- Japan

- /

- Semiconductors

- /

- TSE:6323

Asian Value Stocks Offering Estimated Opportunities In September 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of economic shifts, Asian stock markets present intriguing opportunities for value investors. Amidst fluctuating indices and evolving economic landscapes, identifying stocks that are undervalued can be key to capitalizing on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.99 | CN¥165.09 | 49.7% |

| Takara Bio (TSE:4974) | ¥919.00 | ¥1829.46 | 49.8% |

| Suzhou Zelgen Biopharmaceuticals (SHSE:688266) | CN¥113.00 | CN¥223.99 | 49.6% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.42 | CN¥58.27 | 49.5% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.28 | CN¥28.44 | 49.8% |

| Meitu (SEHK:1357) | HK$9.21 | HK$18.02 | 48.9% |

| Matsuya R&DLtd (TSE:7317) | ¥731.00 | ¥1430.21 | 48.9% |

| Kolmar Korea (KOSE:A161890) | ₩79000.00 | ₩155852.26 | 49.3% |

| HL Holdings (KOSE:A060980) | ₩42150.00 | ₩83199.11 | 49.3% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.18 | CN¥97.08 | 49.3% |

Let's take a closer look at a couple of our picks from the screened companies.

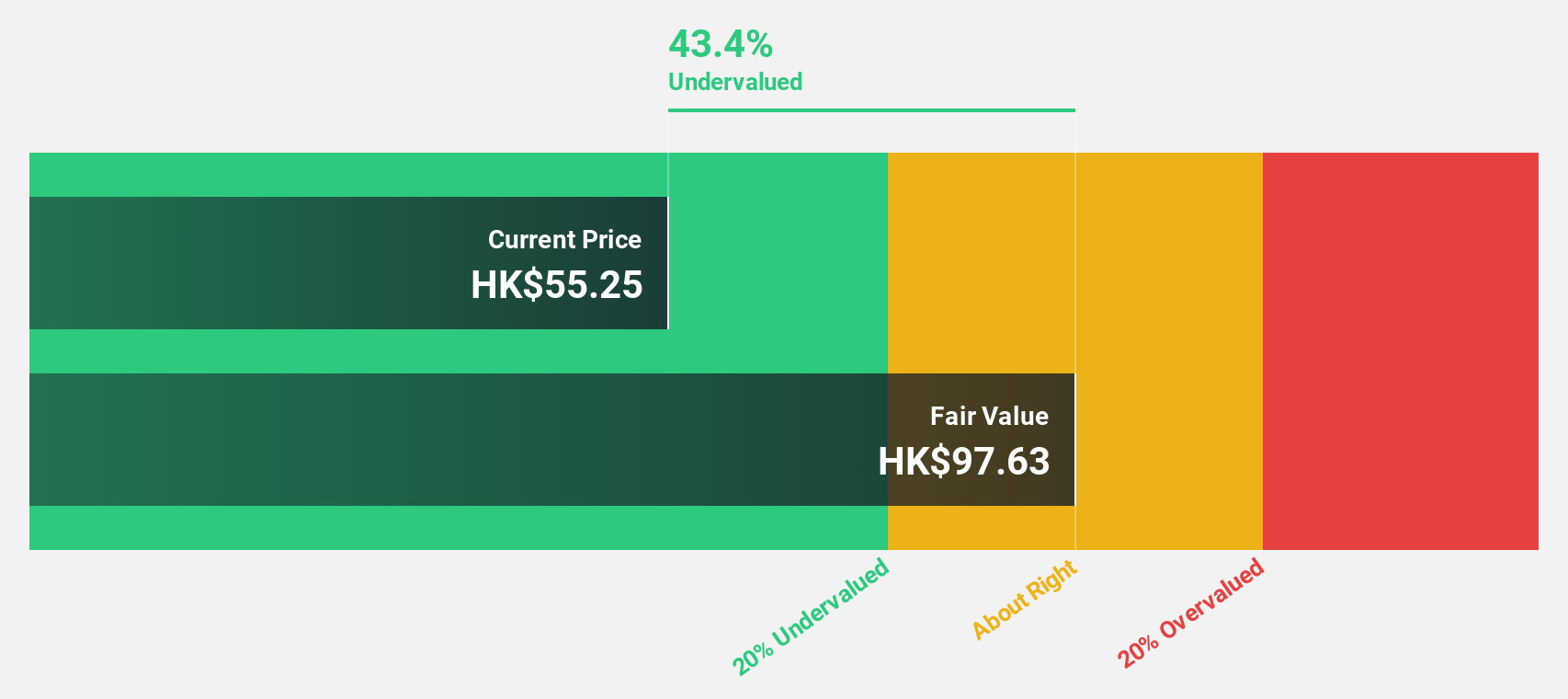

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in the design, manufacture, and marketing of machines, tools, and materials for the semiconductor and electronics assembly industries worldwide, with a market cap of approximately HK$29.57 billion.

Operations: The company's revenue is derived from Semiconductor Solutions, contributing HK$7.77 billion, and Surface Mount Technology (SMT) Solutions, accounting for HK$5.51 billion.

Estimated Discount To Fair Value: 44.3%

ASMPT appears undervalued based on cash flows, trading at HK$71, significantly below its estimated fair value of HK$127.41. Despite a recent downsizing in Shenzhen to optimize operations, the company maintains robust growth prospects with expected annual earnings growth of 40.6%, outpacing the Hong Kong market's 12.2%. While profit margins have decreased to 1.8% from last year's 3%, ASMPT's strategic realignment aims to enhance cost competitiveness and operational resilience.

- The analysis detailed in our ASMPT growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in ASMPT's balance sheet health report.

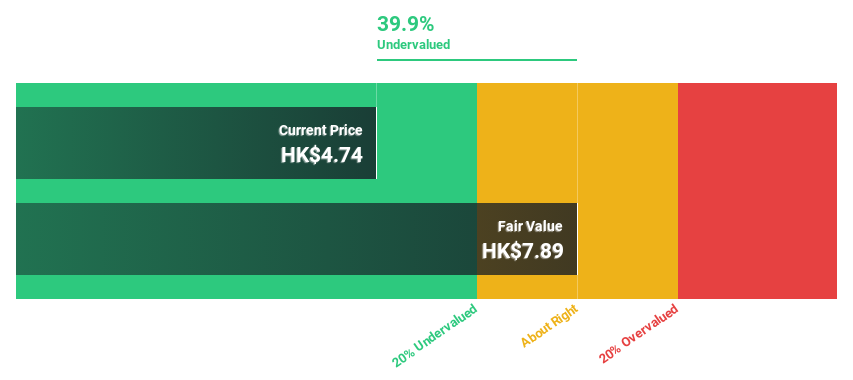

Newborn Town (SEHK:9911)

Overview: Newborn Town Inc. is an investment holding company that operates in the social networking business globally, with a market cap of HK$17.13 billion.

Operations: The company generates revenue from two main segments: Innovative Business, contributing CN¥603.10 million, and Social Networking Business, which accounts for CN¥5.40 billion.

Estimated Discount To Fair Value: 29.5%

Newborn Town is trading at HK$12.76, below its estimated fair value of HK$18.09, highlighting its undervaluation based on cash flows. Recent earnings show a strong performance with net income reaching CNY 489.28 million for the first half of 2025, up from CNY 224.68 million the previous year. The company's projected annual earnings growth of 26.5% surpasses the Hong Kong market average, despite recent board changes that may impact strategic direction.

- According our earnings growth report, there's an indication that Newborn Town might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Newborn Town.

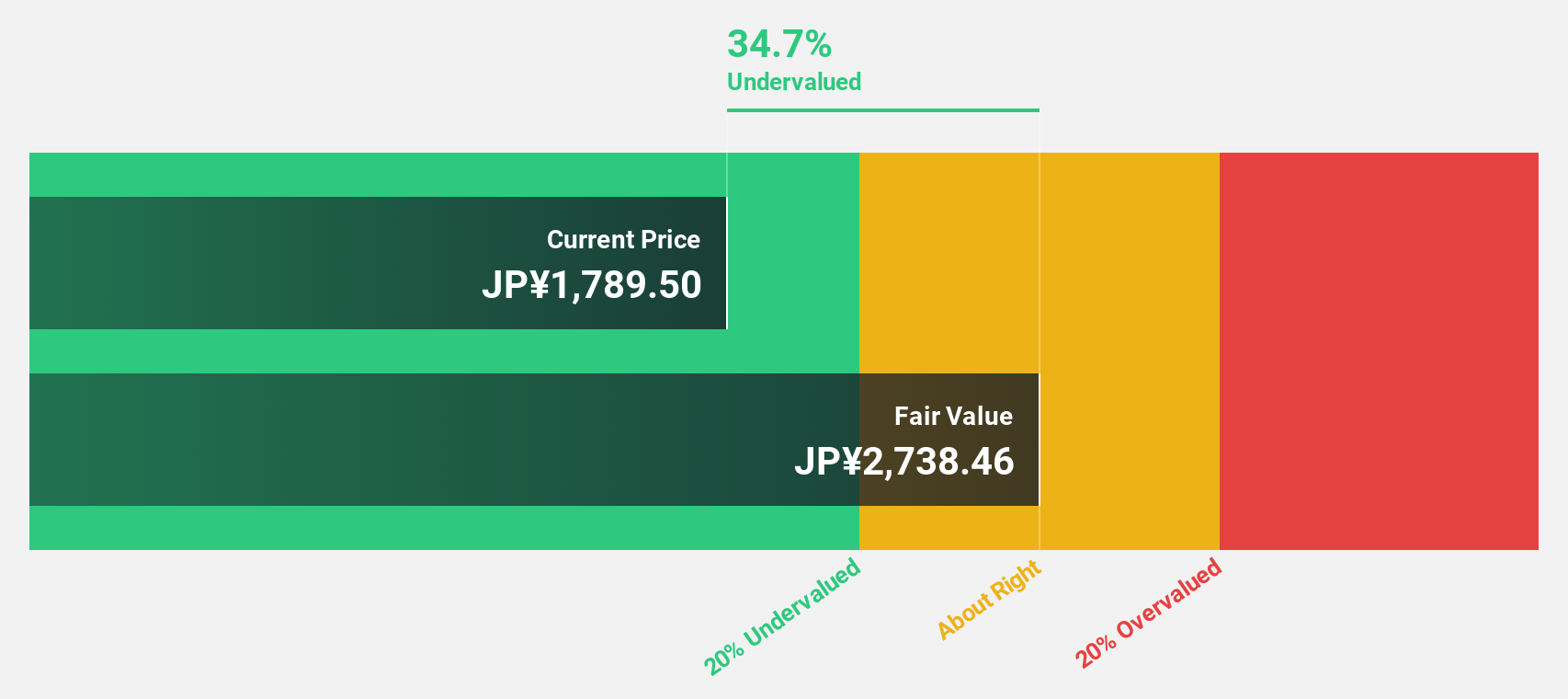

Rorze (TSE:6323)

Overview: Rorze Corporation designs, develops, manufactures, and sells automation systems for semiconductor and flat panel display production globally, with a market cap of ¥312.87 billion.

Operations: The company generates revenue from the design, development, manufacture, and sale of automation systems for semiconductor and flat panel display production globally.

Estimated Discount To Fair Value: 34.2%

Rorze, trading at ¥1804, is significantly undervalued compared to its estimated fair value of ¥2740.71. Despite a decline in profit margins from 23.4% to 15.7%, the company remains a good value, trading 34.2% below fair value estimates. Earnings are forecasted to grow annually by 15.81%, outpacing the Japanese market average of 8.3%. Recent completion of a share buyback program worth ¥4,999.94 million may enhance shareholder value amidst high share price volatility.

- Our comprehensive growth report raises the possibility that Rorze is poised for substantial financial growth.

- Get an in-depth perspective on Rorze's balance sheet by reading our health report here.

Make It Happen

- Click here to access our complete index of 280 Undervalued Asian Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6323

Rorze

Engages in the design, development, manufacture, and sale of automation systems for the semiconductor and flat panel display production worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives