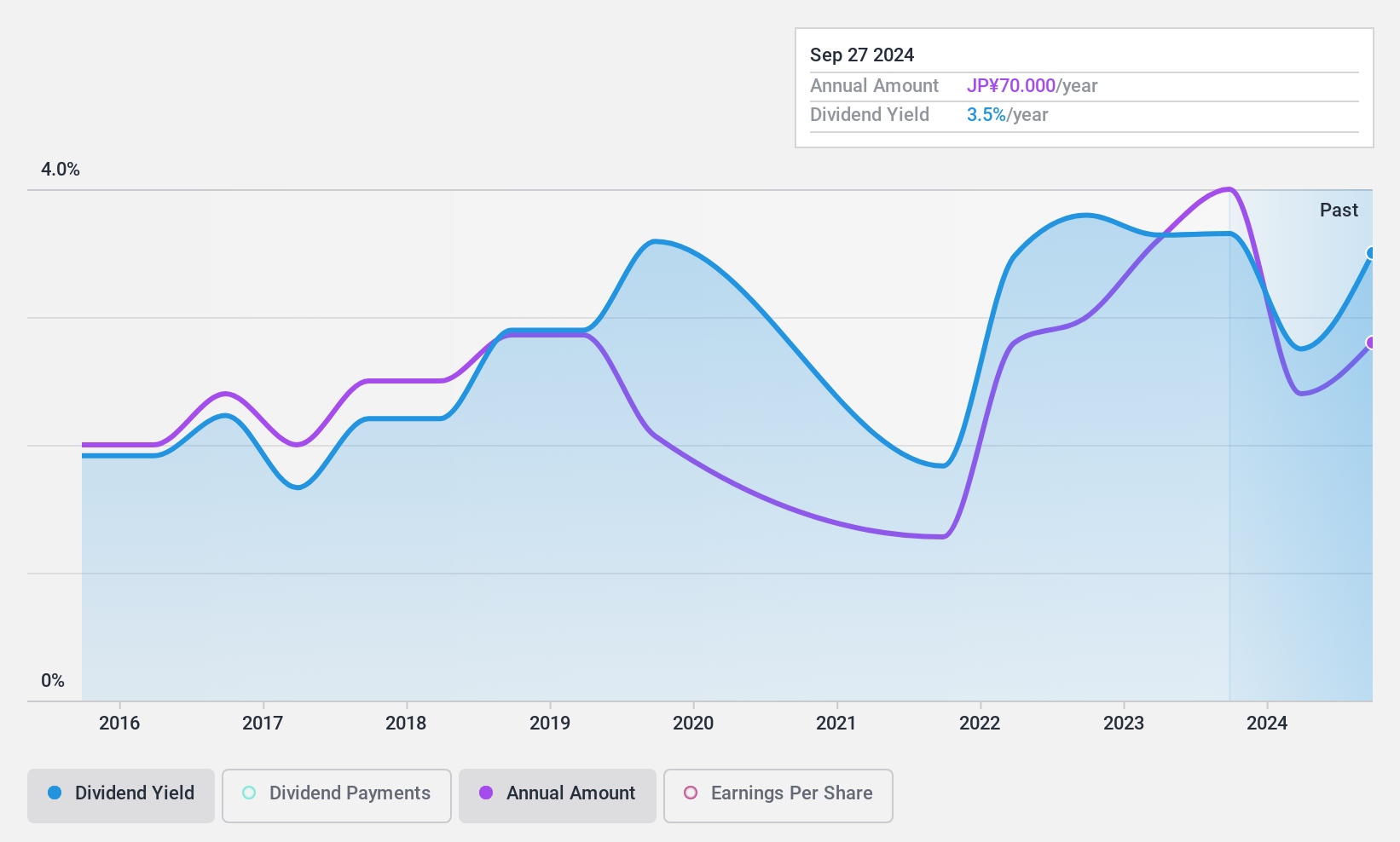

Sanyo Special Steel (TSE:5481)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanyo Special Steel Co., Ltd. manufactures and sells special steel products both in Japan and internationally, with a market cap of ¥97.42 billion.

Operations: Sanyo Special Steel Co., Ltd. generates revenue through its segments: Steel Products at ¥326.92 billion, Formed and Fabricated Materials at ¥18.30 billion, and Metal Powders at ¥5.31 billion.

Dividend Yield: 3.7%

Sanyo Special Steel's dividends are well-covered by earnings, with a payout ratio of 52.2%, and cash flows, with a cash payout ratio of 16.9%. Despite this coverage, the dividend yield of 3.68% is below the top tier in Japan. The company has increased its dividends over the past decade, but payments have been volatile and unreliable at times. Profit margins have declined from last year’s levels, impacting overall financial stability.

- Click here to discover the nuances of Sanyo Special Steel with our detailed analytical dividend report.

- According our valuation report, there's an indication that Sanyo Special Steel's share price might be on the cheaper side.

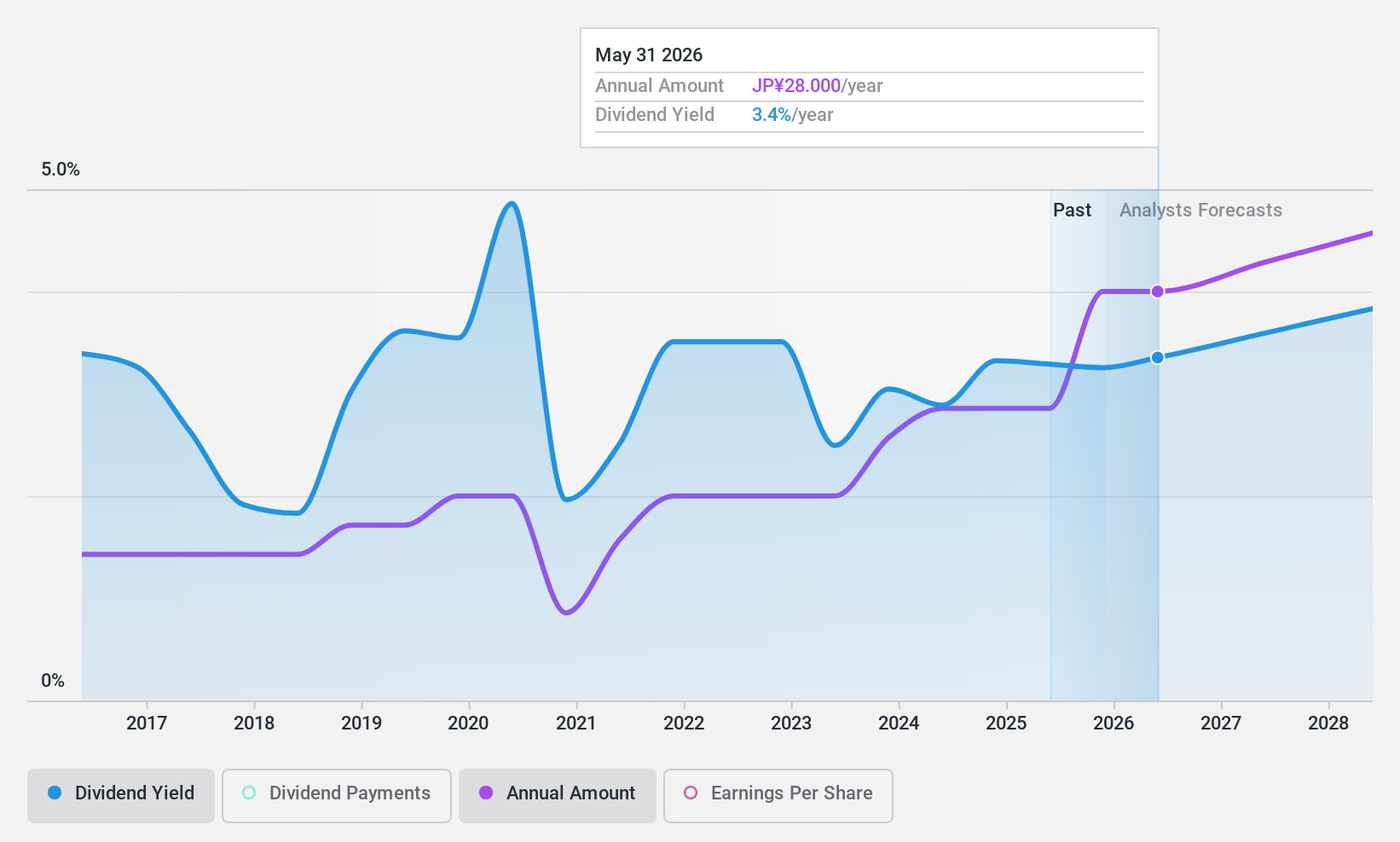

Sanko Gosei (TSE:7888)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanko Gosei Ltd. specializes in the molding and sale of plastic parts both in Japan and internationally, with a market cap of ¥18.23 billion.

Operations: Sanko Gosei Ltd. generates revenue through its operations in the molding and sale of plastic parts across domestic and international markets.

Dividend Yield: 3.3%

Sanko Gosei's dividends are well-covered by earnings, with a low payout ratio of 19.3%, and cash flows, at a cash payout ratio of 78%. However, the dividend yield of 3.27% is below Japan's top tier. Despite past growth in dividends over ten years, payments have been volatile and unreliable. The stock trades at good value compared to peers and industry, while earnings are forecasted to grow annually by 13.44%.

- Delve into the full analysis dividend report here for a deeper understanding of Sanko Gosei.

- Our comprehensive valuation report raises the possibility that Sanko Gosei is priced lower than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2013 more companies for you to explore.Click here to unveil our expertly curated list of 2016 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5481

Sanyo Special Steel

Manufactures and sells special steel products in Japan and internationally.

Flawless balance sheet average dividend payer.