- Japan

- /

- Specialty Stores

- /

- TSE:9983

A Closer Look at Uniqlo Parent Fast Retailing (TSE:9983) Valuation as Sustainability Drives Strategic Shift

Reviewed by Kshitija Bhandaru

Fast Retailing (TSE:9983) is taking its Re.Uniqlo program further, making it a central part of its business approach. The company's focus on increasing recycled materials and investing in advanced sustainability frameworks stands out this year.

See our latest analysis for Fast Retailing.

Fast Retailing’s progress on sustainability comes as its share price has drifted lower in recent months. This might reflect investors waiting to see how these big strategic moves play out. Over the long term, the company’s total shareholder returns show a solid track record, but momentum has eased recently.

If you’re keen to discover companies where change is in the air, now’s a great time to check out fast growing stocks with high insider ownership

But given recent share price weakness, is Fast Retailing quietly trading below its true worth, or are markets already factoring in all the future growth from its bold sustainability push?

Price-to-Earnings of 35x: Is it justified?

Based on a price-to-earnings (P/E) ratio of 35x at the last close price of ¥45,460, Fast Retailing’s shares appear expensive when compared with both its direct peers and wider industry benchmarks.

The P/E ratio measures how much investors are willing to pay per yen of earnings. It is a key yardstick for gauging valuation in retail stocks. A high P/E might suggest high growth expectations, but it can also indicate the market is already pricing in optimism about future performance.

Fast Retailing’s P/E ratio significantly exceeds the JP Specialty Retail industry average of 13.8x and the peer group average of 22.6x. Compared to the estimated fair P/E of 29.4x, this could indicate that the stock is trading at a premium level. The market could eventually adjust toward that lower fair value multiple if growth does not accelerate.

Explore the SWS fair ratio for Fast Retailing

Result: Price-to-Earnings of 35x (OVERVALUED)

However, weaker year-to-date returns and the risk of slowing revenue or profit growth could challenge Fast Retailing’s premium valuation in the near term.

Find out about the key risks to this Fast Retailing narrative.

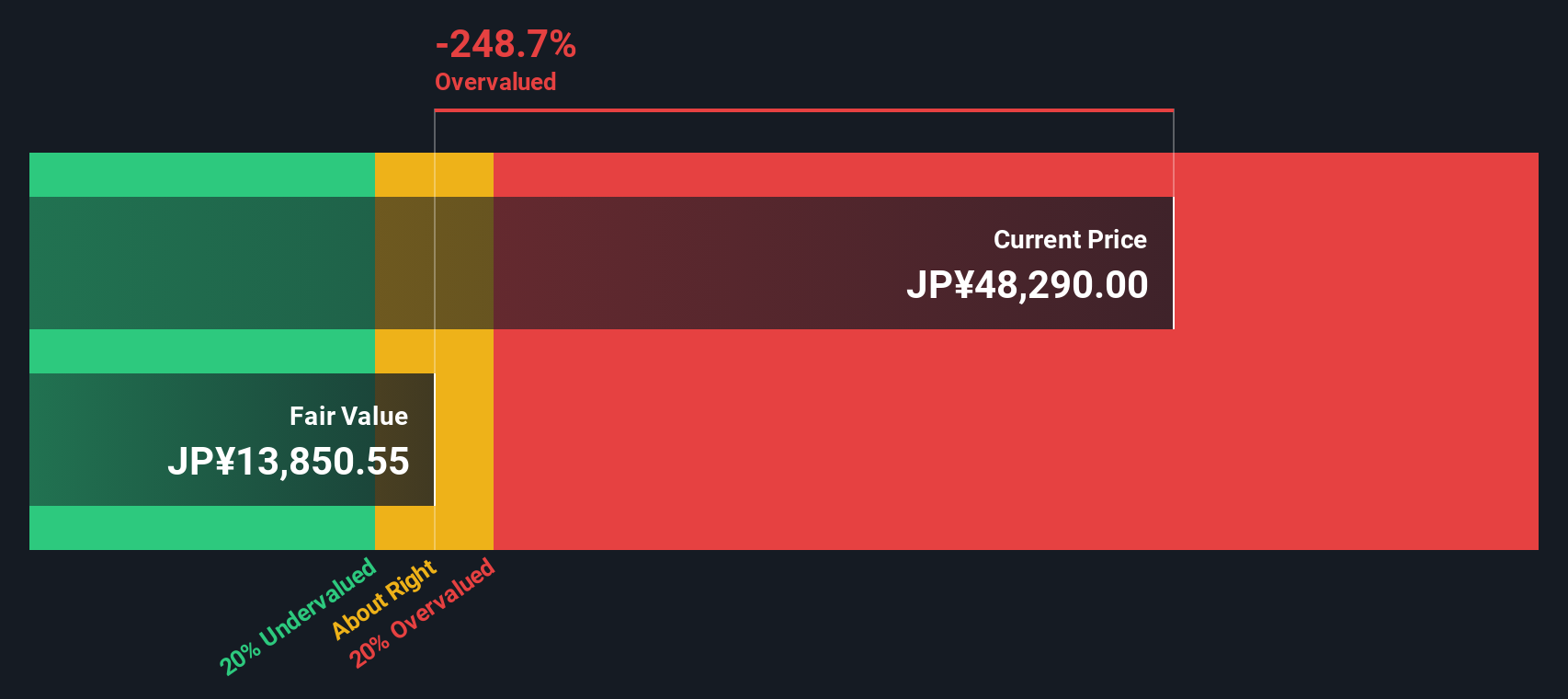

Another View: Discounted Cash Flow Perspective

While multiples like the P/E ratio point to Fast Retailing being overpriced, a different approach tells a similar story. Our DCF model estimates fair value at ¥14,490 per share, which is much lower than the current price. This suggests shares could be significantly overvalued. Does the market see something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fast Retailing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fast Retailing Narrative

If you want to dig deeper or would rather take the driver’s seat in analyzing Fast Retailing, you can shape your own perspective in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Fast Retailing.

Looking for more investment ideas?

Smart investors always keep an eye on standout opportunities. Expand your watchlist with companies reshaping their sectors and set yourself up for success. There's no reason to get left behind.

- Spot income potential by tapping into these 19 dividend stocks with yields > 3% offering above-average yields and reliable payout histories, giving your portfolio a stronger income foundation.

- Get ahead of the next AI surge as you examine these 24 AI penny stocks revolutionizing industries with real-world applications and breakthrough technologies.

- Capture untapped value by searching for these 901 undervalued stocks based on cash flows that could be hidden bargains based on future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9983

Fast Retailing

Operates as an apparel designer and retailer in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives