Stock Analysis

PeptiDream Leads Trio Of Japanese Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 and TOPIX indices experiencing notable gains this week, buoyed by a historic weakening of the yen which has favored export-heavy industries. In such an environment, growth companies with high insider ownership like PeptiDream can be particularly compelling, as they often combine deep market knowledge with a vested interest in driving long-term value.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 26.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Hottolink (TSE:3680) | 27% | 57.4% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 91.1% |

| AeroEdge (TSE:7409) | 10.7% | 28.5% |

| Soracom (TSE:147A) | 17.2% | 54.1% |

| freee K.K (TSE:4478) | 24% | 72.9% |

Here we highlight a subset of our preferred stocks from the screener.

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥322.85 billion.

Operations: The company generates revenue primarily from the development of therapeutic peptides and small molecule drugs.

Insider Ownership: 26.1%

Earnings Growth Forecast: 22.3% p.a.

PeptiDream, a Japanese biotech firm, shows promise with its high insider ownership and growth trajectory. Recent strategic expansions with Novartis and innovative clinical studies, like the first-in-human imaging study for ccRCC diagnosis using 64Cu-PD-32766, underscore its potential in precision medicine. Financially, PeptiDream has revised its earnings guidance upwards significantly for 2024, reflecting robust operational performance and optimistic revenue prospects from ongoing collaborations. However, the company's profit margins have decreased compared to the previous year.

- Navigate through the intricacies of PeptiDream with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report PeptiDream implies its share price may be too high.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

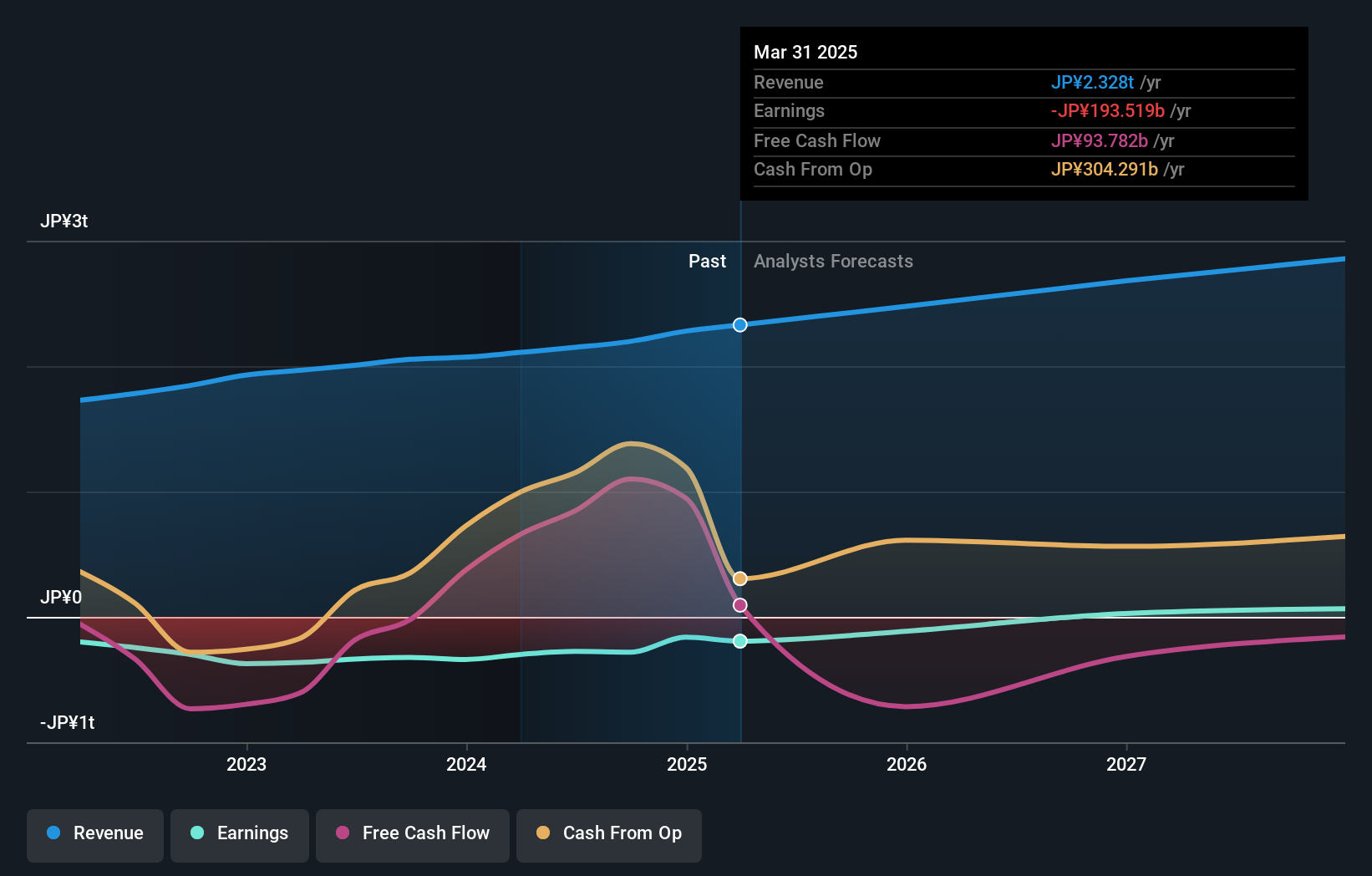

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving a diverse customer base both in Japan and globally, with a market capitalization of approximately ¥1.78 trillion.

Operations: The company generates revenue through its operations in online retail, financial services, digital media, and telecommunications.

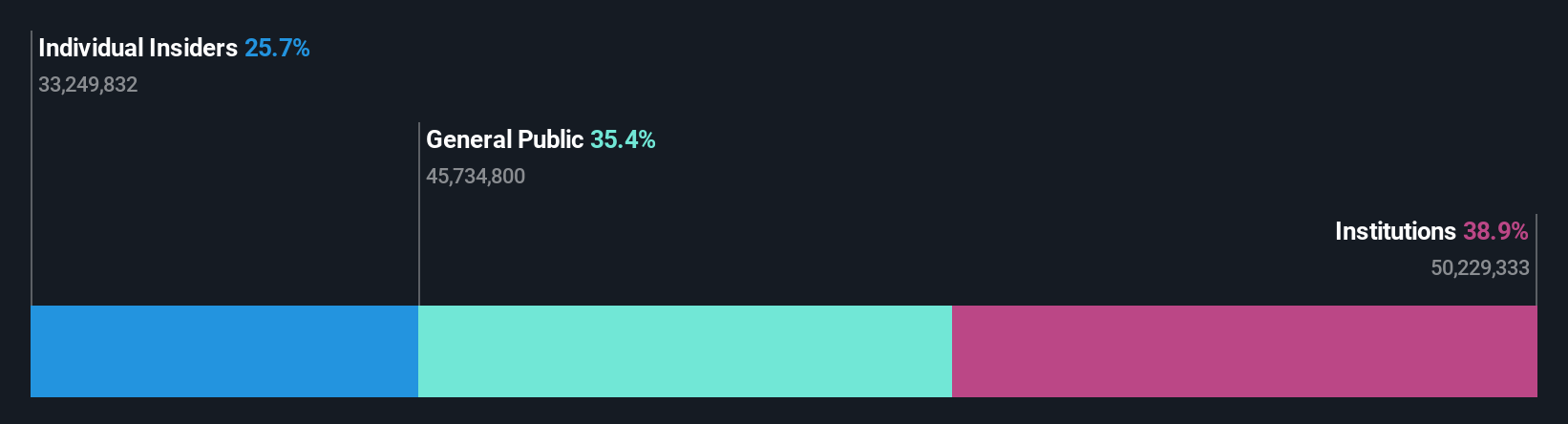

Insider Ownership: 17.3%

Earnings Growth Forecast: 83.9% p.a.

Rakuten Group is poised for notable growth with its revenue expected to increase by 7.4% annually, outpacing the Japanese market's 4.1%. Although currently trading at 77.9% below its estimated fair value, Rakuten anticipates profitability within three years alongside a significant earnings growth forecast of 83.88% per year. However, its projected Return on Equity of 9.1% remains modest. Recent corporate actions include a $1.99 billion fixed-income offering and optimistic guidance for substantial growth in its non-securities business for FY2024.

- Unlock comprehensive insights into our analysis of Rakuten Group stock in this growth report.

- The valuation report we've compiled suggests that Rakuten Group's current price could be quite moderate.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally, with a market capitalization of approximately ¥3.25 trillion.

Operations: The company's revenue is derived from the design, manufacture, and sale of inspection and measurement equipment across domestic and international markets.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.2% p.a.

Lasertec, a growth-oriented Japanese company with high insider ownership, has demonstrated robust financial performance with sales reaching JPY 157.20 billion in the first three quarters of FY2024, nearly doubling the previous year's total for the ACTIS Series. The firm is expected to maintain a revenue growth rate of 16.4% annually, outstripping the broader Japanese market. Recent executive reshuffles aim to bolster this momentum, though its share price has shown significant volatility recently.

- Delve into the full analysis future growth report here for a deeper understanding of Lasertec.

- The analysis detailed in our Lasertec valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Access the full spectrum of 99 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Rakuten Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.