GiG Works Inc.'s (TSE:2375) Shares Leap 25% Yet They're Still Not Telling The Full Story

Those holding GiG Works Inc. (TSE:2375) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 55% share price decline over the last year.

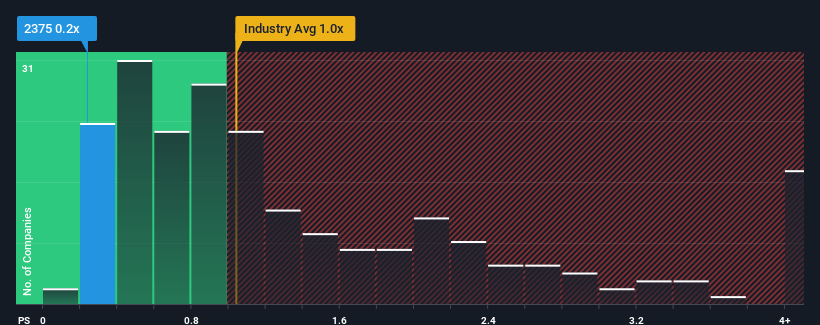

Even after such a large jump in price, when close to half the companies operating in Japan's IT industry have price-to-sales ratios (or "P/S") above 1x, you may still consider GiG Works as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GiG Works

How GiG Works Has Been Performing

For example, consider that GiG Works' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on GiG Works' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For GiG Works?

There's an inherent assumption that a company should underperform the industry for P/S ratios like GiG Works' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.0% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.8% shows it's about the same on an annualised basis.

In light of this, it's peculiar that GiG Works' P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From GiG Works' P/S?

The latest share price surge wasn't enough to lift GiG Works' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that GiG Works currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

It is also worth noting that we have found 3 warning signs for GiG Works (2 don't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of GiG Works' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2375

GiG Works

Provides marketing and communication, field support, and contact center services in Japan.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives