- Japan

- /

- Semiconductors

- /

- TSE:6920

Will Lasertec's (TSE:6920) Share Buyback Discussion Reveal a New Approach to Capital Allocation?

Reviewed by Sasha Jovanovic

- Lasertec Corporation has announced a board meeting held on August 7, 2025, to consider and approve a potential share buyback, with other matters also on the agenda.

- This upcoming meeting signals management's willingness to address capital allocation, which often sparks interest among shareholders regarding potential returns and business confidence.

- With a share buyback on the agenda, we’ll explore how this focus on shareholder value influences Lasertec’s overall investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Lasertec's Investment Narrative?

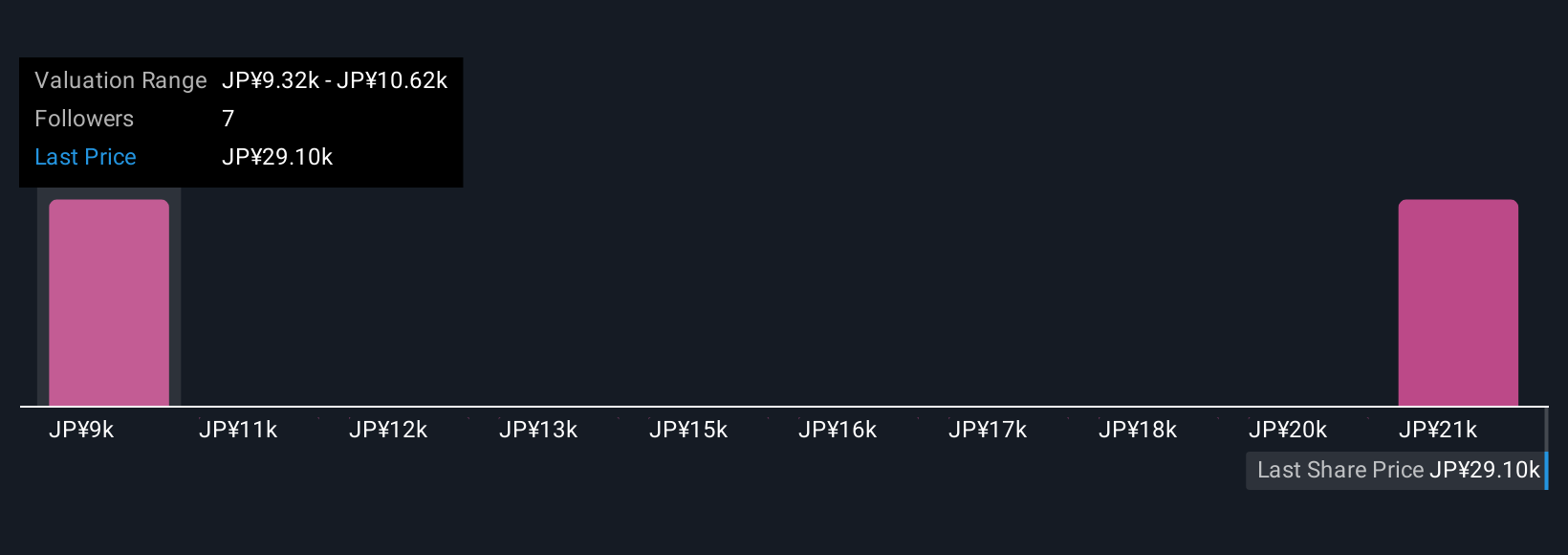

To see Lasertec as an attractive investment, investors usually have to believe in the company’s leading edge within the semiconductor inspection equipment market, and its ability to turn innovation into consistently robust profits. The recent news of a share buyback topping the August board meeting agenda is a positive sign toward capital returns, and shapes the short-term narrative around shareholder value. Up to this point, key catalysts included strong guidance, rising dividends, and healthy profit margins, balanced against risks like a high valuation premium and a relatively inexperienced board. While the buyback plan could provide some support to share price sentiment in the near term, its scale looks modest relative to market capitalization and recent share price moves. As such, the main short-term risks and catalysts remain mostly unchanged, with volatility and board turnover still in focus.

But compare that to Lasertec’s high board turnover risk, something investors shouldn’t overlook. Lasertec's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Lasertec - why the stock might be worth as much as ¥23825!

Build Your Own Lasertec Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lasertec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lasertec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lasertec's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives