- Japan

- /

- Semiconductors

- /

- TSE:6871

Asian Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the current landscape, Asia's stock markets are witnessing a cautious yet optimistic atmosphere as trade discussions between major economies like the U.S. and China show potential for easing tensions, which could positively influence investor sentiment across the region. Amidst this backdrop, identifying growth companies with significant insider ownership can be a strategic approach for investors looking to align with businesses where management has a vested interest in long-term success.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| giftee (TSE:4449) | 34.5% | 67.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's uncover some gems from our specialized screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide, with a market cap of ₩1.64 trillion.

Operations: The company's revenue from Scientific & Technical Instruments is ₩175.06 billion.

Insider Ownership: 33.1%

Earnings Growth Forecast: 21.5% p.a.

Park Systems has demonstrated robust growth, with earnings increasing by 74.3% over the past year. The company's earnings are forecast to grow significantly, surpassing market averages over the next three years. Revenue is expected to rise at a rate of 15.8% annually, outpacing the broader Korean market's growth. Analysts predict a potential stock price increase of 21.1%. Despite high non-cash earnings, insider trading activity remains stable without significant buying or selling reported recently.

- Get an in-depth perspective on Park Systems' performance by reading our analyst estimates report here.

- The analysis detailed in our Park Systems valuation report hints at an inflated share price compared to its estimated value.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persol Holdings Co., Ltd. offers human resource services globally under the PERSOL brand, with a market cap of ¥603.27 billion.

Operations: Persol Holdings Co., Ltd. generates revenue through several segments, including Staffing (Excluding BPO) at ¥597.51 billion, Asia Pacific at ¥463.48 billion, Career services at ¥141.30 billion, Technology services at ¥111.35 billion, and BPO services contributing ¥112.50 billion.

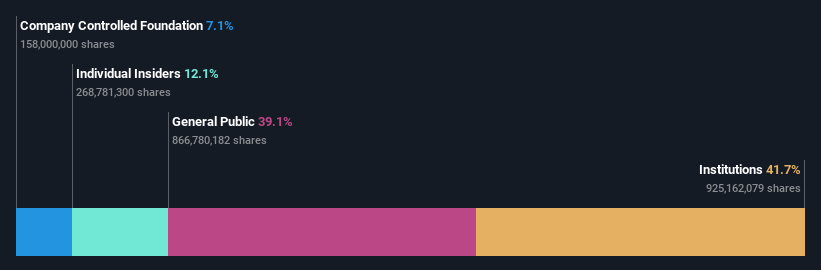

Insider Ownership: 12.1%

Earnings Growth Forecast: 10.4% p.a.

Persol Holdings is forecast to achieve revenue growth of 5.1% annually, outpacing the Japanese market's average. Earnings are projected to increase by 10.4% per year, exceeding market expectations but not significantly high. The stock is trading well below its estimated fair value, suggesting potential undervaluation. Recent events include a board meeting discussing treasury shares disposal as compensation, with no substantial insider trading activity reported in the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Persol HoldingsLtd.

- In light of our recent valuation report, it seems possible that Persol HoldingsLtd is trading behind its estimated value.

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells body measuring instruments as well as semiconductor and liquid crystal display inspection equipment globally, with a market cap of ¥141.40 billion.

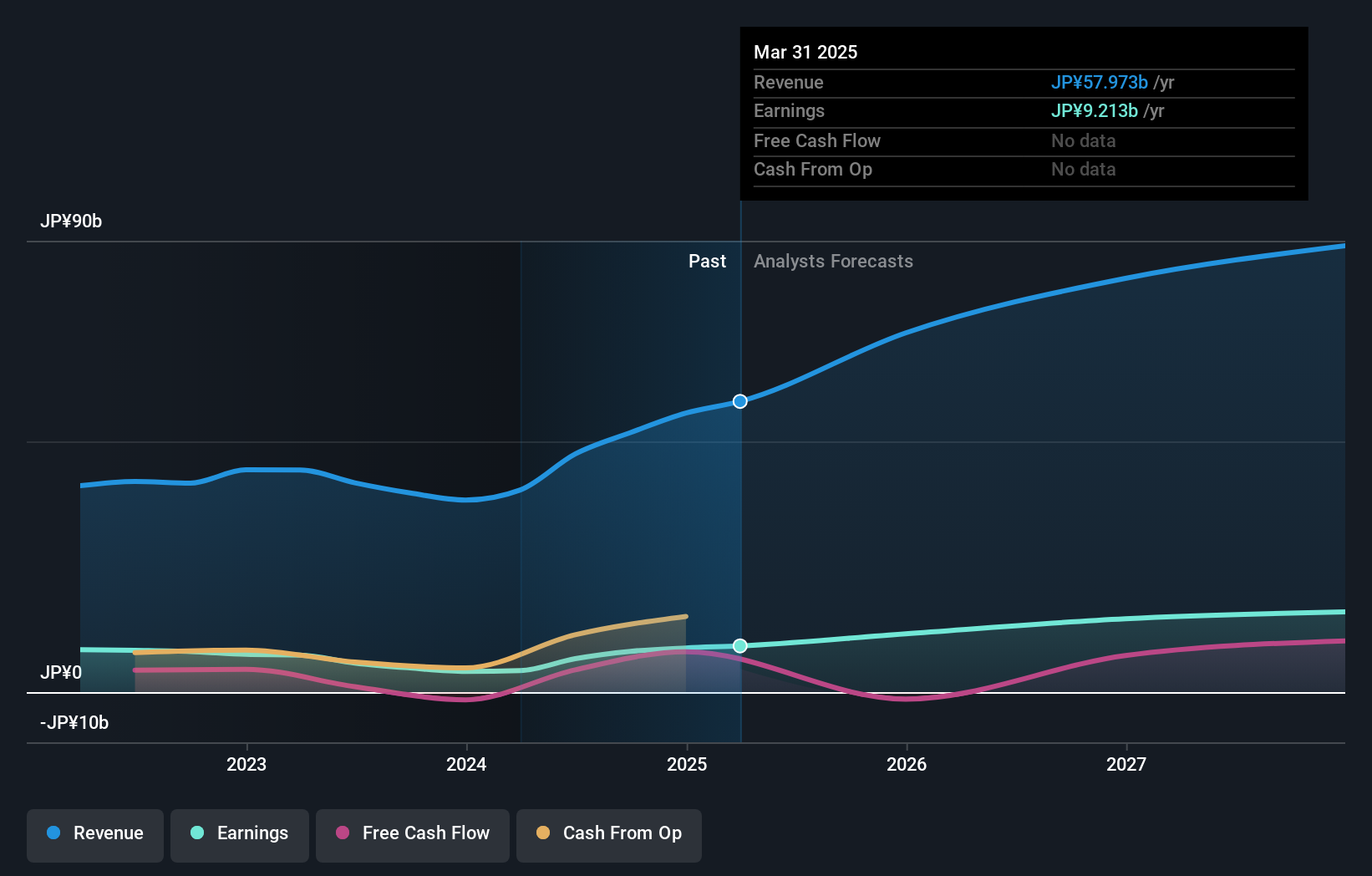

Operations: Micronics Japan's revenue segments include the TE Business, generating ¥2.12 billion, and the Probe Card Business, contributing ¥53.53 billion.

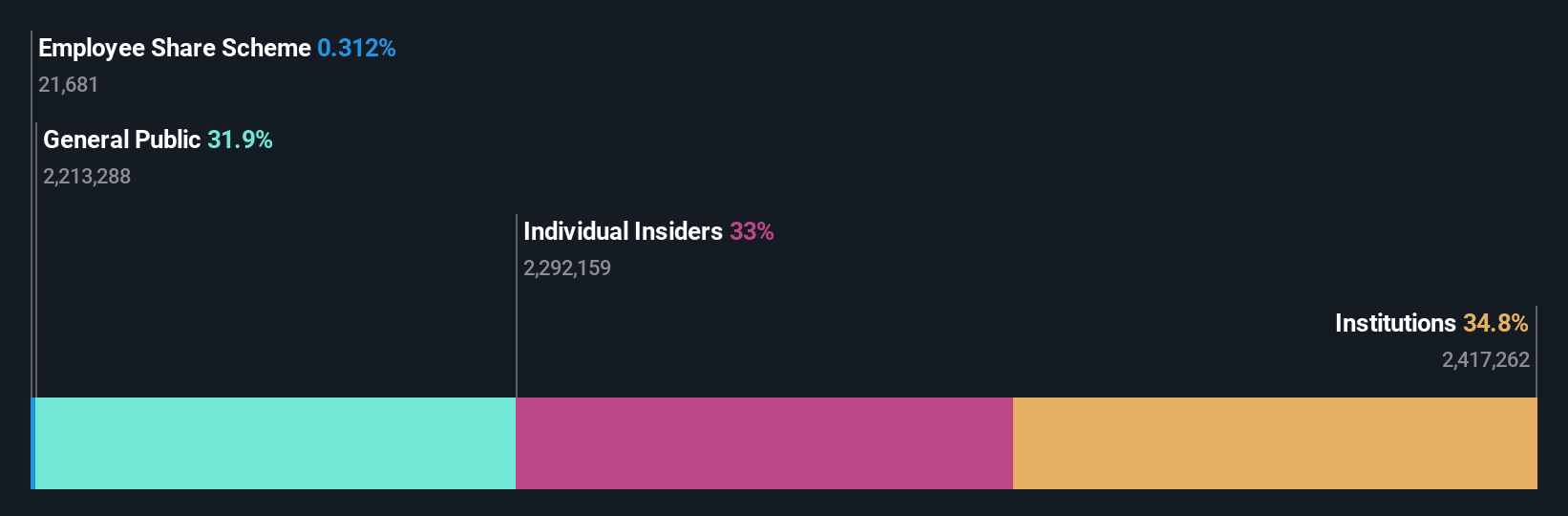

Insider Ownership: 15.2%

Earnings Growth Forecast: 19.2% p.a.

Micronics Japan is forecast to experience robust earnings growth of 19.17% annually, surpassing the Japanese market's average. The company trades at a substantial discount to its estimated fair value, indicating potential undervaluation. Despite recent volatility in share price and an unstable dividend track record, no significant insider trading activity has been observed recently. Recent actions include a private placement involving Advantest Corporation and board discussions on treasury shares disposal for director compensation.

- Click to explore a detailed breakdown of our findings in Micronics Japan's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Micronics Japan shares in the market.

Next Steps

- Unlock our comprehensive list of 618 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Micronics Japan, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6871

Micronics Japan

Develops, manufactures, and sells body measuring instruments, semiconductor, and liquid crystal display inspection equipment worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives