Japan’s stock markets have experienced significant volatility recently, driven by a rebounding yen and concerns over global growth. However, comments from the Bank of Japan have helped stabilize the market, providing a more favorable environment for investors. In this context, companies with high insider ownership can be particularly attractive as they often signal strong confidence from those who know the business best. Here are three top Japanese growth companies with substantial insider ownership that stand out in today's market.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 21.8% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Let's dive into some prime choices out of the screener.

Tri Chemical Laboratories (TSE:4369)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tri Chemical Laboratories Inc. specializes in chemical products for semiconductors, coating, optical fibers, solar cells, and compound semiconductors with a market cap of ¥105.45 billion.

Operations: The company's revenue segments include chemical products for semiconductors, coating, optical fibers, solar cells, and compound semiconductors.

Insider Ownership: 17.4%

Tri Chemical Laboratories is forecast to achieve significant revenue growth of 28.9% per year, outpacing the Japanese market's 4.2%. Earnings are expected to grow by 39.66% annually, also surpassing the market average of 8.6%. Despite trading at a substantial discount (60.4%) below its estimated fair value, its return on equity is anticipated to be relatively low at 19.9% in three years. Recent volatility in share price and lower profit margins (20.3%) compared to last year (32.6%) are notable considerations for investors.

- Click here and access our complete growth analysis report to understand the dynamics of Tri Chemical Laboratories.

- Our expertly prepared valuation report Tri Chemical Laboratories implies its share price may be too high.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

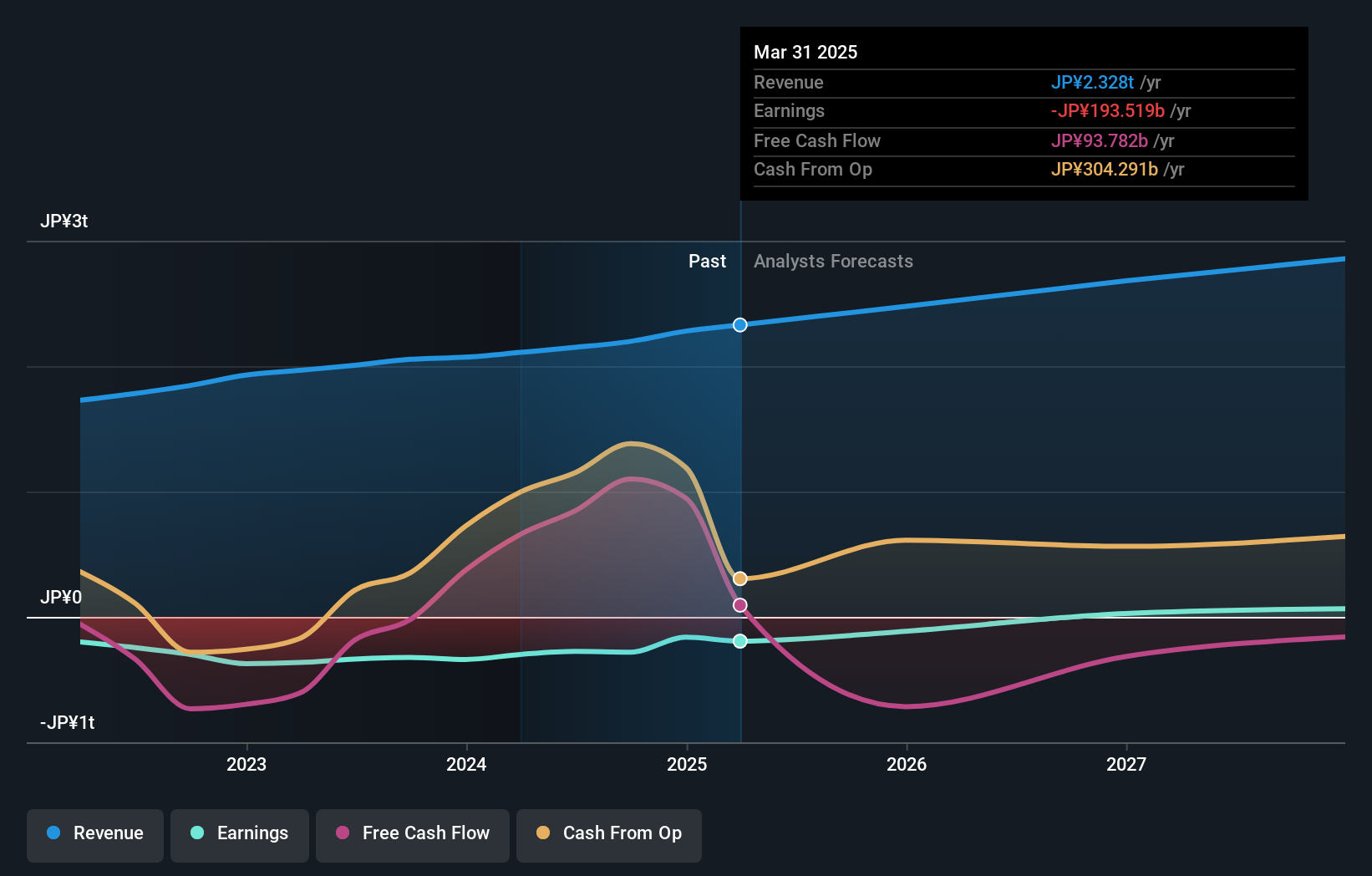

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications both in Japan and internationally with a market cap of ¥1.68 trillion.

Operations: The company's revenue segments include Mobile at ¥382.95 million, Fin Tech at ¥772.29 million, and Internet Services at ¥1.24 billion.

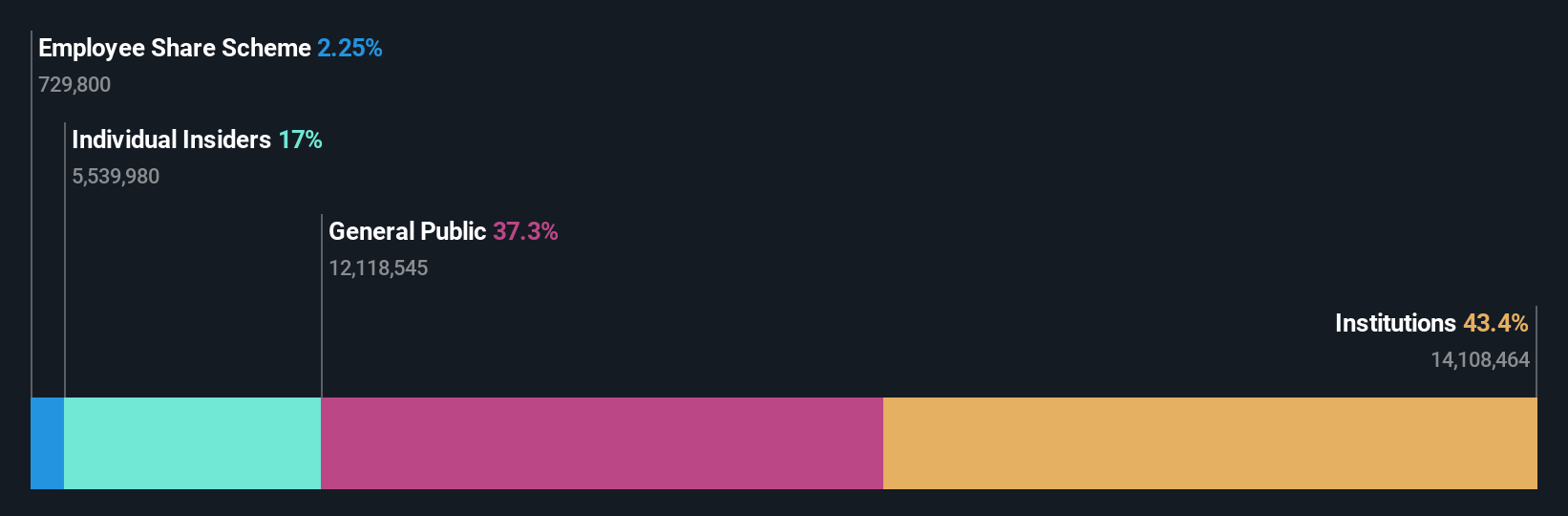

Insider Ownership: 17.3%

Rakuten Group's earnings are forecast to grow 88.76% annually, with revenue expected to increase by 7.9% per year, outpacing the Japanese market's average of 4.2%. Despite a low return on equity forecast (10%) in three years, the company is projected to become profitable within that period. Recent guidance indicates double-digit growth for fiscal year 2024 consolidated revenue, excluding securities business impacts from stock market conditions.

- Dive into the specifics of Rakuten Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Rakuten Group's share price might be too optimistic.

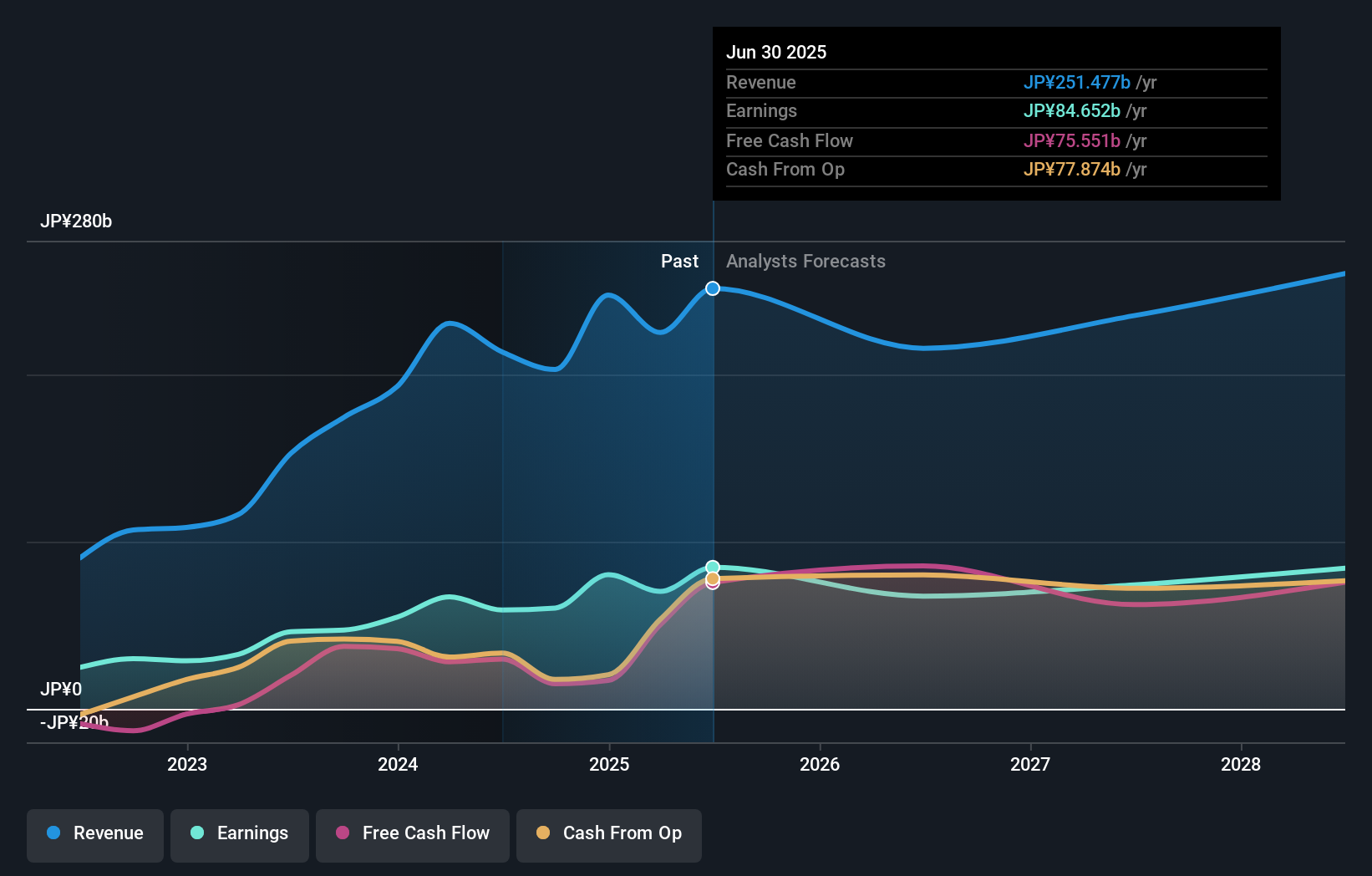

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of ¥2.43 trillion.

Operations: The company generates ¥213.51 billion from its inspection and measurement equipment segment.

Insider Ownership: 12.1%

Lasertec Corporation, a growth company with high insider ownership, has shown impressive financial performance. Recent sales figures reveal cumulative sales of ¥157.20 billion for the first three quarters of fiscal 2024, driven significantly by the ACTIS Series. Earnings grew by 28% last year and are forecast to grow at 19.41% annually, outpacing the Japanese market's average growth rate. Despite high earnings quality and a projected return on equity of 39.8%, its share price has been highly volatile recently.

- Unlock comprehensive insights into our analysis of Lasertec stock in this growth report.

- Our valuation report unveils the possibility Lasertec's shares may be trading at a premium.

Taking Advantage

- Reveal the 101 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.