Returns On Capital At Daiwa Computer (TYO:3816) Paint An Interesting Picture

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So, when we ran our eye over Daiwa Computer's (TYO:3816) trend of ROCE, we liked what we saw.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Daiwa Computer, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = JP¥432m ÷ (JP¥4.8b - JP¥527m) (Based on the trailing twelve months to October 2020).

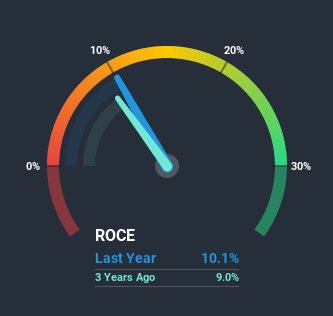

So, Daiwa Computer has an ROCE of 10%. In isolation, that's a pretty standard return but against the Software industry average of 15%, it's not as good.

See our latest analysis for Daiwa Computer

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Daiwa Computer, check out these free graphs here.

So How Is Daiwa Computer's ROCE Trending?

While the returns on capital are good, they haven't moved much. Over the past five years, ROCE has remained relatively flat at around 10% and the business has deployed 38% more capital into its operations. 10% is a pretty standard return, and it provides some comfort knowing that Daiwa Computer has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

Our Take On Daiwa Computer's ROCE

To sum it up, Daiwa Computer has simply been reinvesting capital steadily, at those decent rates of return. However, over the last five years, the stock has only delivered a 38% return to shareholders who held over that period. That's why it could be worth your time looking into this stock further to discover if it has more traits of a multi-bagger.

One more thing to note, we've identified 2 warning signs with Daiwa Computer and understanding these should be part of your investment process.

While Daiwa Computer isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Daiwa Computer, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:3816

Daiwa Computer

Engages in the software development and service integration businesses in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026