- Japan

- /

- Semiconductors

- /

- TSE:8035

Why Tokyo Electron (TSE:8035) Is Up 6.8% After US Lawmakers Push for Stricter China Export Controls

Reviewed by Sasha Jovanovic

- In recent days, US lawmakers called for expanded bans on semiconductor manufacturing equipment exports to China after a bipartisan investigation found that Chinese chipmakers spent $38 billion in 2024 acquiring such tools, significantly enhancing their production capabilities.

- The investigation highlighted that companies from the US, Japan, and the Netherlands, including Tokyo Electron, provided crucial equipment despite regulatory gaps, prompting calls for stricter, coordinated export controls to curb technology transfer.

- We'll explore how potential new export restrictions aimed at China could alter Tokyo Electron's growth outlook and risk profile.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tokyo Electron Investment Narrative Recap

To be a Tokyo Electron shareholder, you have to believe that recurring demand for advanced semiconductor tools, driven by AI, cloud, and next-generation chip cycles, can offset periodic swings in customer spending and regulatory threats. The recent US push for tighter export controls on chipmaking gear sold to China, Tokyo Electron’s largest end-market, spotlights a key risk: if restrictions broaden materially, they could weigh on equipment sales and add revenue uncertainty in the near term. For now, however, the most important short-term catalyst, renewed customer investment ahead of AI server ramp-ups, appears intact, while the risk of further export tightening is heightened but not yet certain. Among recent announcements, Tokyo Electron’s revised earnings guidance issued in July is the most relevant here: the company trimmed its fiscal year outlook and year-end dividend in response to a more cautious demand environment, reflecting some of the same risks raised by export policy uncertainty. This move puts a spotlight on management’s willingness to swiftly recalibrate expectations as market and geopolitical headwinds evolve, underscoring the link between external developments and short-term financial outcomes. Yet, in contrast to the optimism around AI-driven spending, the potential for sudden shifts in export controls remains something investors should be aware of...

Read the full narrative on Tokyo Electron (it's free!)

Tokyo Electron's outlook anticipates ¥2,966.7 billion in revenue and ¥666.1 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 6.9%, with earnings rising by ¥130.4 billion from the current ¥535.7 billion.

Uncover how Tokyo Electron's forecasts yield a ¥27499 fair value, a 8% downside to its current price.

Exploring Other Perspectives

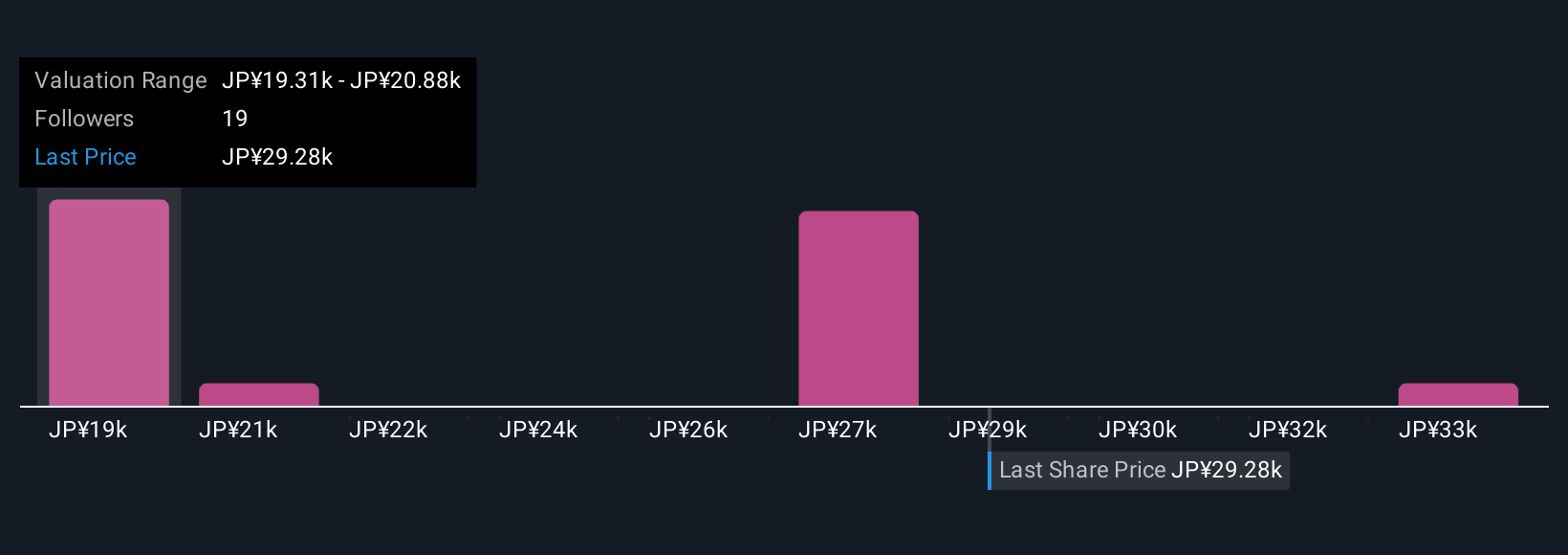

Fair value estimates from the Simply Wall St Community range widely between ¥19,306 and ¥35,063, with five distinct investor perspectives. With export policy risks rising, you can see how views on Tokyo Electron’s outlook may diverge even more, consider the ways these uncertainties could reshape expectations.

Explore 5 other fair value estimates on Tokyo Electron - why the stock might be worth 35% less than the current price!

Build Your Own Tokyo Electron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokyo Electron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tokyo Electron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokyo Electron's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8035

Tokyo Electron

Develops, manufactures, and sells semiconductor production equipment in Japan, Europe, North America, Taiwan, China, South Korea, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives