- Japan

- /

- Semiconductors

- /

- TSE:6963

3 Asian Stocks Estimated To Be Undervalued By Up To 35.2%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade negotiations and monetary policy shifts, Asian markets have shown resilience with positive movements in major indices such as Japan's Nikkei 225 and China's CSI 300. In this context, identifying undervalued stocks can be an opportunity for investors seeking to capitalize on market inefficiencies, especially when these equities are poised for potential growth amidst evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aidma Holdings (TSE:7373) | ¥1926.00 | ¥3727.82 | 48.3% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.00 | CN¥52.89 | 49% |

| Hunan SUND Technological (SZSE:301548) | CN¥48.45 | CN¥95.71 | 49.4% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.64 | CN¥34.55 | 48.9% |

| Rise Consulting Group (TSE:9168) | ¥933.00 | ¥1795.59 | 48% |

| Newborn Town (SEHK:9911) | HK$8.42 | HK$16.55 | 49.1% |

| GEM (SZSE:002340) | CN¥6.34 | CN¥12.24 | 48.2% |

| Seegene (KOSDAQ:A096530) | ₩27150.00 | ₩53038.69 | 48.8% |

| GC Biopharma (KOSE:A006280) | ₩118100.00 | ₩228899.92 | 48.4% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.52 | SGD1.0 | 47.9% |

Let's dive into some prime choices out of the screener.

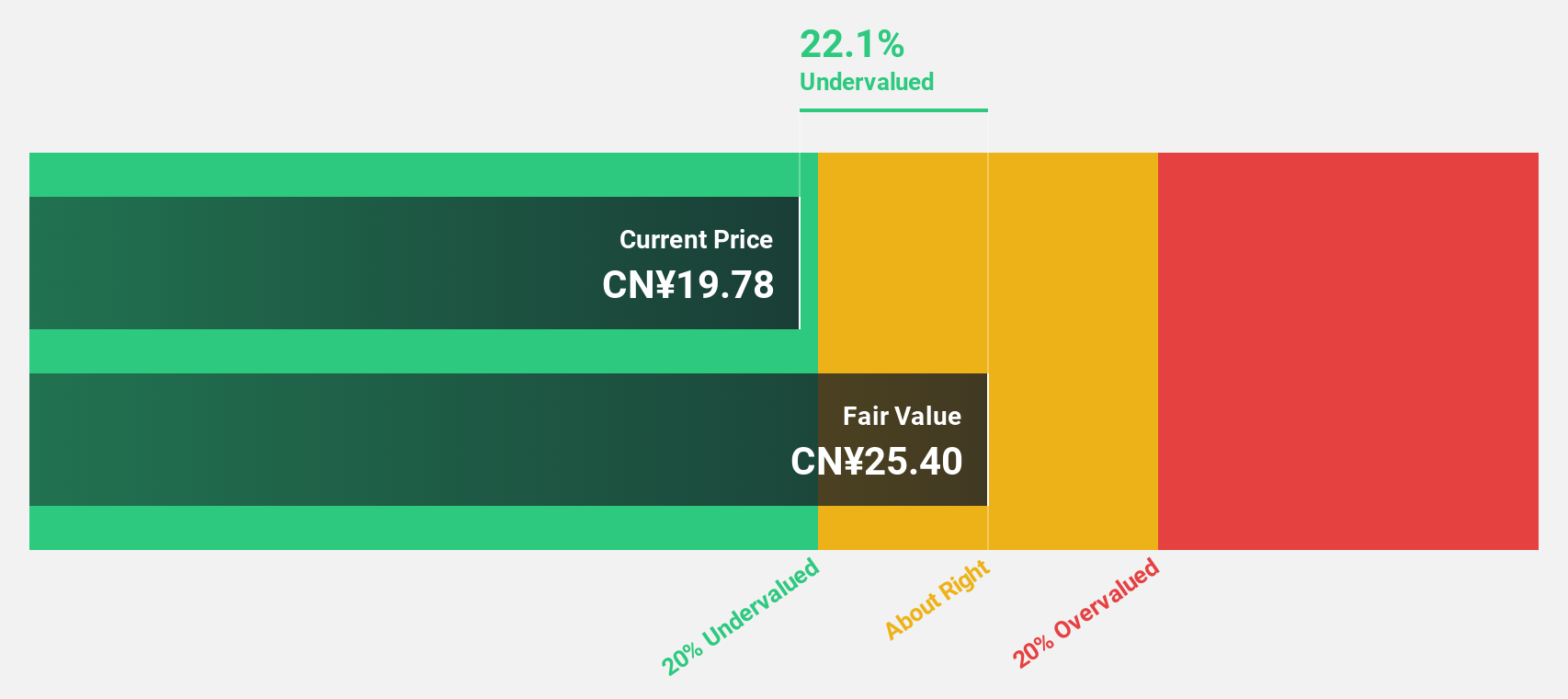

Zhejiang China Commodities City Group (SHSE:600415)

Overview: Zhejiang China Commodities City Group Co., Ltd. develops, manages, and operates a service online trading platform in China, with a market cap of CN¥87.46 billion.

Operations: The company's revenue segments include the development, management, and operation of an online trading platform in China.

Estimated Discount To Fair Value: 35.2%

Zhejiang China Commodities City Group appears undervalued, trading at 35.2% below its estimated fair value of CNY 24.62, with a current price of CNY 15.95. The company reported strong Q1 earnings, with net income rising to CNY 803.32 million from CNY 713.02 million year-over-year. Forecasts indicate robust annual profit growth of over 26%, outpacing the Chinese market average and supported by expected revenue growth exceeding market rates at over 21% annually.

- In light of our recent growth report, it seems possible that Zhejiang China Commodities City Group's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Zhejiang China Commodities City Group stock in this financial health report.

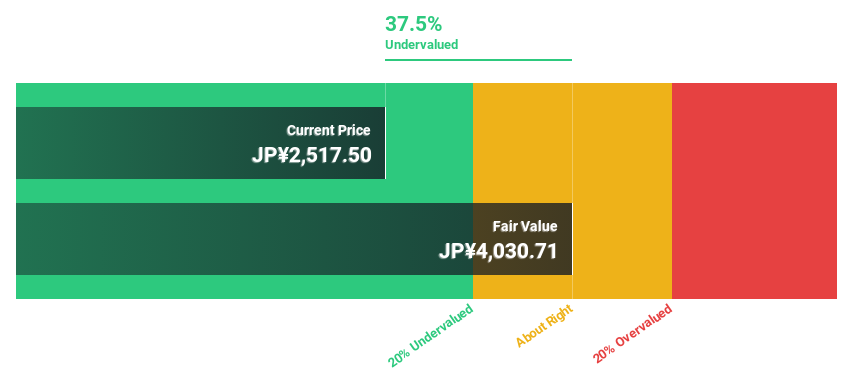

THK (TSE:6481)

Overview: THK Co., Ltd. manufactures and sells mechanical components globally, with a market cap of ¥414.76 billion.

Operations: The company generates revenue through its primary segments, including Industrial Machinery Components and Automotive & Transportation Equipment.

Estimated Discount To Fair Value: 23.9%

THK is trading at ¥3,708, significantly below its fair value estimate of ¥4,873.47. Despite recent share price volatility and a low forecasted return on equity of 8.6% in three years, the company's earnings are expected to grow significantly at 36.64% annually over the next three years, outpacing the Japanese market average. However, profit margins have decreased from last year and its dividend yield of 3.95% is not well covered by earnings or cash flows.

- Upon reviewing our latest growth report, THK's projected financial performance appears quite optimistic.

- Dive into the specifics of THK here with our thorough financial health report.

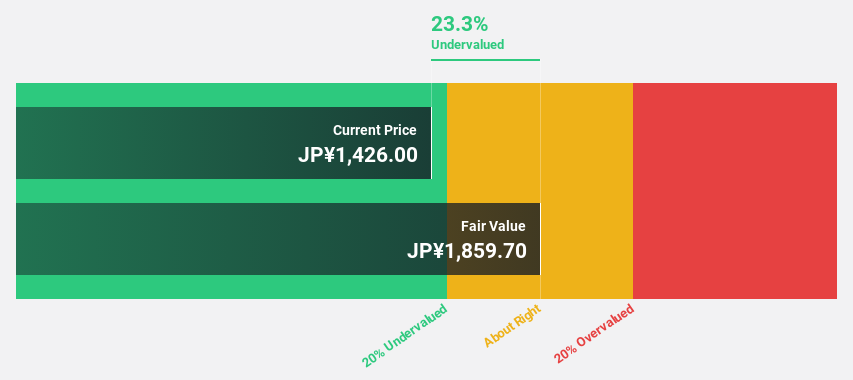

ROHM (TSE:6963)

Overview: ROHM Co., Ltd. is a global manufacturer and seller of electronic components, with a market capitalization of approximately ¥544.62 billion.

Operations: The company's revenue segments include LSI at ¥206.15 billion, Modules at ¥33.14 billion, and Semiconductor Element at ¥198.83 billion.

Estimated Discount To Fair Value: 24.1%

ROHM, trading at ¥1,411, is significantly below its estimated fair value of ¥1,859.7. Despite a volatile share price and low forecasted return on equity of 4.4% in three years, earnings are expected to grow substantially at 52.2% annually over the next three years—surpassing the Japanese market average. However, profit margins have declined from last year and its 3.54% dividend yield is not adequately supported by earnings or free cash flows.

- Insights from our recent growth report point to a promising forecast for ROHM's business outlook.

- Click to explore a detailed breakdown of our findings in ROHM's balance sheet health report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 261 Undervalued Asian Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ROHM, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives