- Japan

- /

- Semiconductors

- /

- TSE:6963

ROHM Co., Ltd. (TSE:6963) Stocks Pounded By 28% But Not Lagging Market On Growth Or Pricing

The ROHM Co., Ltd. (TSE:6963) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

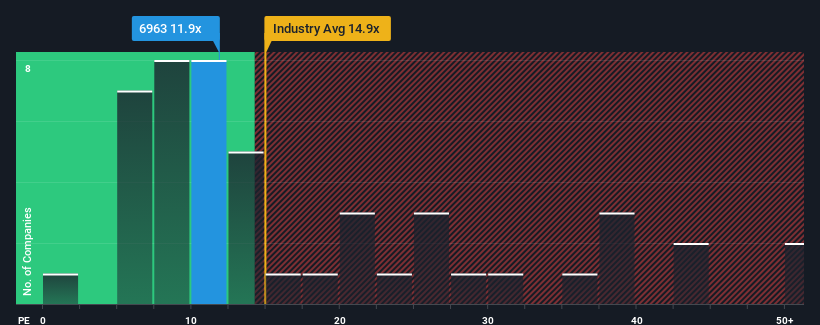

In spite of the heavy fall in price, it's still not a stretch to say that ROHM's price-to-earnings (or "P/E") ratio of 11.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, ROHM's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for ROHM

Is There Some Growth For ROHM?

There's an inherent assumption that a company should be matching the market for P/E ratios like ROHM's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. Still, the latest three year period has seen an excellent 49% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 10% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 9.6% each year growth forecast for the broader market.

With this information, we can see why ROHM is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From ROHM's P/E?

ROHM's plummeting stock price has brought its P/E right back to the rest of the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ROHM maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with ROHM, and understanding them should be part of your investment process.

If you're unsure about the strength of ROHM's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives