- Japan

- /

- Semiconductors

- /

- TSE:6871

Micronics Japan Co., Ltd.'s (TSE:6871) Share Price Is Still Matching Investor Opinion Despite 25% Slump

Micronics Japan Co., Ltd. (TSE:6871) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 433%.

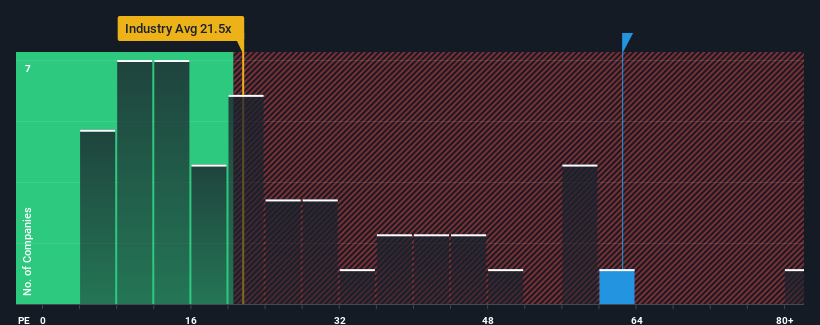

Although its price has dipped substantially, Micronics Japan's price-to-earnings (or "P/E") ratio of 62.4x might still make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Micronics Japan hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Micronics Japan

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Micronics Japan would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. Still, the latest three year period has seen an excellent 49% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 55% each year as estimated by the two analysts watching the company. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Micronics Japan's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Micronics Japan's P/E

A significant share price dive has done very little to deflate Micronics Japan's very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Micronics Japan's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Micronics Japan (2 are concerning!) that we have uncovered.

If you're unsure about the strength of Micronics Japan's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6871

Micronics Japan

Develops, manufactures, and sells body measuring instruments, semiconductor, and liquid crystal display inspection equipment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives