- Japan

- /

- Semiconductors

- /

- TSE:6920

Lasertec Corporation's (TSE:6920) large institutional owners must be happy as stock continues to impress, up 16% over the past week

Key Insights

- Given the large stake in the stock by institutions, Lasertec's stock price might be vulnerable to their trading decisions

- A total of 16 investors have a majority stake in the company with 51% ownership

- Insiders own 11% of Lasertec

If you want to know who really controls Lasertec Corporation (TSE:6920), then you'll have to look at the makeup of its share registry. We can see that institutions own the lion's share in the company with 48% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

And last week, institutional investors ended up benefitting the most after the company hit JP¥2.9t in market cap. The one-year return on investment is currently 111% and last week's gain would have been more than welcomed.

Let's take a closer look to see what the different types of shareholders can tell us about Lasertec.

View our latest analysis for Lasertec

What Does The Institutional Ownership Tell Us About Lasertec?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

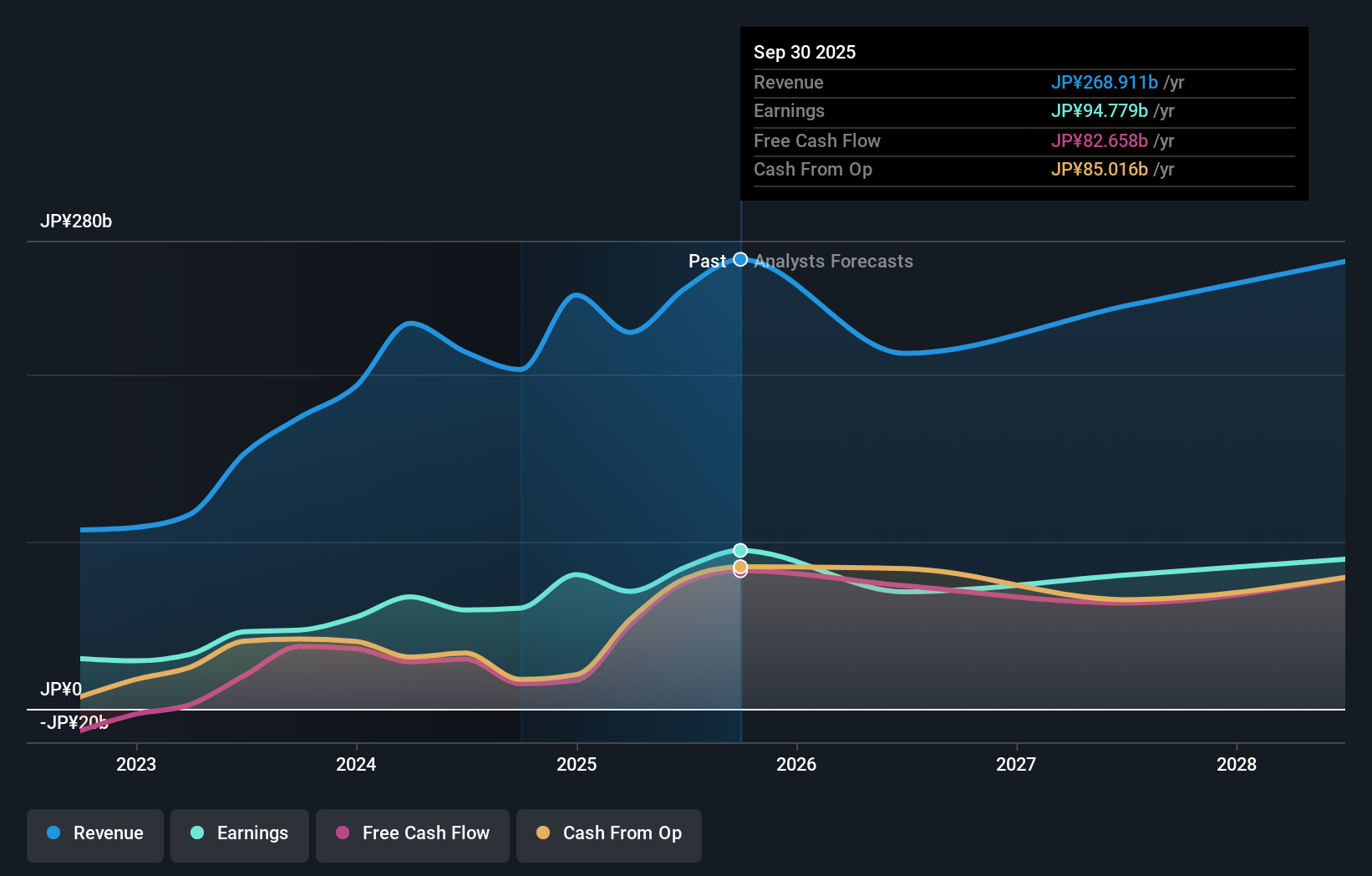

Lasertec already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Lasertec's earnings history below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in Lasertec. Looking at our data, we can see that the largest shareholder is BlackRock, Inc. with 7.2% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 7.1% and 5.5%, of the shares outstanding, respectively.

After doing some more digging, we found that the top 16 have the combined ownership of 51% in the company, suggesting that no single shareholder has significant control over the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Lasertec

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of Lasertec Corporation. It is very interesting to see that insiders have a meaningful JP¥325b stake in this JP¥2.9t business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 40% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Take risks for example - Lasertec has 1 warning sign we think you should be aware of.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026