3 Stocks That May Be Undervalued By Up To 40.3% For Savvy Investors

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. indices showing resilience despite recent slumps and European inflationary pressures influencing policy discussions, investors are keenly observing for opportunities amidst the volatility. In such a climate, identifying undervalued stocks becomes crucial as these can offer potential value when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1878.00 | ¥3755.66 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.55 | CN¥31.07 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1120.30 | ₹2232.36 | 49.8% |

| Kinaxis (TSX:KXS) | CA$170.99 | CA$340.11 | 49.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.30 | 50% |

| Vogo (ENXTPA:ALVGO) | €2.94 | €5.87 | 49.9% |

| Exosens (ENXTPA:EXENS) | €22.505 | €44.77 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥45.41 | CN¥90.65 | 49.9% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2434.90 | CLP4848.26 | 49.8% |

Here's a peek at a few of the choices from the screener.

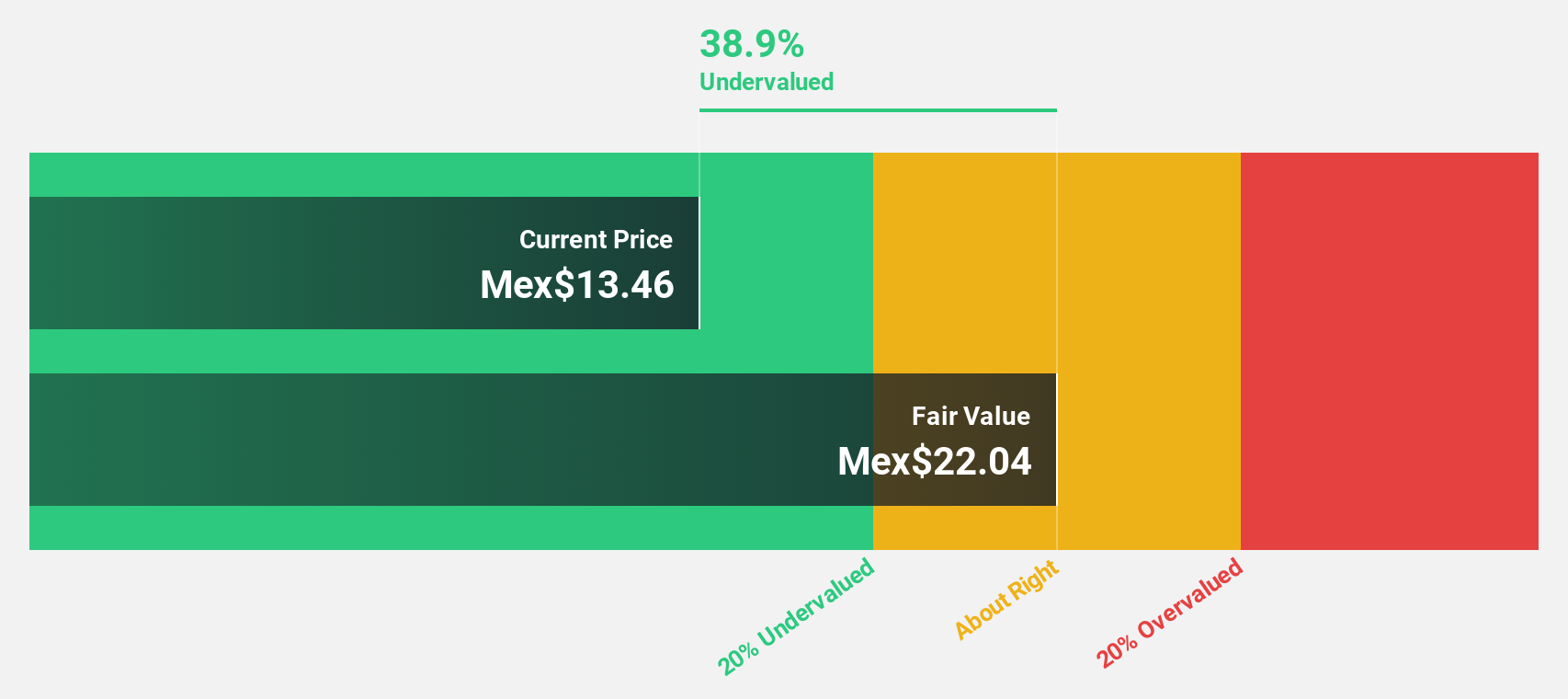

Grupo Rotoplas. de (BMV:AGUA *)

Overview: Grupo Rotoplas S.A.B. de C.V. operates in the water solutions sector by manufacturing, purchasing, selling, and installing plastic containers and accessories for water storage, conduction, and improvement across Mexico, Argentina, the United States, and internationally with a market cap of MX$7.40 billion.

Operations: The company's revenue segments include Individual Solutions, which generated MX$11.05 billion, and Comprehensive Solutions, which contributed MX$803.32 million.

Estimated Discount To Fair Value: 27.1%

Grupo Rotoplas S.A.B. de C.V. is trading at MX$15.62, significantly below its estimated fair value of MX$21.41, indicating potential undervaluation based on cash flows. Despite a volatile share price and recent net loss of MXN 73 million in Q3 2024, the company anticipates annual earnings growth of 12.43%, outpacing the Mexican market slightly. However, its dividend coverage and interest payment coverage remain concerns amidst improved but still modest profit margins at 3.1%.

- Our earnings growth report unveils the potential for significant increases in Grupo Rotoplas. de's future results.

- Click here to discover the nuances of Grupo Rotoplas. de with our detailed financial health report.

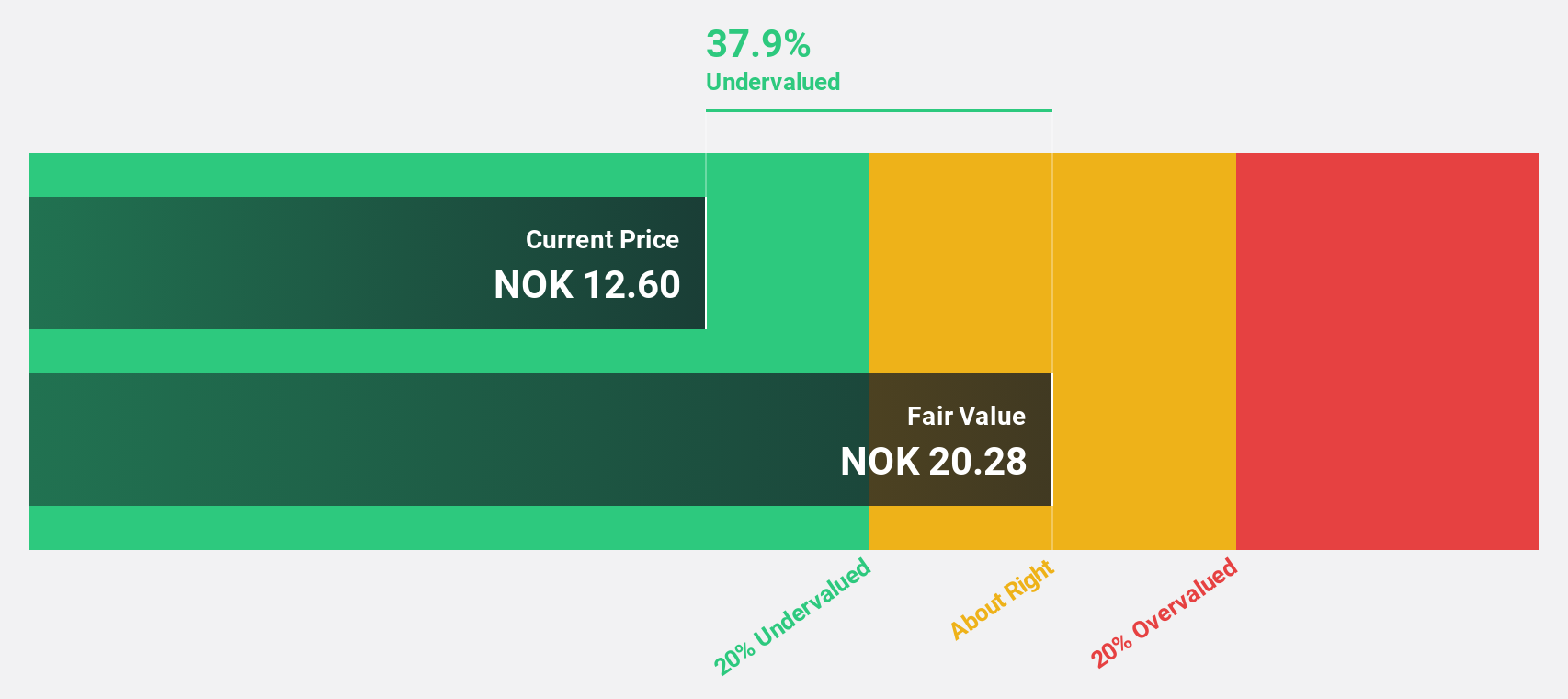

Cloudberry Clean Energy (OB:CLOUD)

Overview: Cloudberry Clean Energy ASA is a renewable energy company with a market capitalization of NOK3.56 billion.

Operations: The company generates revenue from its various segments, including NOK60 million from Operations, NOK572 million from Production, and NOK27 million from Development.

Estimated Discount To Fair Value: 13.1%

Cloudberry Clean Energy is trading at NOK 12.34, slightly below its estimated fair value of NOK 14.2, suggesting a modest undervaluation based on cash flows. Despite reporting a net loss of NOK 19 million in Q3 2024, revenue increased to NOK 84 million from the previous year. The company forecasts annual revenue growth of 14.5%, surpassing the Norwegian market average, and expects profitability within three years despite low future return on equity projections.

- Our expertly prepared growth report on Cloudberry Clean Energy implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Cloudberry Clean Energy's balance sheet health report.

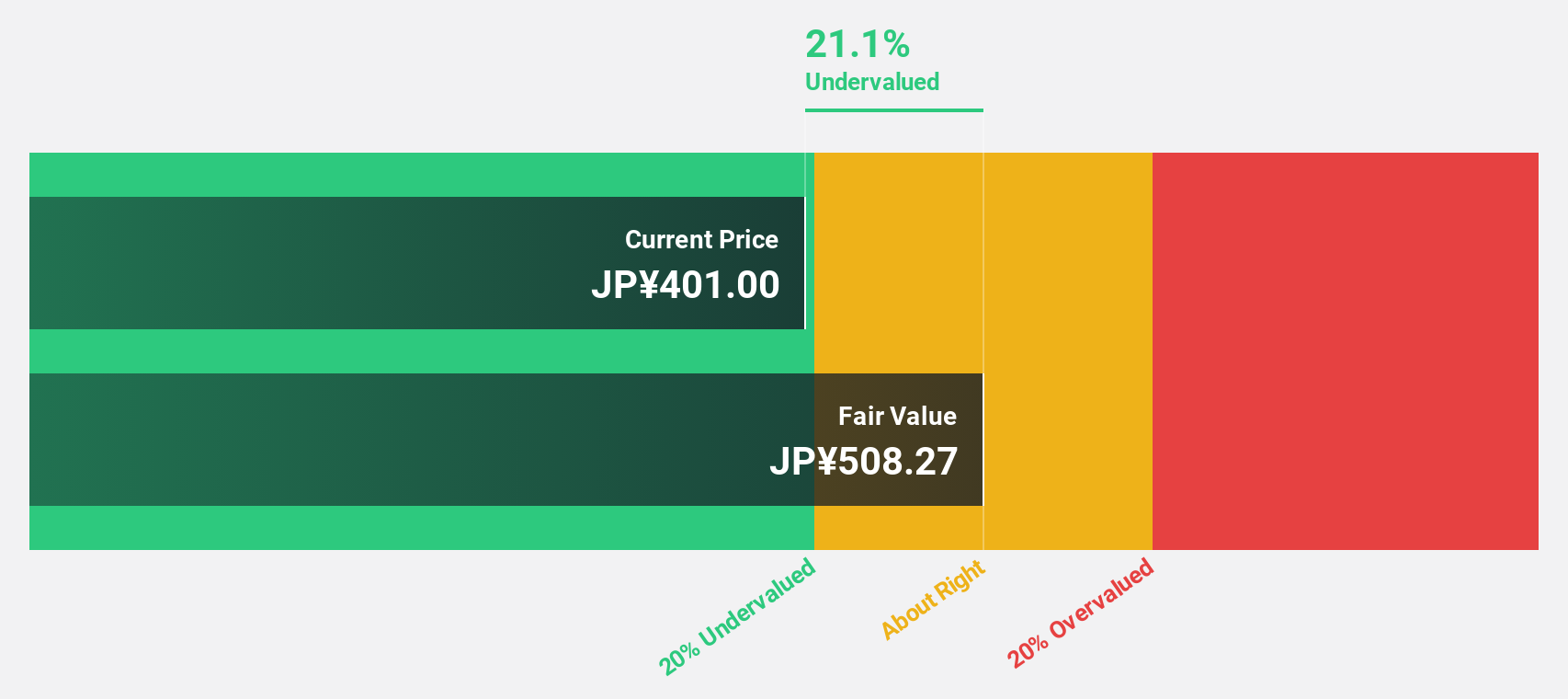

Systena (TSE:2317)

Overview: Systena Corporation operates in Japan, focusing on solution and framework design, IT services, business solutions, and cloud businesses, with a market cap of ¥128.68 billion.

Operations: The company's revenue segments include ¥19.77 billion from the Solution Design Business, ¥7.46 billion from the Framework Design Business, and ¥28.61 billion from the Business Solution Business.

Estimated Discount To Fair Value: 40.3%

Systena is trading at ¥360, significantly below its estimated fair value of ¥602.91, highlighting a substantial undervaluation based on cash flows. The company forecasts annual revenue growth of 7.1% and earnings growth of 10.7%, both outpacing the Japanese market averages. Recent guidance projects net sales up to ¥90 billion and operating profit up to ¥12 billion for fiscal year ending March 2025, alongside increased dividends and share buybacks enhancing shareholder value.

- In light of our recent growth report, it seems possible that Systena's financial performance will exceed current levels.

- Navigate through the intricacies of Systena with our comprehensive financial health report here.

Key Takeaways

- Explore the 885 names from our Undervalued Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2317

Systena

Engages in the solution and framework design, IT service, business solution, and cloud businesses in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.