- Japan

- /

- Specialty Stores

- /

- TSE:9990

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, with major U.S. indices reaching record highs and geopolitical tensions in Europe, investors are keenly focused on the implications for their portfolios. Amidst this backdrop, dividend stocks present an attractive option for those seeking steady income and potential growth, especially as sectors like consumer discretionary and information technology show robust performance while traditional value segments face challenges.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

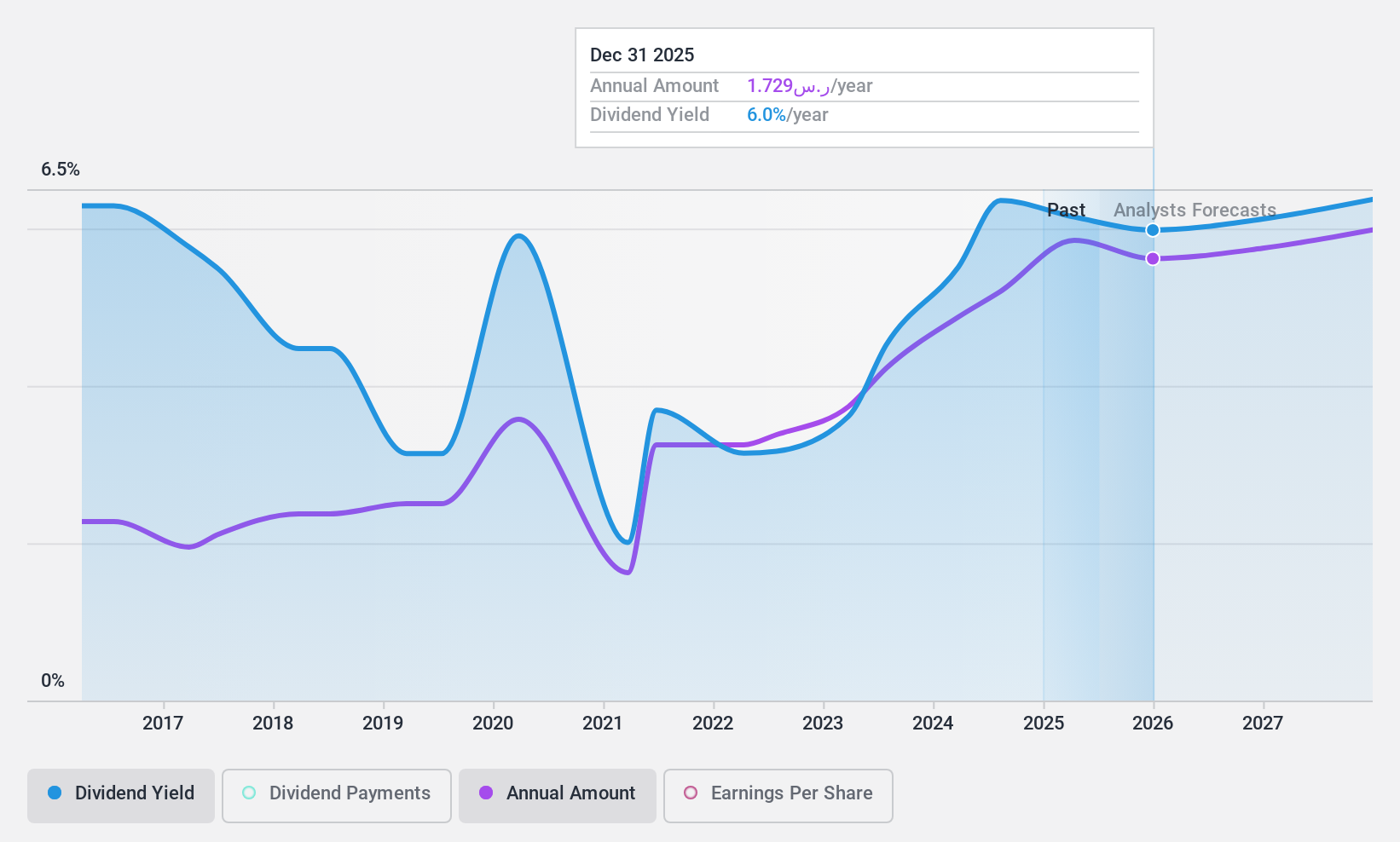

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia, with a market capitalization of SAR86.26 billion.

Operations: Riyad Bank's revenue is primarily derived from its Corporate Banking segment at SAR7.77 billion, followed by Retail Banking at SAR4.23 billion, Treasury and Investment at SAR2.21 billion, and Riyad Capital contributing SAR968.64 million.

Dividend Yield: 5.6%

Riyad Bank's recent earnings report shows a solid net income increase, reaching SAR 2.65 billion in Q3 2024, up from SAR 2.09 billion the previous year, supporting its dividend sustainability with a payout ratio of 53.3%. Despite past volatility in dividend payments, the bank offers an attractive yield within the top quartile of Saudi Arabian dividend payers. Additionally, Riyad Bank's recent $750 million fixed-income offering may enhance its financial stability and support future dividends.

- Get an in-depth perspective on Riyad Bank's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Riyad Bank is trading beyond its estimated value.

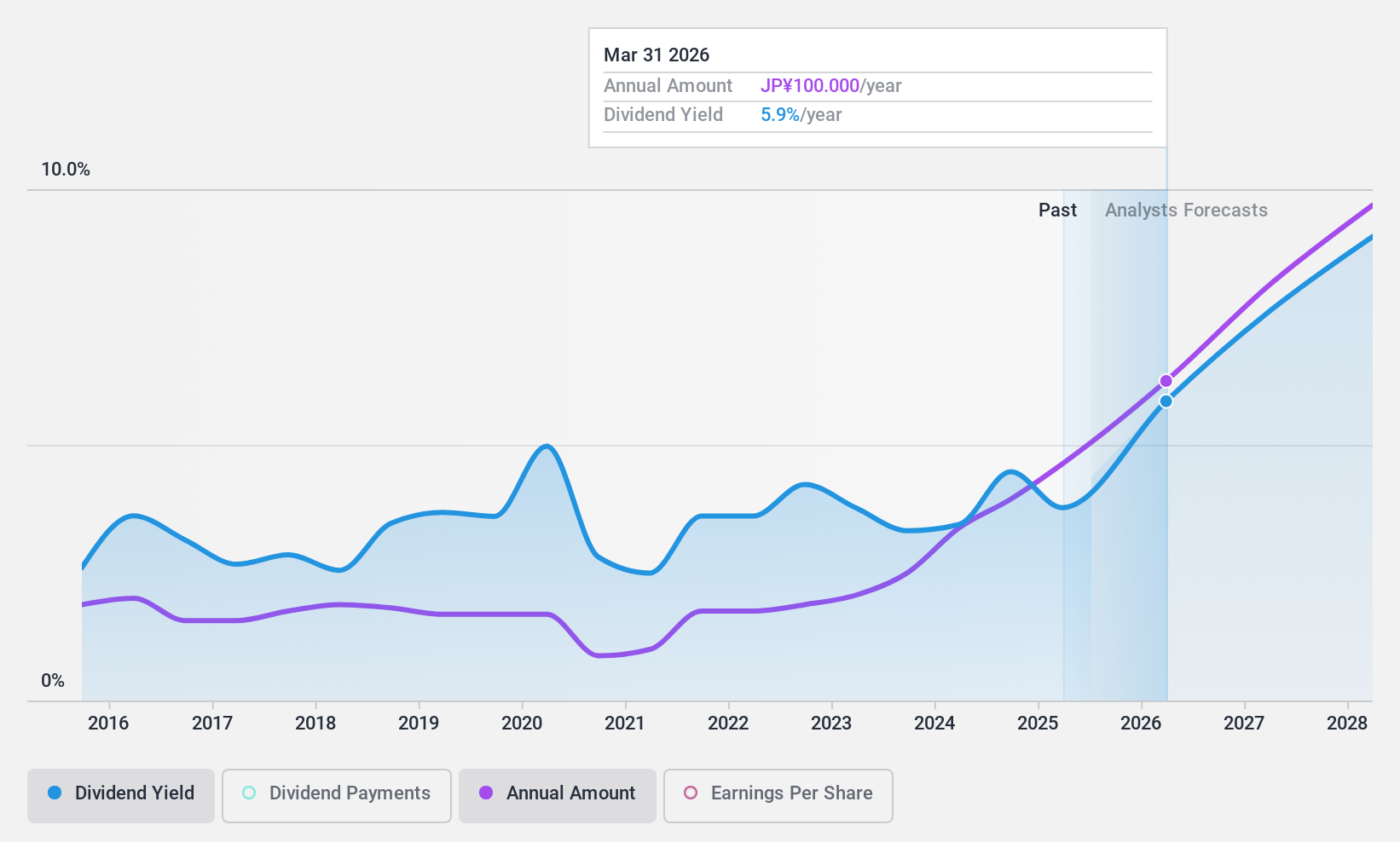

Aisan Industry (TSE:7283)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aisan Industry Co., Ltd. manufactures and sells automotive parts both in Japan and internationally, with a market cap of ¥96.28 billion.

Operations: Aisan Industry Co., Ltd. generates revenue through the production and distribution of automotive parts across both domestic and international markets.

Dividend Yield: 4.2%

Aisan Industry's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 14.3% and 27.3%, respectively. Despite a volatile dividend history, the company has increased its dividends over the past decade. Currently trading at a significant discount to its estimated fair value, Aisan offers an appealing yield in Japan's top quartile for dividend payers at 4.15%. However, investors should consider the unstable track record when evaluating long-term reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Aisan Industry.

- The valuation report we've compiled suggests that Aisan Industry's current price could be quite moderate.

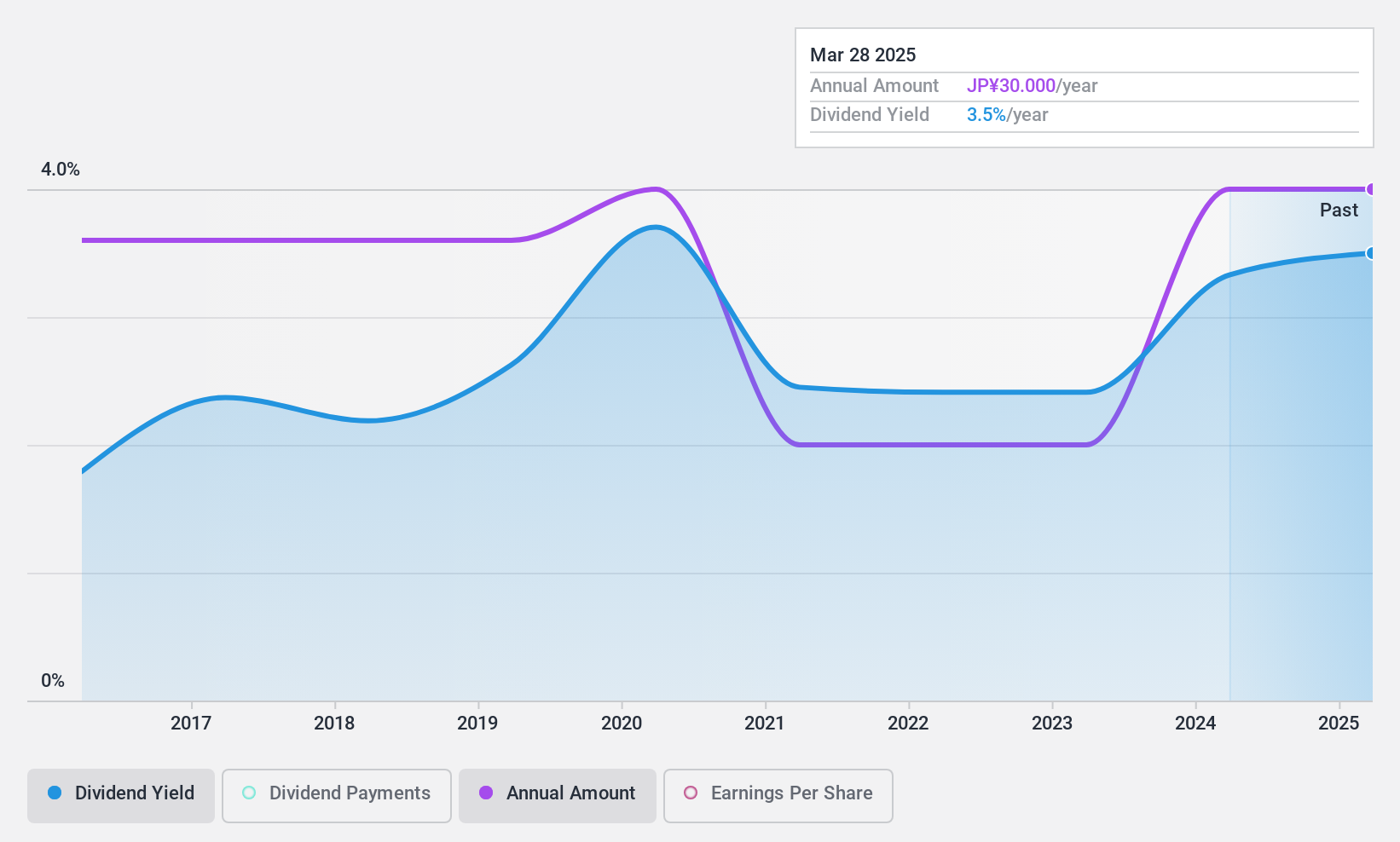

Sac's Bar Holdings (TSE:9990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sac's Bar Holdings Inc. operates in Japan, focusing on the retail sale of bags, fashion goods, and related accessories, with a market cap of ¥28.71 billion.

Operations: Sac's Bar Holdings Inc. generates its revenue primarily from the retail sale of bags, fashion goods, and related accessories in Japan.

Dividend Yield: 3%

Sac's Bar Holdings' dividends are well-covered by both earnings and cash flows, with payout ratios of 33.9% and 20.6%, respectively. Despite a history of volatility, dividends have grown over the past decade. The current yield is below Japan's top quartile for dividend payers at 3.04%. Trading significantly below estimated fair value, Sac's Bar presents potential value but investors should be cautious of its unstable dividend track record when considering long-term reliability.

- Take a closer look at Sac's Bar Holdings' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Sac's Bar Holdings is priced lower than what may be justified by its financials.

Make It Happen

- Delve into our full catalog of 1933 Top Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9990

Sac's Bar Holdings

Engages in the retail sale of bags, fashion goods, and related accessories in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives